We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Q: When I bought my home, my lender mentioned that I was lucky I didn’t live on the other side of town, because it’s in a high flood risk area and buyers there are required to purchase flood insurance. My new neighbor recently mentioned that he had to purchase this insurance—should I reconsider? Do I need flood insurance?

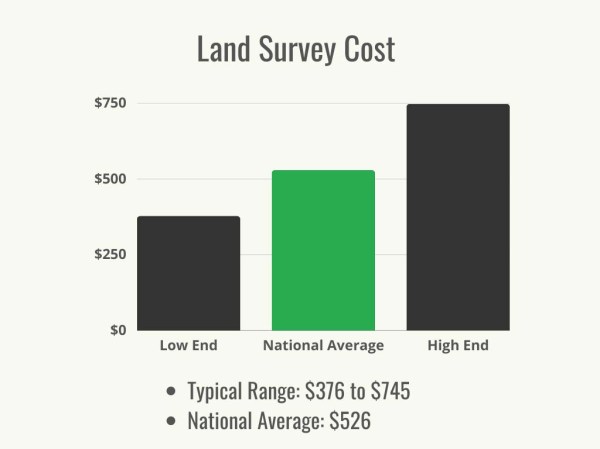

A: Although you may be pleased initially to find out you aren’t required to have flood insurance, it’s something you may want to consider purchasing anyway, especially if your home is close enough to a flood risk area that your lender needed to check the map to verify. Flooding causes a phenomenal amount of damage that costs quite a lot to repair. Floodplains shift frequently based on climate and other environmental factors paired with construction and regrading projects nearby, so it’s possible that you may now live in a floodplain, even if your property wasn’t classified as such when you bought it. Therefore, checking out a flood zone map would probably be a good idea—and even if you’re on the border, it’s probably a good idea to get a flood insurance quote from several companies so you can avoid paying out of pocket for flood damage should a significant storm bring the water to your door.

Typical homeowners and renters insurance does not include flood insurance.

Homeowners and renters insurance policies are called “policies of exclusion,” which means their coverage extends to everything except events that are specifically excluded in writing. Nearly every standard policy excludes flood damage. Why? Flooding causes damage to structures that can require complete replacement, in addition to shifting the very ground a home stands on, which is difficult to identify and repair. Walls, framing, and possessions that are inundated can quickly develop mold and are often unsalvageable. The cost is phenomenal. As a result, homeowners and renters insurance companies recognized that it was not cost-effective for them to include flood damage in their standard policies because the policies for everyone—even those not at risk for flooding—would have to be prohibitively expensive in order for the insurance companies to ensure a profit. Check your policy closely; unless your insurance company offers a separate policy endorsement for flood insurance at an additional cost, you’re not covered for any of the damage should a flood occur.

Flood insurance is a separate policy offered by the National Flood Insurance Program (NFIP) or some private providers.

To bridge this gap in coverage, the National Flood Insurance Program (NFIP) was created to make certain that all residents and business owners living in flood-prone areas had access to flood insurance. The program is run by the Federal Emergency Management Agency (FEMA) and can be accessed directly through the NFIP or through select insurance companies (possibly even the company that currently provides your homeowners or renters insurance) who work with NFIP to provide the coverage.

Flood insurance is offered in two categories: building coverage and contents coverage. Building coverage pays for the repair or replacement of the building’s structure itself: foundations, walls, wall-to-wall carpeting, permanently installed cabinets and bookcases, home systems such as electrical and HVAC, and kitchen appliances. Contents coverage pays for the repair or replacement of personal belongings, such as furniture, clothing, and other items that you own that aren’t affixed to the structure of the house. Homeowners will want to consider buying a policy that includes both types of coverage, while renters really only need to buy contents coverage, as the building belongs to a landlord or property owner, who is responsible for the structural coverage.

If you live in a high-risk flood area, some lenders will require you to have flood insurance.

Your home loan lender has a vested interest in preserving your property. Even a home that’s outfitted with a sump pump to remove water from the basement, as well as one of the best home generators to keep the sump pump working during a power outage, can sustain serious damage from a major flood. Should such a flood occur, damaging your home beyond your ability to pay for repairs, the lender loses its collateral on the loan, and you’re more likely to default—so the lender will end up with a defaulted loan and no house to easily sell to recoup their loss. To protect its interests (and yours), a lender may require you to purchase flood insurance as a condition of disbursing the loan to you. Many lenders require that flood insurance be paid through an escrow account alongside homeowners insurance and hazard insurance. Each month, part of your monthly mortgage payment will go into the escrow account, and when the flood insurance payment is due, the lender will pay it for you out of that escrow account. This way, your lender can be certain that the flood insurance is up to date and current. As most flood insurance policies require a 30-day waiting period between when the policy is purchased and when it takes effect, it’s particularly important that coverage not accidentally lapse.

