We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Auction Excitement

Real estate auctions—whether they’re online or on-site—bring out a feeling of excitement, and if bidders don’t set a firm limit on the amount they’re willing to lay out, they may convince themselves that if they bid just a little bit higher, they’ll win. If they’re not careful, that “one more bid” can turn into 20 more bids, and they may end up overpaying for a property that isn’t worth the money.

No Negotiating

When you make an offer on a home through a real estate agent, you fill out a sales contract that stipulates how much you’re willing to pay, when the sale will close, and other considerations, and then the seller can make a counteroffer. In contrast, no negotiations are possible when you buy at auction, so read the fine print on the auction site (or auction bill) carefully, because if your bid wins, you’re financially obligated to pay for the house, whether it’s a real plum or a lemon.

No Inspections

On a traditional home purchase, the buyer (you) can order inspections after making an offer on the house. If the inspections turn up a major structural problem, you can often get out of the contract. Not so with a house bought at auction. You may or may not get a chance to walk through the home before you bid, so you run the risk of purchasing a house that needs costly repairs.

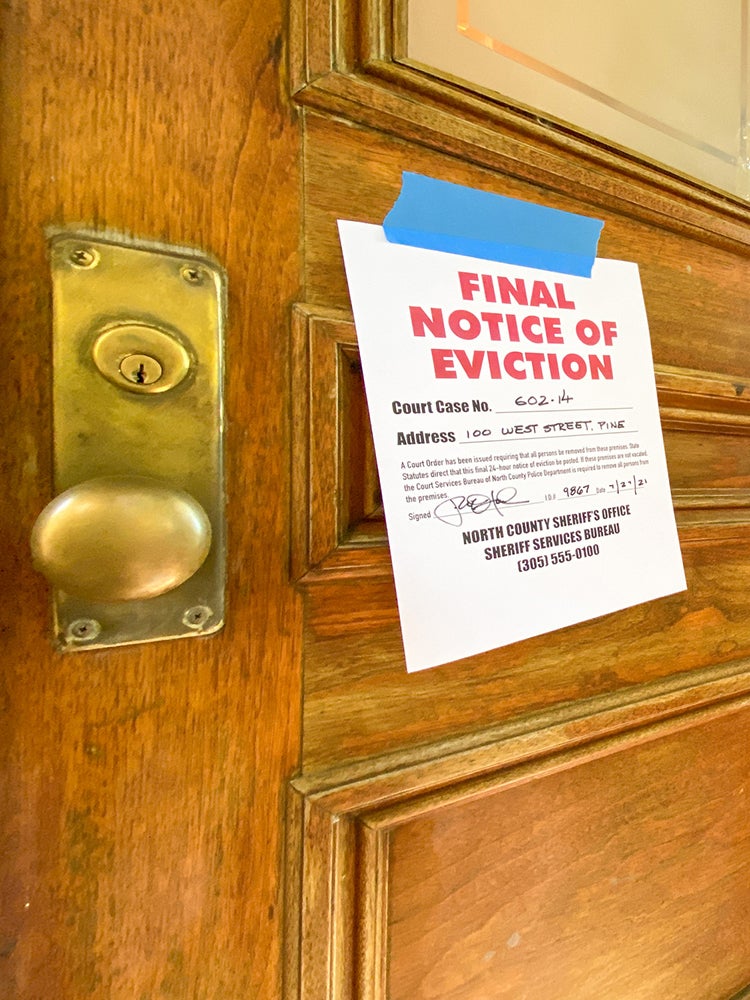

You May Have to Evict a Resident

While any house can be auctioned, homes often end up on the auction block because of foreclosure. When this happens, the lender auctions off the house—but that doesn’t mean the residents have moved out. The lender will inform the residents that the house has sold, but you may have to take steps to legally evict them in order to take possession of your new property.

Little Documentation

Homes sold at auction don’t come with documentation that protects you, such as the disclosure statement you receive when you buy a house the traditional way through a real estate agent. Instead, you’ll have to do your own research by calling the local Register of Deeds office to find out the current value of the home and whether the prior owners filed permits for any remodeling projects.

Proof of Financing

If you’re attending an in-person auction—many are conducted on the steps of a county courthouse—you will probably have to show a bank letter of financing approval or a financial statement before you’ll be allowed to bid. This tells the auctioneer that you’re capable of paying for the house if you win the bid.

Even if You Win, You Might Not Get the House

County tax assessors may auction off property because the owners have not paid their property taxes. When this is the reason for the auction, even if you win the bid, depending on the laws in your state, the former owner may still have a chance to pay the back taxes owed and regain ownership of the property.

If the auction is a lender confirmation auction, the bid must still be approved after the auction is over. If your bid does not reach the lender’s reserve amount, it could be tossed out and the house could be reauctioned or sold in a different manner.

Buyer’s Premium

When buying a house through an agent, the agent’s fee will be deducted from the seller’s proceeds at closing, but auctioneers don’t operate in the same manner. Rather, they charge a buyer’s premium that typically ranges from 5 to 10 percent or more, depending on the auctioneer, and that amount will be tacked onto the winning bid at the end of the auction.

Unseen Damage

One of the reasons houses sometimes sell below their apparent value at auction is that there may be hidden problems within a house. Driving by a house will give you an idea of the condition of its exterior, but it’s not unheard of for previous residents to damage the interior if their lender foreclosed on their home. You won’t get a guarantee on any part of the home’s condition, so take that into account when setting your maximum bid.

Related: How to Avoid Overpaying for a House

You Might Not Get a Clear Title

The fine print on a house auction bill often has terminology that indicates the house is being sold “as is, and where is,” which means the property could have a mechanic’s lien against it or another type of claim. If you’re serious about bidding on the property, you’ll be money ahead to hire a real estate attorney to do an independent title search to ensure you won’t have legal problems if you win the bid.