We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

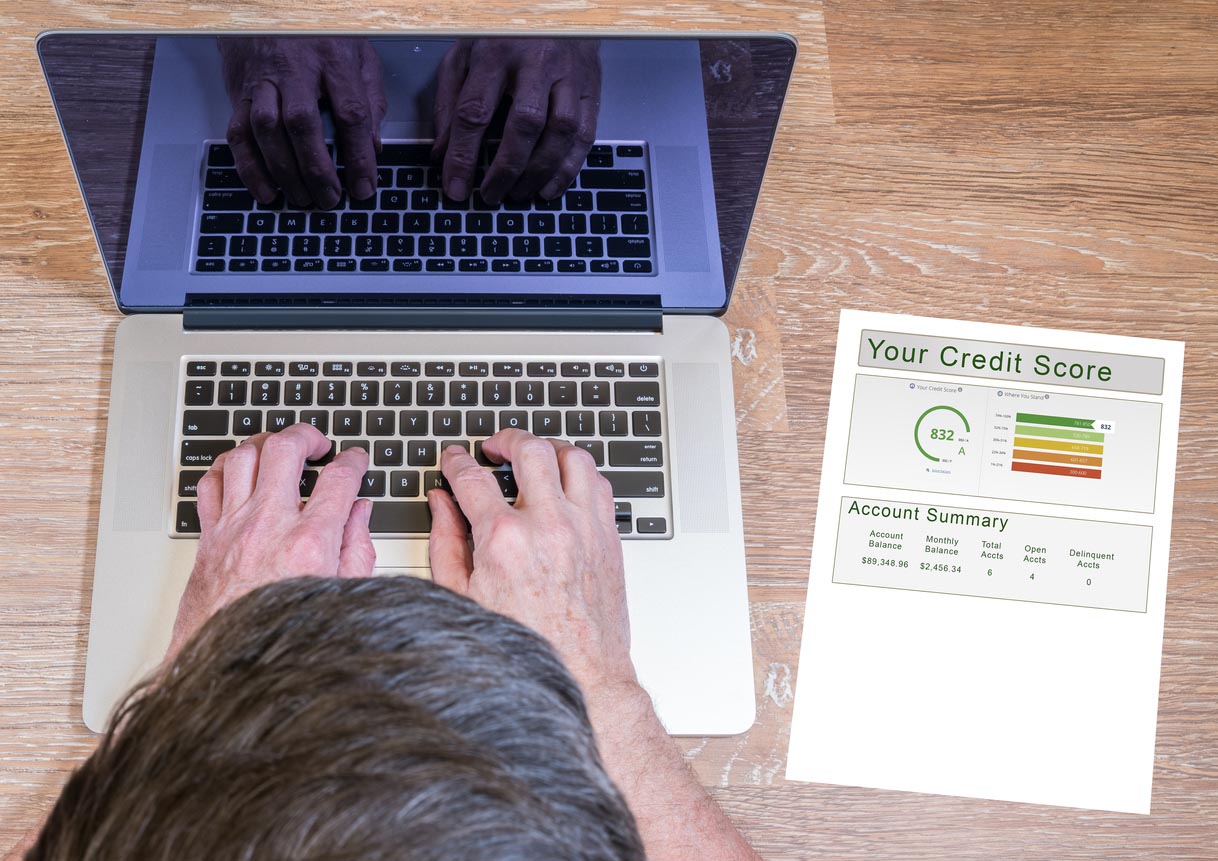

Prospective homeowners looking into how to get a home loan will notice that just about every article lists credit score as one of the most important factors when it comes to qualifying for a mortgage. As borrowers dig into the home loan process, they’ll find that almost every part of it is connected to their credit score: whether they can even get a loan, as well as the interest rates and loan terms they’ll qualify for.

