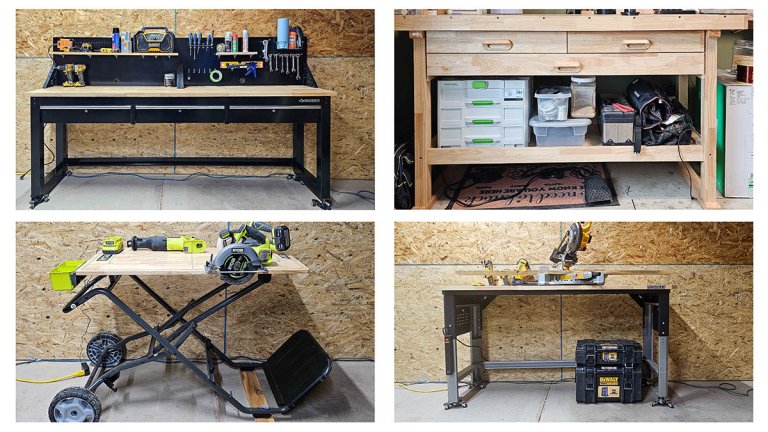

The Best Workbenches for DIYers, Woodworkers, and Pros

From weekend projects to pro-level builds, these workbenches provide the space and stability you need.

From weekend projects to pro-level builds, these workbenches provide the space and stability you need.

Increase kitchen functionality at any hour with extra output from easy-to-install under-cabinet lighting.

Get the lowdown on drill bits so you’ll know which ones to buy and rely on for all kinds of drilling tasks and DIY projects.

Add an essential tool to your workshop without overspending.

The first step to carpeting your staircase is knowing how much carpet to order. Here's how to get an accurate measurement.

Whether you plan to update wood furniture with a new coat of paint or just need to smooth a freshly cut edge, this guide will help you select the best sandpaper, tools, and technique for the job.

A professional deck builder shares basic steps (and a few secrets) for sanding a wood deck to renew its surface.

One of our go-to oscillating multi-tools is temporarily priced at over half off, making it a good time to buy if you’re into remodeling or repair work.

Blur the lines between inside and outside by adding these features to your home.

Low water pressure in your home can be caused by things like clogged pipes, valve issues, even municipal supply problems. Learn why your water is trickling, and what you can do to fix it.

The contrast of sculptured shrubs with meandering pathways and beds bursting with color paints an alluring picture. Here’s how you can pull this off yourself.

The updated lineup adds a sealed-head XR ratchet with interchangeable drives and two compact Atomic 1/4-inch models – including a long-neck version built for tight engine bays and equipment work.

The best kitchen and bath products of 2026 are smarter, quieter, and more space-saving than ever.

If you’re already on Kobalt’s 24V system, Lowe’s has rare $79 pricing on core add-ons, including batteries and an impact wrench, plus more tool kits under $100.

Chop saws and miter saws are often confused for the same tool, but there are important differences every DIYer should know.

Which mighty power saw is best for your woodworking projects and skill level—or do you need both?

Both saws have round blades, but have very different functions.

Don’t settle for making cuts on an old workbench. Pick up a miter saw stand to improve the speed and accuracy of your DIY projects.

Paint primer helps paint adhere better on slippery surfaces and is a must for a paint color change. After testing a variety of paint primers, we found a favorite that offers low odor and works on all surfaces.

Are you planning to hang a garden hose reel or artwork on a brick wall in your home, and don't know where to start? Choose the right tool, drill bit, and technique, and you can bore holes in brick walls—indoors and out—in mere minutes.