Shopping for homeowners insurance can be daunting. Not only are there a lot of insurance providers out there, but you also need to know details about your home’s construction and the value of your belongings in order to get an accurate quote.

New Jersey homeowners insurance is generally pretty affordable, compared to the national average. However, rates can vary, sometimes dramatically, from one insurer to the next.

In this post, we will explore some tips for securing the best homeowners insurance in New Jersey for your situation, including a list of the top-rated companies you can get quotes from online.

This blog covers the following topics:

- Tips for Shopping for Home Insurance in New Jersey

- The Top Three Home Insurance Companies in New Jersey, According To Customer Reviews

- The Top 3 New Jersey Home Insurance Companies Based on Customer Price Rating

Before you read our guide, get New Jersey homeowners insurance quotes to see what it available. Use our free tool below to compare home insurance rates and options.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

Tips for Shopping for Home Insurance in New Jersey

Shopping for home insurance in New Jersey takes time, but it’s worth the effort if you want to get the right coverage and save money.

Here are a few things to keep in mind before you start your research:

- Pricing is important to all homeowners. No one wants to pay high prices. However, price isn’t the only factor to consider. You want to make certain that all of your belongings have sufficient coverage in the event of a loss.

- Comparing quotes is essential. While insurers do use many of the same pieces of information to determine insurance premiums, prices can vary widely from one insurer to the next because they weigh these various factors differently.

- Reading reviews will give you insight into factors that you might not have thought of as being important, such as the ability to get an agent on the phone if you need one, or the level of customer service that you can expect.

Using the internet and Clearsurance.com, it’s easier than ever to find reviews and research insurance companies.

With these points in mind, here are some tips for finding the right New Jersey home insurance at a good price.

1. Get Quotes From multiple New Jersey Insurance Companies

Comparing rates from different providers is the best way to find the New Jersey home insurance that is right for you.

2. Research Your NJ Coverage Options, and Make Sure You’re Covered

Many homeowners have discovered the hard way that flooding isn’t covered by their homeowners insurance policy. If you live near water, look into whether you might need flood insurance coverage.

3. See if Bundling Is an Option

One way to save money on your homeowners insurance policy is to group, or “bundle,” several of your insurance policies (such as home and auto) with one insurance company.

For example, you may be able to bundle your car insurance and home insurance to receive an insurance discount. Check to see if your company offers a bundling discount and see if it’s the best and cheapest option for you.

The Top Three Home Insurance Companies in New Jersey, According to Customers on Clearsurance

Clearsurance has identified the three best New Jersey home insurance companies, according to customer reviews as of July 2020.

Below are the best companies for homeowners insurance in New Jersey that offer quotes on Clearsurance.com, as rated by customers. This includes an analysis of common trends found in reviews of what customers tend to like and don’t like about the companies.

Please note: In order to qualify for the list, companies must sell homeowners insurance in New Jersey, have at least 25 homeowners insurance reviews, and they must be a Clearsurance.com affiliate and offer quotes on the site. For a complete and updated list of the top-rated companies in New Jersey, you can visit the New Jersey home insurance rankings page. On this page, you can also get insurance recommendations based on your specific requirements and zip code.

1. Lemonade Insurance for New Jersey Homeowners Insurance

Lemonade’s customers speak very highly of the company, particularly its customer service and pricing. Lemonade earned a score of 4.84 out of 5.00 stars for home insurance. If you’re looking for New Jersey home insurance, reading some of the customer reviews will quickly convince you to add Lemonade to your list to get a quote,

Pros: Customers on Clearsurance frequently mention Lemonade’s clear and transparent pricing and that they explain coverage well. They also praise Lemonade’s easy-to-use website and for offering a variety of coverage options.

Cons: The only “con” mentioned by customers is that Lemonade doesn’t reward loyal customers.

Lemonade policyholders tend to be really happy and satisfied with their Lemonade insurance experiences.

- 92% of Lemonade’s customers say they have plans to renew their policies.

- 95% of customers say their claims experience was positive, and

- 94% of Lemonade’s customers say they’d recommend the insurance to a friend.

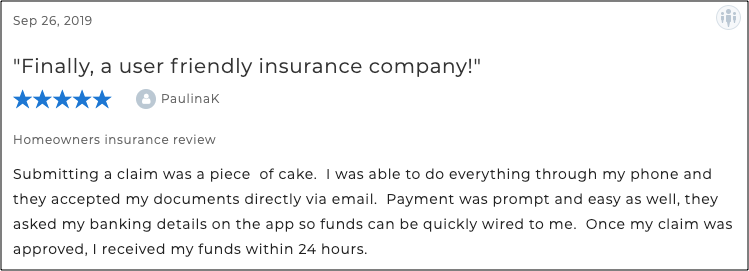

In the Lemonade review below on Clearsurance from a New Jersey home insurance policyholder, you can see the great experience this customer had with Lemonade’s claim service.