For borrowers with bad credit, home loans can be hard to come by, but what constitutes a bad credit score? Most lenders view a FICO score between 670 and 739 as “good,” and scores between 580 and 669 as “fair.” Borrowers in those categories can typically secure a conventional home loan, though those who are unable to put down a hefty sum of money at closing will likely find themselves paying for mortgage insurance. Borrowers with a score below 580 will have some challenges acquiring a home loan, and those with a score below 500 may find it almost impossible. Repairing credit is possible, but with negative statements on a credit report remaining in place for 7 years, it could be a very long process. What if someone is ready to buy a home now and has the money to do so, but is being held back as a result of their credit? There are a number of steps borrowers can take to increase their odds of getting a home loan.

Before You Begin…

Borrowers with poor credit may need to seek out specific programs or grants in order to secure a home loan. These programs and grants are designed to help borrowers with the resources, but not the credit score, to take out a loan as they figure out how to buy a house with bad credit. However, borrowers will want to be careful as they explore their various options. First, they’ll want to make sure that they take a close look at each program and wait to apply until they’ve done their research and decided which one is the best fit. When a borrower starts applying for home loans, all the applications within a 30-day period count as one credit inquiry because the credit bureaus know that the borrower is shopping around rather than taking out multiple home loans. If the borrower applies for a mortgage beyond that 30-day period, however, multiple inquiries into their credit history can negatively affect their credit rating by a few points. A borrower who is already struggling to get a loan with their current credit score won’t want to push it even lower.

Secondly, borrowers will want to consider whether they actually want to take advantage of the options available to them. If their negative credit information is older, they may be able to get better rates and terms simply by waiting another year or two to improve their credit score before they buy. Some loans that are aimed at buyers with lower credit scores will carefully assess the borrower’s financial situation to make sure they’re not taking out a loan they can’t pay back. Other programs offer bad credit mortgage loans, or what are known as subprime mortgages. These are mortgages for which borrowers may pay an exorbitantly high interest rate, or may only be offered an adjustable-rate mortgage (ARM). With an ARM, the interest rate will initially be fixed and payments will stay the same for a set number of years, and then the rate will become variable and could cause the borrower’s monthly mortgage payments to increase. These loans can seem attractive to borrowers who want to get into a house, but can backfire on them in the long run and further damage their credit. Borrowers will want to make sure they can really afford to make the payments they’re committing to before closing on any loan.

Tips for Getting a Home Loan With Bad Credit

- Access your credit reports from all three agencies to check for errors.

- Take the time to speak with agents for several lenders.

- Be patient. It’s going to take a little more effort and time than it would if your credit was excellent, but it will likely pay off in the end.

STEP 1: There are some loans with lower credit score minimums to consider, such as an FHA loan, VA loan, USDA loan, and more.

Several programs guaranteed by the federal and state governments offer legitimate home loans for bad credit. Before these programs existed, homeownership was often limited to those who had a substantial down payment, significant income to cover their monthly mortgage payments, and excellent credit to qualify for a low interest rate. Buyers who were missing any of those pieces were regarded by lenders as too risky. Low down payments could mean lenders would lose money if they had to foreclose and sell a home. Lower income could reduce the chances that a borrower would be able to make consistent monthly payments. A dicey credit history could suggest that the borrower had problems paying their debts in the past. Some lenders did offer loans to less-than-ideal borrowers, but few lenders that offer bad credit mortgage loans guaranteed approval, so applying would damage the buyer’s credit with little hope of success. These standards were preventing quite a few buyers who were capable of making payments from taking out loans. Homeownership adds stability to the economy, so several government agencies, including the Federal Housing Administration (FHA), the United States Department of Veterans Affairs (VA), the United States Department of Agriculture (USDA), and a number of state and local agencies saw the opportunity to get more people into homes by securing their loans, reducing the risk to lenders.

