We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Q: I’ve heard homeowners insurance is important to make sure your assets are covered in the event of a loss. But how much homeowners insurance do I really need, and how do I determine the right amount?

A: The question of how much homeowners insurance you really need is a detailed one to answer. There are different coverage types that handle different assets. Someone might need to take out additional insurance, such as flood insurance, for certain types of disasters. And how much insurance a homeowner needs can also depend on how much their home and possessions are worth. These points are just for starters. Homeowners insurance comprises several different types of coverage, and knowing what they are can help you determine how much coverage you need, and at what cost.

Most homeowners insurance policies will cover certain perils such as theft and fire.

The base of homeowners insurance is set up to cover the most common forms of loss. These common loss types typically encompass disasters, theft, and accidents. A homeowner may choose between levels of insurance. The most popular policy is often listed as the HO-3 policy, open-peril insurance which provides coverage for the structure of the home, personal belongings, and personal liability coverage.

Some of the perils covered by homeowners insurance might seem quite outlandish, but they do happen, and a homeowner would be relieved to know they’re covered if on the off chance these perils happen to them. Policies tend to cover explosions, riots or civil commotions, damage from an aircraft, damage from vehicles running into the home, volcanic eruption, and falling objects. More common situations covered include fire or lightning and windstorm or hail damage. A home might also be covered in the event of smoke damage or theft. Vandalism or malicious mischief is also often covered. Common problems in northern regions such as damage caused by the weight of ice, snow, or sleet, may also be covered. The policies might also cover more specific damages, like accidental discharge of water and steam overflow from a component in the home like the plumbing or an appliance, damage from sudden broken components of the home like the air conditioning or water heater, damage caused by freezing, and damage from sudden electrical currents.

However, some events, such as flooding, are not covered.

While the list above may seem very comprehensive to the point of absurdity in some cases (most people do not think of an airplane falling from the sky onto their home, for instance), there are also some potential perils that a standard homeowners insurance policy doesn’t typically cover. One example, as mentioned above, is coverage for flooding. Flood insurance is a separate insurance product homeowners may have to purchase, and it’s especially important in areas that are at risk of flooding. Properties that have wells on them, for example, properties that are at sea level, or riverside properties are a few examples. It might even be that a mortgage lender requires homeowners to carry this type of insurance if they’re in a federally marked high-risk flood zone.

Beyond flooding, there are other types of insurance for certain types of disasters that might not be included on standard homeowners policies. Common types include earthquake insurance, coverage for landslides and land movement, and even mold coverage. While volcano coverage is often part of basic homeowners insurance policies, the damage covered may be more limited and homeowners who live near an active volcano, such as residents of Hawaii, might want to consider additional coverage. For instance, while a basic plan might cover initial damage from ash, dust, and lava flow, it might not cover events after the fact such as ash carried by winds, shock waves, or tremors. Additionally, a mortgage lender may also require that homeowners carry flood or earthquake coverage if they are in high-risk areas for these events.

Homeowners are not legally obligated to purchase homeowners insurance—this is typically the requirement of the mortgage lender. However, it would still be wise for homeowners without a mortgage to protect their investment.

Some people may wonder if they can get away without homeowners insurance to save some money. After all, there is no federal or state mandate that homeowners have to have homeowners insurance. But that doesn’t mean homeowners might not face insurance requirements. Lenders who own the mortgage or home equity loan will more than likely require that the home be insured. Since they are the ones backing the financing of the home and expect to be paid in full, they have every reason to make sure that investment is protected.

Even for homes without a mortgage where there is no obligation to a mortgage company to carry homeowners insurance, it’s in a homeowner’s best interest to protect their home investment. Accidents and weather events do happen, and in the case that they do happen, the homeowner’s finances are protected. And for those who buy into a co-op or condo, the board of the building may require that owners have homeowners insurance.

So once a home is paid off, do you still need to have homeowners insurance? Technically, no, since the home is entirely the homeowner’s to do with what they want. However, it is still a sound financial decision to keep a homeowners insurance policy in place. A homeowner is not just insuring the structure of the home but also all the possessions in the home. Basic homeowners insurance also covers liability in case of an injury or property damage lawsuit, which this guide will cover more below.

Homeowners insurance typically has six types of coverage with customizable coverage amounts.