Read all Lemonade reviews on Clearsurance.com.

2. Esurance for New Jersey Homeowners Insurance

Esurance is widely available in many states and customers on Clearsurance rate the carrier highly. With a score of 4.34 out of 5.00 stars for home insurance, Esurance is the second-highest rated New Jersey homeowners insurance company that offers quotes through Clearsurance.

Pros: Customers mention a number of pros, including Esurance’s flexible billing and they also receive praise for having an easy-to-use website. Esurance also gets positive feedback for its clear explanation of coverage and for having a wide variety of coverage offerings.

Cons: The one frequently mentioned negative by customers about Esurance is that it doesn’t reward loyal customers. An analysis of customer reviews turns up solidly positive data for Esurance.

- 74% of Esurance customers are likely to renew their policies,

- 77% of Esurance customers would recommend the insurance to a friend, and

- 75% of Esurance customers rated their claims experience positively.

Among the many positive reviews, the one below highlights how the Esurance customer had such a great experience and found Esurance easy to deal with.

Read all Esurance reviews on Clearsurance.com.

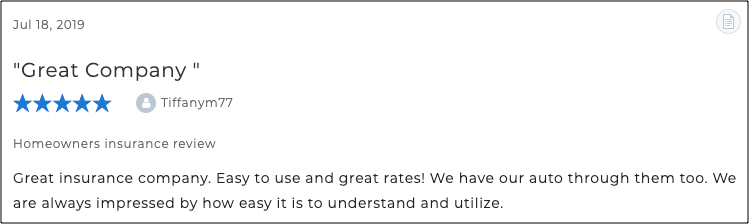

3. Allstate Insurance for New Jersey Homeowners Insurance

Allstate Insurance Company is a well-known company that is available across the country, and the reviews provided on Clearsurance reflect a largely happy customer base. With a score of 3.99 out of 5.00 stars for homeowners insurance on Clearsurance.com, Allstate is the third-highest rated New Jersey homeowners insurance company. Founded in 1931, Allstate has more than 16 million customers with more than 175 million policies in all 50 states. The company also owns several other insurance companies including Encompass Insurance, SquareTrade, and Esurance.

Pros: Customers on Clearsurance enjoy Allstate’s flexible billing options and transparent pricing. Other key positives listed include a wide range of coverage options and an easy-to-use website.

Cons: No “cons” were listed by customers in the analysis of reviews.

With lots of positive feedback, Allstate customers on Clearsurance rate the company highly.

- 80% of Allstate customers are likely to renew,

- 78% of Allstate customers would recommend the insurance to a friend, and

- 77% of Allstate customers rate their claims experience positively.

Allstate has received many positive reviews on Clearsurance.com from policyholders. One New Jersey customer commented on their experience in the review seen below.

Read all Allstate reviews on Clearsurance.com.

The Top 3 New Jersey Home Insurance Companies Based on Customer Price Rating

Although there are many factors to consider when shopping for New Jersey home insurance, price is one of the most important factors. Clearsurance analyzed New Jersey companies and how customers rated the company for the price of their policy.

Below you can find the top 3 New Jersey home insurance companies rated by customers for their perceptions of price.

Please note: for this ranking, we looked at all homeowners insurance companies in New Jersey that had at least 25 reviews that included a rating on price. The ratings displayed are shown out of a 5-star scale.

- NJM Insurance Group: price rating of 4.40

- GEICO: price rating of 3.96

- Allstate: price rating of 3.85

Finding the right homeowners insurance policy can take time, but it’s also a very important task. You want to make certain that you have the right coverage in case you ever need to make a claim, but at the best and cheapest price.

There are many types of homeowners insurance coverage that you can choose: dwelling coverage, personal property coverage, liability protection, guest medical protection.

Dwelling coverage will protect the structure of your home while personal property coverage protects what's inside the home, items that are damaged or stolen from your home.

Liability coverage protects you if someone sues you after being injured on your property or after you damage their property, while medical protection covers medical payments for someone who's injured on your property.

Now that you've read our guide for buying New Jersey home insurance, make sue to shop around and get quotes from multiple companies so you can find the best price. Use our free insurance quote comparison tool below to get personalized recommendations.

Save Money by Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.