We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Q: Our landlord requires that we carry a renters insurance policy. His landlord insurance covers the building, but we’re responsible for covering our own belongings. I know a renters policy will cover damage, but will it protect us in case of a break-in and theft?

A: This is not an uncommon requirement. Landlords carry policies to protect themselves against financial loss as a result of structural damage or disaster. It would be a huge financial risk, however, for landlords to be financially responsible for the personal possessions of all their tenants, so many require that tenants carry their own coverage. What is renters insurance coverage? Renters insurance is purchased annually. You’ll pay a premium, select coverage levels, and choose a deductible. If your personal items are damaged in a covered event, the insurance company will reimburse you for the cost of repairing or replacing those items—with some restrictions. Renters insurance, like homeowners insurance, is inclusive. This means only perils listed specifically in the policy are covered, so you’ll want to check yours carefully. Perils usually included are fire, windstorm, lightning, explosions, vandalism, and theft. So in all likelihood, your policy covers theft.

But what kind of theft? Does renters insurance cover car theft? Does renters insurance cover bike theft? Does renters insurance cover theft outside the home? What about theft from other locations—does renters insurance cover theft from vehicles? The answers depend on your policy. Once you’ve determined the types of theft your policy covers, you’ll need to consider how much insurance you have, because every policy has a deductible that you pay before the insurance kicks in and a maximum payout. In other words, it’s a good idea to do some homework to make sure the payout will be what you need to repair or replace your items.

Renters insurance typically covers theft with personal property coverage.

Rental insurance coverage includes personal property coverage when a covered event occurs. If you ruin your couch by spilling spaghetti sauce all over it, you’ll have to pay for the repairs yourself, but if a tree branch comes crashing through the window during a windstorm and destroys the couch, then you’re likely covered. Theft is usually deemed out of your control, so it is a covered event in nearly every policy. If someone breaks into your apartment and steals your TV and electronics, you’ll be covered, barring certain exceptions.

What kinds of items does renters insurance cover? To start, your policy will pay to replace anything that is damaged or lost in a covered event. Furniture, dishes, books, electronics, clothing—pretty much everything you own. Most policies will replace stolen cash, but they’ll place a specific limit on cash coverage because it’s so difficult to prove that you had the cash at the time of the theft, so it’s wise to limit the amount of cash you carry or store in your rental. Renters insurance will also cover theft that is specific to renters.

If theft was due to “negligence,” your claim may not be approved by your insurer.

While your policy will cover personal items stolen from your home, there are certain conditions under which the insurance company might decline to pay out. The insurer expects you to take basic precautions to try to secure your property. If the police report filed about the theft shows that all the windows and doors were open and unlocked and you weren’t home, or that you left your laptop unattended on a library table for a half-hour when you went to grab a coffee, your insurance carrier may decide that the items were stolen as a result of negligence. If this is the case, it will reject your claim. In addition, if your items are in the possession of someone else at the time of the theft—for example, you checked your luggage, and your luggage is stolen—the insurer might refuse to reimburse you, as it would argue that the company who had possession of your items at the time they were stolen was negligent and it should cover the loss.

Renters insurance can cover theft both in and outside your home.

Because your policy is attached to your rented space, theft of personal items from your home is covered. However, you may be surprised to know that your items are usually covered wherever they are, as long as you’re the responsible party at the time the items are taken. So if your items are stolen from a hotel room you’ve rented, they’re covered. If your backpack is stolen while you’re in the street or on the bus, you’re covered. If you have a rental with a yard and garage, those areas are included in this coverage as well. So if your bicycle is stolen out of your locked garage, you’ll be reimbursed for its replacement after your deductible is paid.

The one sticky spot in outside-the-home coverage is automobiles. Does renters insurance cover theft from cars? Yes. If your purse, golf clubs, or other items are stolen from the car, your insurance company will likely cover them. If the car itself is stolen, however, you’ll have to file the claim with your auto insurance company (which should provide coverage for it if your policy has comprehensive coverage). What about parts of the car, such as tires? Does renters insurance cover catalytic converter theft? With the recent rash of cars being stripped of salable parts while parked in lots or driveways, these are reasonable questions. Again, these thefts, as frustrating as they are, should result in claims on your auto insurance policy. Renters insurance does not cover automobiles in any way, but it will reimburse you for items inside the car if they’re stolen.

Your coverage is dependent on your policy: If you have $10,000 worth of belongings stolen but only have $5,000 worth of personal property coverage, your renters insurance will only pay up to $5,000.