FHA loans allow buyers with smaller down payments or lower credit scores to qualify for home loans. The FHA saw a contingent of buyers who were fully able to make payments, but had been unable to save up a large enough down payment due to high rent and sometimes lower income, and had possibly struggled to make ends meet in the past. Lenders saw these buyers as too risky, so the FHA developed its own program. It guarantees the loans, so if a borrower defaults on their mortgage, the FHA will cover the funds lost by the lender, making it safer for lenders to extend loans to borrowers with bad credit and lower down payments. The parameters are specific: For buyers with credit scores of 580 or higher, the minimum down payment is only 3.5 percent, but buyers with scores as low as 500 can get a loan if they can scrape together a 10 percent down payment. Scores below 500 will not be able to qualify for this program. FHA loans include mortgage insurance payments each month that cannot be canceled until the loan is paid off or refinanced, so some of the monthly payment will go toward that insurance instead of the loan balance, which can increase the monthly payment amount.

Service members in all the branches of the United States military face special challenges when it comes to home buying. Long deployments, sudden reassignments, and the comparably lower pay scale for enlisted members can mean frequent (and sudden) moves. Service members and their families may struggle with down payments, especially if they find themselves in a situation where they’re trying to sell a home in one location when they’ve been suddenly transferred to another—so they’re still paying a mortgage on a home they no longer live in. And while some veterans make the transition to civilian life easily, it’s not always a smooth or swift path, which can lead to financial instability. The VA offers a home loan program to veterans, active service members, and the surviving spouses of service members that helps make home buying easier. Similar to the FHA program, the VA guarantees a part of the loan, making it less risky for lenders to approve mortgages for eligible members even if their credit scores are on the lower end. It’s possible to get a VA loan even if the borrower has a bankruptcy on their credit report, and often they can get a VA loan with no down payment at all. The credit score requirements vary from lender to lender, so VA-loan-eligible borrowers with credit scores on the lower end will want to shop around to find a VA lender that will finance their home purchase.

The USDA loan program has two objectives: helping lower-income buyers get into homes, and repopulating rural areas to increase productivity and economic stability in those areas. The parameters for these loans are quite specific: The home must be in a designated rural area, and the buyers must meet income parameters that vary by location. There are two types of USDA loans. The first is achieved through USDA-approved lenders, in which the USDA guarantees the load to offset the lender’s risk, and the other is acquired directly from the USDA. Buyers with credit scores of at least 640 can get a loan through a lender, but there is no minimum credit score required for a loan taken directly from the USDA and no down payment required for either type.

Two other programs operate a bit differently: Fannie Mae’s HomeReady loan program and Freddie Mac’s Home Possible loans are disbursed directly from Fannie Mae and Freddie Mac, rather than being issued through other lenders and guarantees. HomeReady is aimed at borrowers without credit scores—those who haven’t taken loans or used credit significantly enough or for long enough to generate a credit score. This program can help freelancers get approved for a mortgage, as well as other borrowers who don’t have standard paperwork documenting income and assets such as independent contractors. Borrowers in this program can use other sources to demonstrate their ability to make timely payments, such as stubs from utility and bill payments and bank statements. This program only requires a 3 percent down payment, but down payments lower than 20 percent will require private mortgage insurance. Home Possible loans are also focused on buyers without credit histories, but they require a 5 percent down payment and also require private mortgage insurance for down payments less than 20 percent.

STEP 2: Boost your approval chances by increasing your down payment, decreasing your debt and DTI, and more.

For borrowers whose credit score is the only significant negative in their loan application package, lenders are more likely to see it as just one component of their financial package and will look to other strengths to balance it out. If, however, the rest of the application also has numbers that skate close to the line, the borrower will look like a much bigger risk. A borrower’s credit score will take the longest to improve, so while they continue to focus on that, they can take immediate steps to bolster the rest of their package.

First, borrowers will want to work on building their down payment because higher down payments signal lower risk to lenders—the more of the home the borrower has paid for outright, the less the lender stands to lose if they default. In addition, a higher down payment reduces the likelihood that the borrower will need to pay private mortgage insurance (PMI) or a mortgage insurance premium (MIP), so more of each monthly payment will go toward paying down debt.

