Hurry, These Lowe’s Member Week Deals Beat Amazon Prime Day Deals and Include Free Tools

Lowe’s Member Week runs through July 18. Here’s how to find the best markdowns—including a popular power tool under $100.

Lowe’s Member Week runs through July 18. Here’s how to find the best markdowns—including a popular power tool under $100.

Now’s the time to upgrade your tired, old power tools or add some essentials to your toolbox with this incredible offer.

We tested several hose timers to bring you the best options for perfectly hydrated lawns and gardens.

It's the worst surge in 5 years.

Find out what’s in and out when it comes to backyard upgrades.

Tame an unruly garden hose with a sturdy retractable storage reel that best suits your yard and budget.

Try these expert-backed tricks to boost window efficiency.

Ryobi and DeWalt tools, patio sets, and power washers—these Home Depot deals beat Prime Day prices, and they’re live now.

Know the best way to incorporate dark colors into your home without going overboard.

Get ready to cool off: From shaded toddler pools to deluxe setups, I found the best pool deals on Amazon for Prime Day.

A sale on essentials, like water filtration and fire blankets? Yes, please.

These top-rated Greenworks tools are still on sale, but not for long. Shop mowers, blowers, pressure washers, and more before the Prime Day deals disappear.

Keep annoying pests 15 feet away with this must-have gadget. It's also safe for kids and pets.

From dual-fuel workhorses to smart solar stations, these rare Prime Day generator deals—up to $1,600 off—are still live (for now).

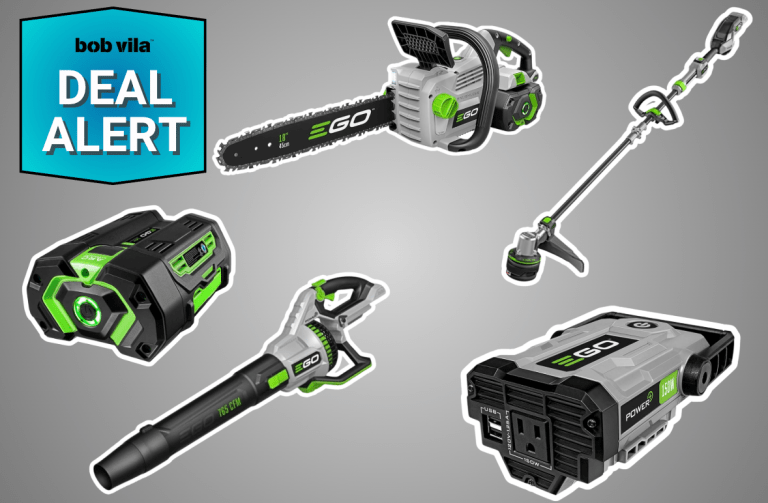

Ego’s most-wanted cordless tools—from a souped-up power blower to a commercial-grade trimmer—are marked down now, but not for long.

From sheet sanders and multi-cutters to blowers and combo kits, these pro-grade Makita tools are still marked down, but not for long.

Save up to $400 on Milwaukee, Nest, Rheem, and more—but these deals disappear after today.

Window screen replacement is an easy, inexpensive project that even novice DIYers can do. Here’s how to keep insects from coming through the holes in your screens.

One of these small yet mighty window air conditioners can help folks sleep cooler and otherwise feel more comfortable indoors during hot weather.

These garden accessories keep my plants well-watered, even when I'm away for the weekend.