Homeowners will typically find six types of coverage included in most homeowners insurance policies. Ideally, homeowners want to check that each of these six types of coverage is included in their policy. The six types of coverage are:

- Dwelling: What is dwelling coverage? This part of the coverage is the protection that covers the home itself, along with attached features such as garages, fences, or decks. As mentioned above, it provides coverage in the event of major accidents or weather, often called “perils.” Homeowners who require coverage for damage resulting from earthquakes or floods will need to purchase separate policies in addition to their homeowners insurance. Other events that are not covered include issues caused by poor maintenance, damage caused by insects or animals, and general deterioration over time.

- Other Structures: This coverage protects things that are not attached to the house, such as unconnected garages, storage units, sheds, swimming pools, or play gyms in the backyard.

- Personal Property: This coverage protects personal property. Personal property coverage has some exclusions; fine art, electronics, and jewelry (among others items) may need additional protection. To be covered, personal property must sustain damage from a peril specifically listed in the policy. Depending on the coverage selected, a homeowner will have actual cash value coverage or replacement cost coverage. Actual cash value coverage takes into account the value of the item today, less depreciation and wear and tear, so a homeowner may find they face a larger out-of-pocket expense to replace the items at today’s prices. Replacement cost coverage replaces items at today’s prices, regardless of what the value of the item was at the time of the loss.

- Loss of Use: This part of the policy covers the living expenses homeowners incur while the home is being repaired. As such, it would cover any temporary housing they had to procure, and even food and transportation. But this part of the policy typically only covers additional expenses that go above what a family normally pays for these costs. So if someone had to stay in a hotel, for example, the policy might cover additional housing fees above and beyond their mortgage payment.

- Personal Liability: If a homeowner, their family, or their pets are found legally responsible for causing property damage or physical injury to someone else, personal liability coverage kicks in. It pays for defense costs and any assessed damages related to the covered incident to satisfy the judgment in relation to covered incidents. For this coverage to apply, the damage or injury must be accidental.

- Medical Payments: Finally, this coverage provides payments for treatment of accidental injuries that happen in the home to people who are not part of the resident family. For instance, if a guest trips and falls in the home, the medical payments coverage would cover that person’s medical bills up to the policy limits.

It’s important to talk with an insurance agent to see what all is covered within the various parts of the plan. It’s critical to know what situations are covered and how they are covered, as plans can vary.

It’s best if dwelling coverage is equal to the replacement cost of the home.

There are two terms that are important to know with homeowners insurance: the replacement cost and the actual cash value. These terms refer to how the policy reimburses a homeowner to cover their loss after damage. Actual cash value policies, for example, cover homeowners for their home and possessions’ depreciated value. That means they get paid for what their home and possessions are worth now versus when they first bought them, which is often less money. Depreciation factors in age and wear and tear into the value of what a homeowner is being reimbursed for.

When shopping for insurance, homeowners have the option to select different levels and types of coverage. Levels of coverage may affect their premium payments or even their deductible amounts, but it’s important to have enough coverage in the event of needing to replace their whole home. You may wonder, how much home insurance do I need? In the event that a home is wiped out by a major weather event, like a tornado, a homeowner would want enough coverage in place to cover the cost of replacing the whole home. Otherwise, they might end up having to build a smaller home or even footing part of the replacement costs themselves. Homeowners might check the limits of their policy to make sure that it covers the cost of rebuilding. They might also check their policy to make sure it covers anything they may have added, such as a new or rebuilt deck, a garage expansion, or a new bathroom. Homeowners don’t want to be underinsured.

It’s important to select a policy that covers the replacement cost of the home, which does not factor in depreciation. It also covers homeowners for the actual amount of money it takes to rebuild the home. To make sure a policy covers how much the home is worth and the cost of rebuilding, it might make sense to talk to an insurance agent or an appraiser to see what the cost of rebuilding the home would be. Someone might also use a dwelling coverage calculator. Also, keep in mind that many lenders require homeowners to have homeowners insurance that covers the amount of the mortgage. If someone only insured their mortgage amount, that amount should ideally be enough to cover rebuilding costs. Additionally, building costs can change, so every few years or so, be sure to review what the costs would be to rebuild your home and make sure you have enough coverage. A homeowner might also look into an inflation guard clause that resets their coverage amounts to reflect local building costs, which they might have to purchase as an extra endorsement.

The ideal amount of personal property coverage is between 50 percent to 70 percent of the dwelling coverage amount.