DTI, or debt-to-income ratio, is the balance between the borrower’s pre-tax income and the amount of debt they have. Lenders use this as an indicator that the borrower is not taking on more debt than they can afford to pay. This ratio only includes monthly payments toward debt; it does not include utilities, insurance, food and clothing expenses, entertainment, gas, or any of the borrower’s other expenses. While each mortgage lender and program will stipulate its maximum DTI, it’s not really a number a borrower wants to max out if they want to be able to comfortably pay their bills. Paying down existing debt as quickly as possible will reduce this ratio and increase the borrower’s chances of getting a loan.

One other option to support the application and take the onus off of credit problems is for the borrower to find a cosigner. Cosigners sign the paperwork for the mortgage with the main borrower, and in doing so, agree to pay the debt should the borrower be unable to do so, which can make the difference when buying a house with bad credit. It’s a huge risk for the cosigner, who is then also carrying the borrower’s mortgage on their own credit report and increasing their own DTI. Usually cosigners are close family members who have faith in the borrower’s intention to pay the loan and who may be comfortable carrying them over a rough patch or two—but who can count on the borrower to take care of their business.

STEP 3: Understand what’s on your credit report and take steps to repair your credit.

Credit scores are somewhat mysterious; few people really understand how they are calculated, as the math that goes into determining a FICO credit score is a closely guarded secret. However, there are several factors that have clear effects on a credit score, and borrowers can take steps to improve those factors. Before worrying about how to adjust their score, the borrower will need to take a solid look at their credit history. They can get copies of their credit report from all three major credit bureaus (Experian, Equifax, and TransUnion). Sometimes creditors report to one of the agencies and not the others, so the borrower will want to check all three. Borrowers are entitled to one free credit report each year from each agency through the Federal Trade Commission’s website—they’ll want to be careful about signing up for other “free” credit report sites that promise their report and score for a fee. Borrowers will want to check their credit report carefully, looking for errors and ensuring that all the accounts on the report are accurate. Any problems can be disputed with the credit bureaus, but that can take some time, so it’s advised that borrowers start early.

What goes into a credit score? A borrower’s payment history makes up about 35 percent of their overall score, and a clear, lengthy record of on-time payments goes a long way toward showing lenders that they take debt payment seriously. If this is something a borrower has struggled with, they’ll want to put an extra effort into making those payments on time before they apply for a mortgage—assuming that their payments have been late because they’re forgetful or just don’t get payments in the mail on time. In those cases, borrowers may consider taking advantage of their bank’s payment scheduling function or autodraw options offered by their creditors and utilities to ensure payments get in on time. If, however, the borrower’s payments are frequently late because they’re struggling financially, it’s probably a bigger priority that they become more financially stable before they apply for a loan.

Credit utilization, or the amount of credit that a borrower has available balanced against the amount of credit they have used, makes up another 30 percent of a credit score. Borrowers who have a significant amount of unused credit show that they can be responsible, and they will have higher credit scores as a result. If, on the other hand, a borrower’s credit cards are all close to maxed out, or they have personal loans that are early in repayment, it appears to lenders that the borrower is dependent on credit to remain financially solvent, which will lower their credit score. To improve a credit score, borrowers will want to work on paying down their existing credit card debt so that they have a healthier ratio between available and used credit. If the borrower is in good standing with their credit card provider and they’re not overextended, they can ask for an increase in their credit limit, which will shift the balance in a positive way.

There are several other components, such as the age of the borrower’s credit history and the mix of existing credit, that the borrower has little influence over. A borrower can’t jump back in time and take out their first credit card or car loan sooner, but they can avoid closing their oldest accounts, even if they don’t use them, and avoid opening a lot of new accounts shortly before applying for a loan. If a borrower has bad credit, they may find it hard to get approved for a credit card, but also adding new accounts will skew the average age of their credit. The mix of a borrower’s existing credit involves the combination of different types of credit they have on file: credit cards, car loans, student loans, and other types of debt. The greater the mix, the higher their score. If the borrower is still some distance away from applying for their home loan, they may be able to affect this mix by paying off and closing some accounts.

