We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Living in a condo certainly has some appeal. You are only personally responsible for the cleaning and upkeep of your individual unit, while the community’s homeowners association takes care of exterior maintenance projects and landscaping. Many condominium owners also enjoy access to a variety of amenities on the property, such as pools, gyms, and tennis courts.

However, as you’re weighing the pros and cons of owning a condo and debating your next real estate move, you’ll want to understand a number of unexpected costs associated with owning a condo. Many people don’t know about these hidden expenses until it is too late. Read on to learn more before signing on the dotted line and purchasing a new condo.

RELATED: Real Estate Regret: 13 Simple Ways to Avoid It

HOA Dues and Maintenance Fees

While it is a well-known fact that condo owners are required to pay homeowners association (HOA) dues or maintenance fees, some people don’t realize just how costly these fees may be. Depending on the area where you live, the age of the property, and the different amenities included, your fees could range between $100 and $1,000 every month. One of the main differences between condos and townhouses is that condo fees are typically much higher. Always work with your real estate agent to determine the specific HOA dues associated with the condo you’re considering purchasing.

Special Assessments

The HOA dues are designed to cover amenities and routine maintenance work. However, as with any other property type, unexpected repairs or expenses can occur. A condominium association passes these expenses on to the condo owners through special assessments. Each owner is charged a percentage of the total bill, which can be quite high with larger repairs.

Additional Insurance Premiums

Some condominium owners will also face additional insurance premiums. Depending on your location—particularly beachfront properties or other areas with a higher risk of natural disasters—an insurance company may charge a higher premium. While it is true that your homeowners association will have its own insurance to cover damage to the building’s exterior, you will still be on the line for any damage to the interior.

RELATED: The Best Real Estate Websites of 2022

Higher Mortgage Rates

Another expense to prepare yourself for if you’re in the market for a condo is higher mortgage rates. Lenders view a condominium as a riskier purchase than a single-family home. They make up for this additional risk by charging a slightly higher interest rate—typically between 0.125 and 0.250 percentage points—for those looking to take out a loan on a condominium. While you may be able to work with your lender and avoid these fees if you make a larger down payment, that isn’t an option for many homebuyers.

RELATED: 18 Hidden Costs of Moving

Pet Fees

Some condominium associations have rules in place prohibiting residents from owning pets—or some types or breeds of pets. Other associations may allow pets, but will charge annual pet fees to cover the potential damage they can cause to common areas. If you have a pet, or plan to get one after moving, be sure to check on the pet policy and whether you’ll face additional fees.

Property Taxes

You’ll have to pay property taxes regardless of whether you purchase a condo, townhome, or single-family home. Property taxes increase as the value of the property rises. Beyond this expected expense, however, you may be surprised by a larger tax bill than you were anticipating. Some developers are given tax breaks while they’re building a property. If these tax breaks end, your property tax bill will go up.

RELATED: 10 Ways to Lower Your Property Taxes

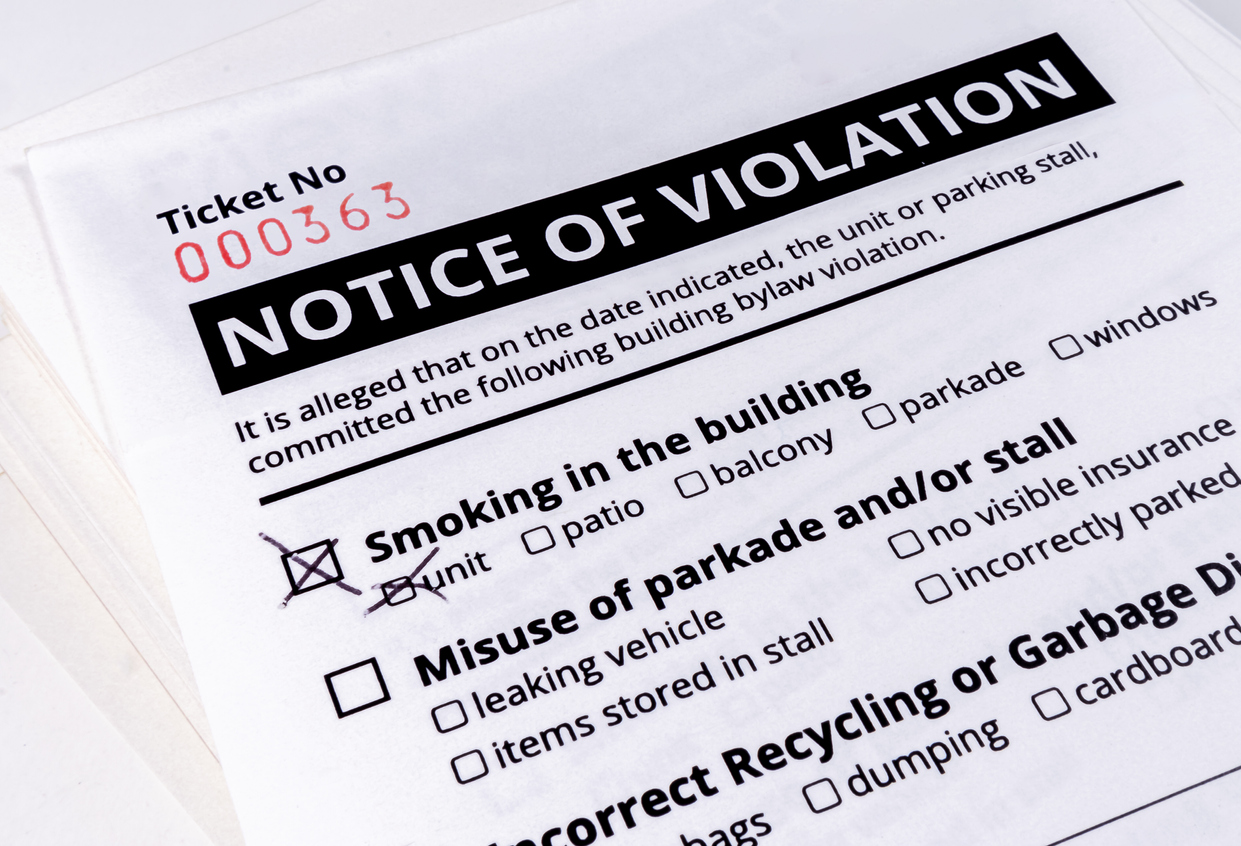

Fines

Condominium associations have covenants, conditions, and restrictions (CC&Rs) that govern the property. These CC&Rs often have very specific rules regarding what owners can and can’t do. These rules may dictate the types of window coverings you can hang, when or if you can display holiday decorations or political signs, the types of hardware you can use on your front door, and more. Breaking any of these rules could result in fines from your condominium association—not to mention the other headaches involved in such disputes.