Renters may also be required to carry flood insurance by their landlords. While the landlord will likely purchase building coverage for their property (either because they are required to by their mortgage holder or because it reduces their financial risk in case of a flood), the cost of carrying contents coverage for all of their tenants would be complicated and extremely expensive. To reduce the likelihood that they will be sued by tenants to cover the cost of replacing possessions lost in a flood, many landlords in high-risk areas require tenants to show proof of contents coverage as a condition of their lease.

Keep in mind that FEMA’s flood zone map is constantly updated and flood risk is constantly evaluated.

Think you know where you fall on the FEMA flood map? When was the last time you looked? Floodplains change relatively often. Sometimes they shift as FEMA’s funding increases or decreases, allowing it to support coverage for more or fewer residents. Communities can also lobby FEMA to change the maps. Other times, the maps change when FEMA checks the topography and determines that fires or floods in other areas have placed an area at higher risk. Land development and paving can change natural drainage patterns as well.

It’s possible that you may get a letter from your home lender out of the blue, informing you that you’ll need to purchase flood insurance when previously you did not need to. This demand can be upsetting and feel unfair, as it’s an expense that you hadn’t budgeted for. However, if it’s being required by your lender, there’s a good chance you really do need it. Regardless, even if your lender doesn’t pick up on the change, it’s a good plan to check FEMA’s maps from time to time on your own so you can be aware of your own risk and protect yourself appropriately.

Even if you live in a low-risk area, flooding can occur anywhere, anytime, and flood insurance can offer financial protection and peace of mind.

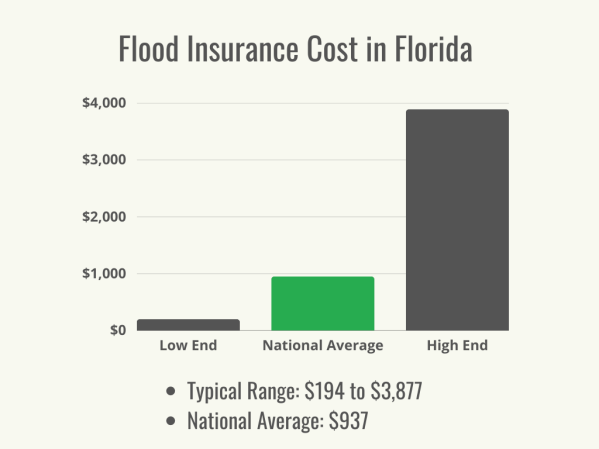

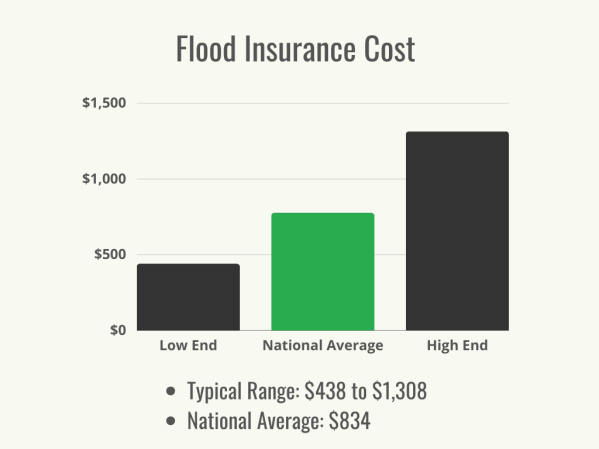

Perhaps you checked the FEMA flood maps and determined that you’re in a low-risk area. Do you still need coverage? It’s possible you don’t need it as much as someone in a higher-risk area, but that doesn’t necessarily mean you don’t want it. While homes in floodplains are certainly at greater risk of damage, floods don’t follow maps, and an unexpected storm, swift snowmelt, or water main break can cause a flood anywhere—in which case you could unexpectedly find yourself without coverage in a situation where 1 inch of floodwater can cause up to $25,000 in damage. Approximately 20 percent of flood insurance claims are filed by homeowners living in low- to moderate-risk zones, so unless you have the resources to pay for repairs after a flood, you’ll want to consider your options; flood insurance rates are based on a combination of the size and structure of your home and your distance from high-risk areas. Like other types of insurance, flood insurance is available with a variety of coverage limits and deductibles, so by working with an insurance agent you should be able to balance your risk and your finances to find a level of NFIP or private flood insurance coverage that protects you from the unexpected and provides peace of mind.