We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Beware of Thieves

Hackers grow ever more sophisticated, putting personal and financial information at risk of theft. Many people don’t even know they’ve been hacked until they’re stuck with charges they didn’t make on accounts in their name they didn’t open. Reducing your risk of identity theft starts with awareness and continues with on-going commitment and action. No plan is foolproof, but you can make it harder for thieves to get your information with a few easy precautions.

Pick Up the Mail

Mail theft happens fast, and incidents of it are on the rise. Don’t give thieves an easy target. Pick up the mail every day since it’s easier to steal at night. For some people, it may make sense to invest in a locked mailbox, especially if the post office is too far away to make a PO Box practical. Finally, put in a call to the local post office to put the mail on hold during vacations.

Check Account Statements

Thieves sometimes skim small amounts out of accounts to avoid detection. Keep a close eye on all withdrawals and charges on bank and credit card accounts. If there’s a charge you don’t recognize, call the bank or credit card company immediately to dispute the charge. Identity theft is common enough that banks and credit card companies usually have policies that work in your favor as long as you identify the charge within a reasonable time frame.

Related: 7 Documents You’re Probably Forgetting to Shred

Lock Up the Social Security Cards

Social Security cards aren’t meant to be carried in a wallet like a credit card. A stolen purse, backpack, or wallet gives thieves an easy way to create fraudulent accounts in your name. A locked safe is the best place to store a Social Security card. Be careful giving out your Social Security number. Scammers often call claiming to be from a bank or credit card company and ask for a Social Security number to verify the account. However, most financial institutions will not call and ask for that information over the phone.

Shred Sensitive Information and Credit Card Offers

These days throwing sensitive information into the garbage isn’t enough. Dumpster divers easily pull out discarded bank statements, and even credit card offers. They can then use that information to create accounts in your name, leaving you to pay the tab. Shred any sensitive information, including receipts, bank statements, credit offers, and expired cards.

Related: 9 Documents to Keep Locked Up

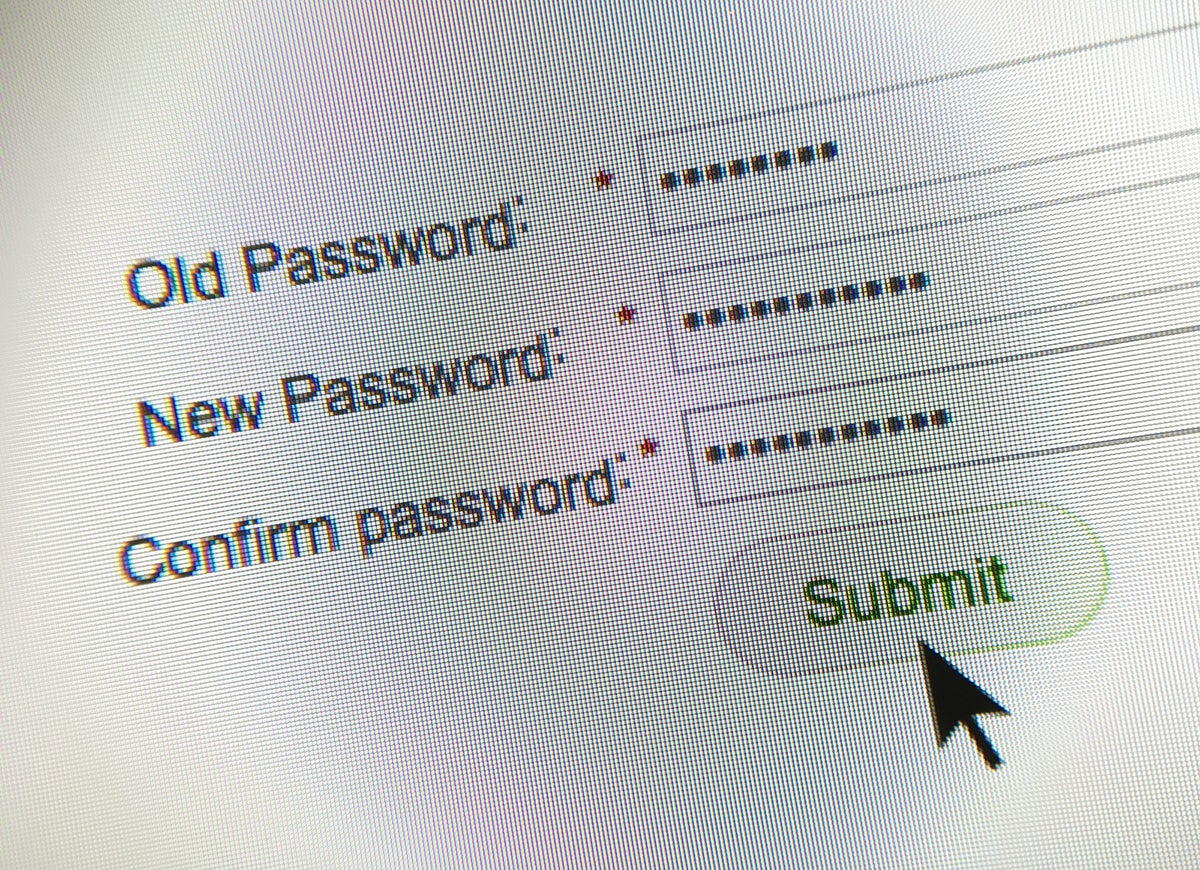

Create Complex Passwords and Change Them Regularly

Passwords are a part of modern life that can’t be avoided. Do not use PASSWORD, 12345, your birthday, or the birthday of someone close to you. A smart thief will try common passwords and probably already has your birthday and possibly the birthdays of loved ones on file, so dig a little deeper. Try coming up with a phrase or sentence that’s easy to remember. If remembering passwords is a problem, there are programs that remember and automatically input passwords. Another option is to write them down, but keep the written passwords locked away in a safe.

Request and Review Credit Reports

The three main credit bureaus — Experian, Equifax, and TransUnion — offer one free credit report per year. Take advantage of the opportunity, and check your report. The reports show every account associated with your Social Security number, name, and birthday. They’re a great way to spot unfamiliar, and usually, fraudulent accounts. If you do notice an account you didn’t open, get on the phone to shut it down as soon as possible.

Opt for Two-Step Verification

If an app, bank, or any other institution asks if you want two-step verification on an account, say yes. Two-step verification requires two layers of identifying information to access or make a change to the account. It could involve entering a password and answering a pre-selected question or choosing a former address from a list. Chances are thieves only have one piece of identifying information, so they won’t get both verification steps correct.

Activate Mobile Security Features

Cell phones have a number of security features, but you’ll need to activate some of them on your own. If possible, use both a password and biometrics like a fingerprint or facial recognition to unlock the phone. Be very careful when using public Wi-Fi as hackers can watch every transaction. Install apps that secure information or alert you to the status of the Wi-Fi connection—so you know when it’s safe to use. Make sure to keep the operating system software updated since it will include the latest security features.

Be Familiar with Billing Cycles

Keep track of the billing cycles for all accounts, including utility, mortgage, car payments, and any other regular bills. If you’re not aware of due dates, a stolen bill may go unnoticed. It may pay to keep a spreadsheet that lists when each bill typically arrives. Go paperless if paper bills aren’t really necessary. If a bill doesn’t show up, call the sender to see if there was a problem on their end.