We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Highlights

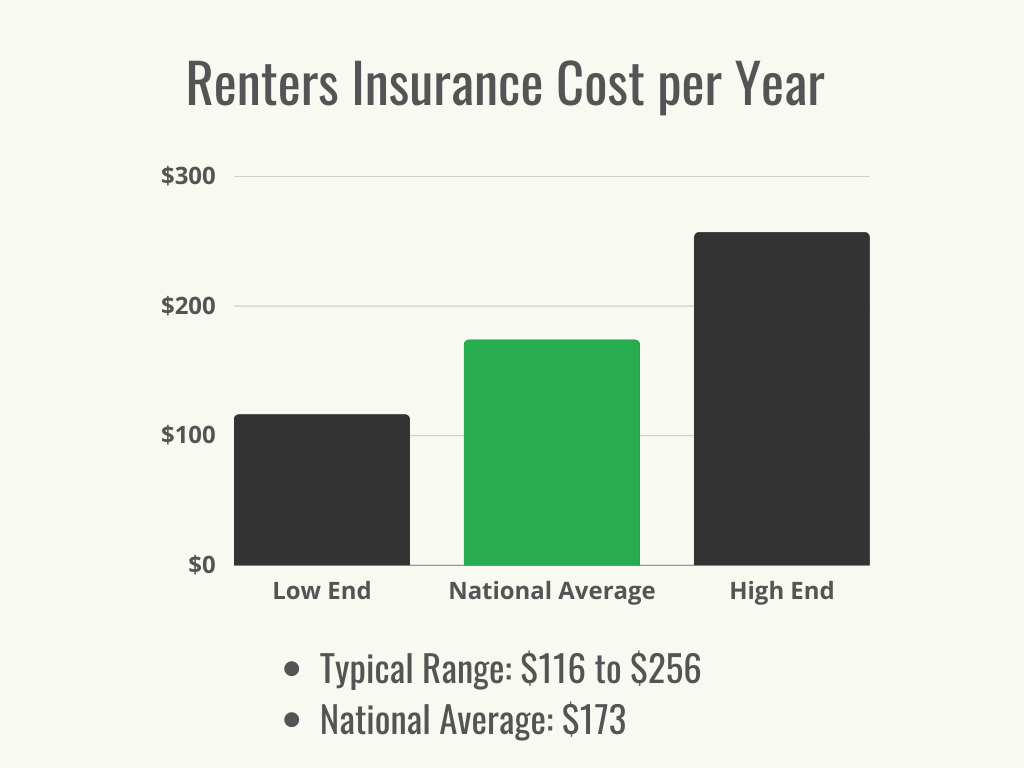

- The typical price range of renters insurance is $116 to $256 per year, with a national average of $173.

- Renters’ exact costs will depend on the amount and type of coverage they choose, their location, and their deductible.

- It’s generally advised for all renters to get insurance to cover their personal possessions should they be damaged or destroyed in a covered event.

Renters may think that their landlord will be held responsible if anything happens to their personal belongings—say, if a fire in the unit destroys their wardrobe or if a burglar breaks in and steals their laptop—but that’s usually not the case. Without renters insurance to provide financial protection, tenants could be left paying to cover these losses on their own.

What is renters insurance? Renters insurance is designed to provide financial protection against losses due to accidents, weather, theft, and vandalism, which is similar to homeowners insurance. Unlike homeowners insurance, though, renters insurance is designed to cover the contents of the apartment or rental home and doesn’t cover the structure itself since the renter doesn’t own it—that is covered by landlord insurance taken out by the property owner.

In the event of a covered disaster or significant burglary, having renters insurance can provide peace of mind for renters knowing that their personal property is covered and can be replaced with much less financial burden to them.

So how much is renters insurance? The exact costs can vary based on a number of factors. According to the Insurance Information Institute (III), most renters pay between $116 and $256 for renters insurance annually, and the national average cost of renters insurance is $173 per year. Understanding the components of the coverage and cost can help renters decide whether renters insurance is a good fit for them.

Factors in Calculating Renters Insurance Cost

Insurance for renters doesn’t come in a one-size-fits-all policy; the cost and benefits of carrying a policy will depend on a number of factors. Some of these factors are within the renter’s control, such as the building in which they choose to live, their credit history, and the coverage they choose to purchase. Other elements outside their control, such as the state in which they live and the potential for severe weather in that area, can also affect the cost of renters insurance. As such, policyholders may find that their rates don’t exactly match the average renters insurance cost of $173.

Geographic Location

According to Brenda Cude, Ph.D., professor emeritus at the Department of Financial Planning, Housing and Consumer Economics at the University of Georgia, “Geographic location matters in any type of property insurance. For example, the crime rate in a neighborhood influences the risk of theft. Whether you live in an area where floods or earthquakes are likely influences the risk of property loss.”