Accounts that are in collection are the biggest negative that a borrower can have on a credit report, because they suggest that they have not made an attempt to pay back the debt or have abandoned it. There are some options, once an account in collections is paid off, that will allow a borrower to pay an extra fee to have the collection removed from their account. If they choose to do this, they’ll want to take care to get confirmation of the deletion in writing and to check their credit report a month or two later to make sure the negative item has been removed from their credit history.

STEP 4: Look for grants.

Most of the agencies that back home loans for low-income or poor-credit buyers are part of the federal government or are federal contractors. State and local programs don’t generally have the resources to take on that kind of risk. What borrowers will find in state and local programs are assistance programs to help with down payments. A larger down payment makes borrowers with poor credit appear less risky to the lender, so increasing their down payment through a grant or down payment assistance program can significantly impact their overall application and make their poor credit weigh less on their options. Some of these programs are income-dependent, while others are designed to help recent college graduates afford a down payment, and there are many other specific programs based on where the borrower lives. Borrowers can contact local government housing agencies or work with a mortgage lending professional to learn more about programs available to them.

STEP 5: Take the time to find the right lender.

This is an incredibly important step when a borrower’s credit score is less than optimal and they’re seeking home loans with bad credit. While federal programs have specific parameters that approved lenders must meet, there’s no rule that every lender has to participate in those programs. A borrower may need to call quite a few lenders to inquire about programs available for buyers with poor credit. Because there are so many different loan programs available, some lenders may not participate, or may not be aware that certain programs even exist. Buyers who have a strong application package other than their credit score will need to advocate for themselves and seek out cooperative lenders who know what they have available and are willing to explain it to the borrower clearly. If the borrower contacts a lender who won’t explain their options clearly or gives them a hard time, it’s probably not the right lender for that borrower. The best mortgage lenders will be open to explaining their programs and how a borrower’s profile fits each one, and discussing the terms and implications openly. Ideally, borrowers will identify several lenders with whom they’re comfortable, and then apply with them to compare terms and rates and choose a mortgage lender that’s the best fit.

STEP 6: Consider other options, such as taking out a personal loan or simply waiting before taking out a mortgage.

It can feel very unfair to be rejected for house loans for bad credit, especially if the borrower has put significant effort into improving theirs. The fact is that credit takes time to improve as the negative items age out and are replaced by a more positive history. If a borrower is unable to get a home loan, they can consider applying for a personal loan, which has different criteria that they may be more able to meet. But borrowers will want to be careful: The terms on personal loans may be shorter, and the interest rates higher, which can mean a higher payment and a higher chance of defaulting.

If the borrower finds that their applications for home loans are repeatedly unsuccessful, they may want to adjust their plans. Those rejections suggest that lenders are too uncomfortable with the borrower’s financial situation to loan them money, and that’s an important piece of information for a borrower to have. Lenders are businesses, certainly, and operate to make money, but they’re also not in the business of destroying people financially if they can avoid it. If several lenders think a borrower can’t manage a home loan right now, they will want to consider why. Defaults on home loans may make it impossible to get another one for years and often result in bankruptcy. So if the borrower is struggling to get a home loan, they’ll want to consider taking some time to repair their credit, build savings toward a solid down payment, rebalance their DTI, and try again in a year or two when their financial health is on more solid ground.

Is it possible to get a home loan with bad credit? If the rest of the borrower’s financial profile is healthy, then it can be, especially if they apply through one of the programs designed to help. As always, borrowers will want to look at their overall financial situation, and remember that just because they can take a loan doesn’t mean that they should. Discussing an application with a mortgage professional can go a long way toward helping borrowers make the best choice for them and get them into a home they love at the right time.