You might be asking, how much home insurance do I need for personal property? Homeowners will likely want to make sure their personal property is covered in such a way that they’ll be properly reimbursed in the event of a covered loss. As with the dwelling coverage, homeowners could select a policy that covers the replacement cost of possessions. If they choose an actual cash value policy, they’ll be compensated only for what the items are worth after depreciation, not what they’d cost to replace them today. This type of policy won’t fully compensate homeowners who need to buy new items to replace the ones that were damaged or lost.

To make sure they get reimbursed for everything they have, homeowners could make a list of their personal possessions and keep that list up to date. Homeowners could include the possessions in their home and anything out in the garage, shed, or other structures on their property. The list ideally can be as detailed as they can possibly make it, so they could include everything from appliances to computers to clothing to jewelry to furniture. They could include the date the items were purchased, where they were purchased, and a description of each item. They might also take video or photos of all their rooms to show the items in each place, adding new items as they buy them. This can help get claims settled faster. Also, they might update the list with the current value of all the items, and saving receipts is a good idea, too.

The typical homeowners insurance policy offers $300,000 to $500,000 in liability insurance, but homeowners should consider the total value of their assets and belongings as the ideal minimum.

You might wonder, how much liability insurance do I need? Remember, personal liability coverage is part of a homeowners insurance policy that covers against lawsuits for bodily injury or property damage caused by a homeowner, their family members, or their pets. The personal liability insurance part of a homeowners insurance policy covers court costs and awarded damages. As such, you might also ask, how much liability insurance do I need as part of my homeowners insurance? People might see limits as low as $100,000 available, but they may see recommendations up to $300,000 or even $500,000.

A homeowner would factor the total amount of all of their assets and belongings to see what sort of liability coverage they would need. They might even need to look into an excess liability or umbrella policy to cover additional assets like investments or savings that go above and beyond the liability limits of their policy.

Adjustments to the typical coverage amount are based on factors such as lifestyle and possessions. Additional policies, such as flood insurance, should also be considered.

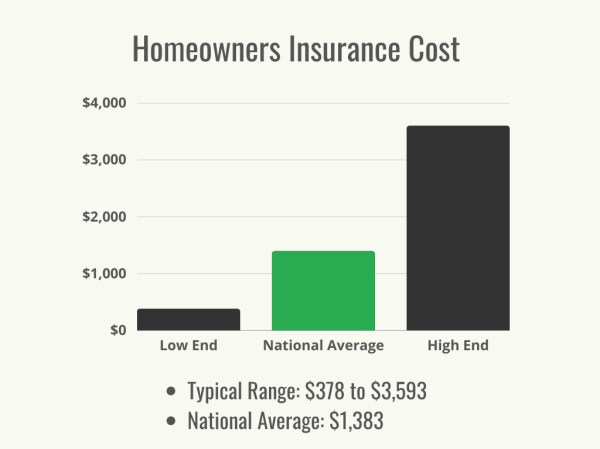

If a homeowner finds they need more coverage than the typical limits and covered perils, they can talk to their insurance agent to find the best homeowners insurance for them. These professionals can help them assess fully what they need to have covered. Coverage needs can vary greatly based on lifestyle, and they might need to cover everything from additional investment properties to certain items that may need additional coverage, such as jewelry or expensive collectibles. They might also use a home insurance calculator or homeowners insurance calculator to see what they need for coverage and how much it would cost. An agent can also provide them with a home insurance estimate. As with any purchase, it will help to shop around.

Certain features a home has can also mean different levels of coverage. One major example is if a homeowner has an older home. Older homes may have been built under different building codes, so rebuilding or repairing them will require more expense as these homes are brought up to code. A homeowner might also have a home with many antique one-of-a-kind features that might be harder to replace, like that authentic colonial lighting fixture. Some policies may not even cover these repairs, and homeowners may have to have a modified replacement cost policy, which will replace these features with more modern building materials.

Homeowners insurance is not a covers-all-disasters prospect. Flood insurance and earthquake insurance, as examples, are often sold separately. This is where talking with an insurance agent about all specific needs can help homeowners avoid coverage oversights that leave them without protection when they need it most. Making sure the coverage is adequate will require a solid understanding of all assets, the current worth of possessions, repair costs analysis, and the local risk factors like flooding or earthquakes.