This risk varies by state but also within individual states; areas within a state that are prone to flooding, fire, or wind conditions will have rates higher than areas of the same state with less risk, and neighborhoods with older buildings or high-crime areas can have higher rates than the surrounding areas. In general, states with exposed coastlines that are in the paths of hurricane-force winds have the highest rates, including Louisiana, Georgia, Mississippi, and Alabama, along with Kansas, where the threat of tornadoes keeps rates relatively high. Interior and northern states (states that have less-severe coastal wind and that are at higher elevations, reducing flooding) such as Wyoming, Iowa, Vermont, North Dakota, and Pennsylvania, have some of the lowest rates nationwide. The following are some examples of the average cost for renters insurance in various states.

| State | Average Monthly Premium | Average Annual Premium |

| Arizona | $13.67 | $164 |

| California | $14.25 | $171 |

| Georgia | $17.67 | $212 |

| Massachusetts | $14.33 | $172 |

| Michigan | $15.08 | $181 |

Extreme Weather Risk

Severe weather such as hurricanes and tornadoes are expensive events for insurance companies. Large swaths of a state can be flooded, buildings can be destroyed, and residents can be left without power for weeks. All insurance operates on a gamble that the insurance company will collect more dollars in premiums than it has to pay out in claims over time, so when extreme weather strikes, that careful balance sheet can tip. The kind of total destruction that can be caused by hurricanes, wildfires, and tornadoes means the insurance companies have to pay to rebuild properties from the ground up, replace their clients’ belongings, and pay for the living costs of displaced policyholders. As a result, apartment insurance companies charge higher rates in areas where this kind of destruction has happened in the past or where it is likely to happen in the future.

Renters who want coverage for such catastrophic events may need to pay extra for endorsements that expand the scope of their coverage beyond what a standard renters insurance policy can offer. For instance, states such as California, Oregon, Washington, and Nevada may be at risk of earthquakes, and residents may want to buy an earthquake endorsement to protect against this kind of damage, which would increase the cost of their renters insurance policy. Sinkholes are another natural disaster not typically covered by renters insurance, and policyholders may need to purchase an add-on if they want their belongings to be insured for any sinkhole damage. Flooding can occur in various areas across the country, but coastal regions may be especially at risk. Renters insurance rarely covers flood damage outside of extra add-ons, which would increase the total cost of the policy if purchased.

Crime Risk

Renters insurance typically covers instances of theft and can even provide off-premises theft coverage, which insures belongings even when the policyholder is away from home. For instance, this insurance could cover the policyholder’s laptop if it’s stolen while they are riding the bus (a deductible would still apply in this scenario, though). This can be a huge source of relief for tenants, but insurance companies will often charge higher premiums in areas with higher crime rates. Generally speaking, renters can expect to pay more for an insurance policy if they live in a city than they would if they lived in a small town in a rural area. That being said, policyholders may be able to lower their premiums by taking advantage of any protective devices discounts if they live in a home with burglar alarms and other safety features (such as smoke detectors or carbon monoxide detectors) installed.

Renter Credit History and Score

Studies show that people with poor credit scores are more likely to file claims, so insurance companies see them as higher risks. While most companies don’t run an actual credit report, they use another tool called a credit-based insurance score—a metric that estimates how likely the person is to file an insurance claim. Calculations vary by company, but in general this score includes someone’s payment history, outstanding debt, the length of their credit history, recent credit applications, and the types of credit they have. These details combine to create a score that indicates their likelihood to file a claim, so the higher their score, the lower their rates will likely be. Because so many of the same factors make up a credit-based insurance score and credit score, the two often go hand in hand, so if a renter’s credit score is good, it’s likely that their insurance score will be as well—unless they have a significant history of filing large and small insurance claims. Some states, including California, Maryland, and Massachusetts, forbid the use of credit in setting insurance rates.

Dog Ownership and Breed

Renters insurance provides liability coverage to policyholders, which can cover damages or injuries caused by the policyholder’s dog. As a result, owners of larger-breed dogs or dogs considered “aggressive” breeds can expect to pay a larger premium to protect the insurance company against additional claims should the dog bite a neighbor. Unfortunately, some insurance companies may refuse to cover larger or so-called aggressive-breed dogs, so a renter who has this type of dog may need to shop around to find a company that will offer them a policy. Additionally, an insurance company may implement a sublimit if the dog has a history of biting, which means it will cover incidents only up to a specified amount.

Building Type

Newer apartment buildings often have modern smoke alarms, integrated sprinkler systems, smart security systems, and up-to-the-latest-code egress options. Renters insurance companies love this kind of building, where the building owners have taken actions to reduce the risk of loss; therefore, insurance companies will likely offer renters a reduced rate. Living in a charming older building with quirks and bits of history has its rewards, but insurance companies see those charming quirks as risks: Older buildings are less likely to have safety features that meet modern standards and are more likely to have older pipes and electrical systems, so rates will likely be higher.

Coverage Type

There are four major coverage categories within a renters insurance policy: personal property, liability, loss of use coverage, and medical payments to others.

- Personal property coverage protects the renter’s belongings in the event they are stolen or damaged by a covered peril such as a fire or storm.