Most people tend to underestimate the value of what they own, probably because it’s been acquired over years from a variety of sources. Especially if some of the items are inherited from family members or received from friends, it can be hard to place a value on them. The ratty couch you love that came from your parents’ basement isn’t worth much on the street, nor is the ancient tube TV in the kitchen. But if you have to replace either of those items, either because there’s been a theft or another covered event, you’ll quickly discover that the replacement value of those items—what you’ll have to shell out in a store to get a new one—is pretty significant. There are two considerations when you’re deciding how much coverage you need, because it’s not just how much—it’s what kind.

There are two types of payouts that renters insurance policies offer. The basic, less-expensive option is called actual cash value coverage. With this choice, you’ll compile a list of items that were damaged or stolen, their age and condition, and their cost at the time of purchase. The insurance company will do some math, determine how much age and wear and tear have depreciated the value, subtract that from the original value, and pay you what’s left. This amount will help defray the costs of repurchasing your items, but it won’t come close to covering the complete cost of replacement. For that, you may need to upgrade to replacement cost coverage, which will pay out the cost to replace your items at today’s prices. To maximize either type of payout, you’ll want to assemble a digital file into which you scan copies of purchase receipts, appraisals, and photos of your items to support your claim should you need to file one.

Once you know what type of payout you prefer, you’ll need to do a good valuation of your possessions. Your insurance policy will have a clearly stated maximum, and if the value of your belongings is higher than the coverage maximum, you may find yourself without enough reimbursement to replace your possessions. How do you do this? First, take stock of what you have. You can make a list, use an app, or just walk slowly around your home taking a video of everything in your apartment. There are a number of value calculators online that will help you determine the value of what you have, and if you’re planning to choose replacement cost coverage you can do a little research into how much it would cost to replace items that are older with a comparable model. Tally up your total; that’s the amount of insurance you’ll need to cover your home.

Before you decide you’re finished with your valuation, though, there’s one more thing to consider. Your insurer will let you choose from several preset levels of coverage. If, however, you own expensive or heirloom jewelry, rare collectibles, musical instruments, fine artwork, or other unusual and costly items, you’ll want to acquire appraisals of their value and discuss them with your insurance agent. You may need to add extra coverage endorsements specifically to cover those items beyond the basic policy maximums.

Last but not least, you’ll need to think about your deductible. Your deductible is the amount of money you’ll have to pay out of your pocket toward the replacement of your items before the insurance company will begin to reimburse you. You’ll be offered several deductible amount options, with lower deductibles usually resulting in higher premium costs and higher deductibles correlating with lower premium costs. It’s a balancing act, and you’ll have to decide if you’d rather prepare to pay a little more in the event you need to file a claim but save on your up-front cost, or pay a higher amount for the policy and reduce the amount that you’ll need to pay out of pocket after you file a claim.

The best way to ensure that your renters insurance covers theft is to get enough coverage for all your belongings and to be cautious in protecting your property.

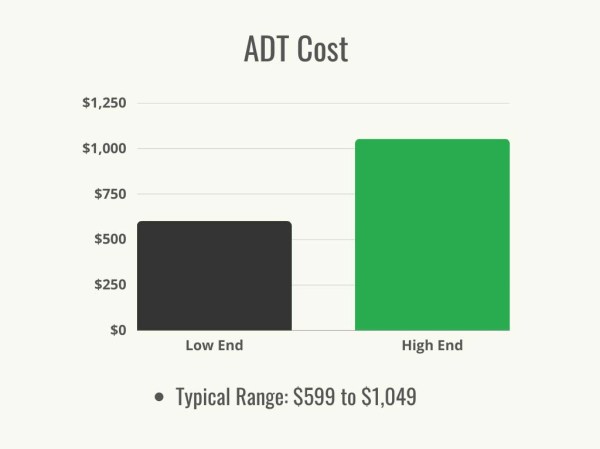

Your policy covers theft—and probably more types and instances of theft than you’d expect. If you are the victim of a theft, however, finding that you’ve underinsured the value of your possessions or fallen into one of the coverage loopholes (left the garage door open…again!) can be devastating. Your best defense against theft is to carefully secure your rental unit, improve the security of your door locks, tuck valuables out of sight both in your home and car, and consider security options, such as a doorbell camera or one of the best apartment security systems. If these measures fail, however, be sure that you have chosen coverage maximums and added appropriate endorsements to the policy to ensure that you’re able to replace what was taken. Theft is a personal crime that can be very stressful and overwhelming, especially if it’s achieved during a break-in into your personal space. Knowing you’re properly insured can add to your peace of mind, and if a theft does occur, you’ll be able to file a claim and begin replacing and rebuilding quickly.