- Liability coverage protects renters who are found to be at fault for causing third-party injury or property damages.

- Loss of use coverage applies if the renter cannot stay in the home or apartment because it has become uninhabitable due to a covered event.

- Medical payments to others provides coverage for smaller medical bills if someone is hurt on the property, regardless of fault. There is no deductible associated with this coverage.

The types of coverage listed above are standard on renters insurance policies, but in some cases renters will want to add a rider, also called a floater or endorsement, for additional coverage, as there are certain events that renters insurance does not cover. “Most renters policies don’t cover floods or earthquakes so you might ask about adding that coverage, which may require buying a separate policy,” says Cude. “If you use your home for business purposes, you’ll need to buy a commercial policy to cover risks associated with your business. And, if you have expensive jewelry, electronic equipment, or antiques, you may want to ask about an endorsement to increase your coverage for those items.” Other common riders include those for pet damage, identity theft, and scheduled property riders (additional coverage for named items of higher value, such as expensive jewelry, sports equipment, or antiques).

Additional Coverage or Riders

Policyholders often have the option to purchase additional coverage with their renters insurance through riders, also known as endorsements. These add-ons can expand the scope of their renters insurance so it covers more types of damage—water backup damage, for instance—or provides services that might otherwise not be covered by a standard renters insurance policy. For example, insurance companies may offer additional identity theft protection to help policyholders restore their identity if it’s been stolen as well as cover related costs such as legal fees or lost wages. Such additional coverage may be very appealing to renters, but any rider will come at an extra cost and increase the total price of an insurance policy.

Coverage Amount and Limits

One of the first actions for renters to take when considering insurance coverage is a full inventory of belongings. Once renters have figured out what items they have, they’ll need to decide what they’d like to have covered, and for how much. Surprisingly, many people undervalue their possessions and don’t insure them for as much as they should. The insurance company will set general limits as to how much they’ll pay out in the event of a loss, and if the renter chooses to limit their coverage further, they may be able to lower their premium. In the event of a complete loss, however (such as a fire), policy limits will apply, and if a renter has chosen to insure their property for less than it’s worth, they may be left paying out of pocket to replace items that were lost.

However, there is also the option to add endorsements, or specific coverage extensions with higher limits, for certain items that have a higher value than the policy would otherwise pay out. Expensive jewelry, musical instruments, and heirloom artwork are some examples of items that can be covered under endorsements. Because adding endorsements increase a renter’s payout in the event of a loss, they’ll increase the overall cost for renters insurance, so it’s important to consider adding endorsements for any items that would not be covered under a standard renters insurance policy to ensure the renter is compensated in the event of a loss. Insurance companies may have a renters insurance cost calculator that can help tenants anticipate how much insurance they will need and how much that coverage will cost them.

Deductible

Insurance companies will assess a deductible on any approved claim that is filed by the policyholder. Contrary to the common misconception, policyholders do not pay deductibles out of pocket; instead, this amount is deducted from their payout before the insurance provider disburses their funds. Insurance companies often offer a range of deductibles for policyholders to consider, and renters insurance deductibles typically run anywhere between $500 and $2,000. Renters can control, to an extent, how much they pay for their monthly insurance premium by adjusting their deductible. A lower deductible will result in a higher premium, because renters are expecting the company to assume more of the risk and pay out more for an approved claim. A higher deductible can reduce the premium, but it can also lead to a smaller payout if a renter needs to file a claim.

It’s generally wise for renters to compare renters insurance policies from multiple companies, and it may be a good idea to account for deductible options when doing so. Renters may want to get a few different renters insurance quotes to see how much the deductible affects the premium cost and if having a higher deductible will create a hardship if they need to file a claim. They can then balance the up-front cost of the insurance premium against the deductible they’d need to pay in the event of a claim and adjust these figures until they feel comfortable that they’re not paying more than they can afford in premiums but still feel protected with a deductible that is manageable.

Claims History

Policyholders may want to be judicious about filing small claims on their renters insurance as having a history of previous claims can cause rates to rise. In extreme cases, a track record of excessive claims could result in policy cancellation. This may sound unfair—after all, if a renter is paying a premium for access to coverage, they might wonder why they are being punished for using it. From an insurance company’s perspective, it makes perfect sense: The renter has filed multiple claims before, so they are more likely to file one again. A claim on a renter’s record within the previous 3 to 5 years can result in a rate hike of as much as 20 percent. Certainly, a renter should file a claim when it’s warranted, but especially if the claim amount will be close to the deductible, renters will want to consider whether the payout will be worth the potential rate hike or policy cancellation.

Types of Renters Insurance Coverage

One of the most common questions renters have is, “What does renters insurance cover?” Policies include more than one type of coverage by default: personal property coverage, liability coverage, medical payments coverage, and loss of use coverage. Understanding these different types of coverage can help answer the natural next question: “How much renters insurance do I need?”

Personal Property Coverage

If an event covered by a renters insurance policy occurs, the insurance company will cover the cost of the damage beyond the renter’s deductible. The renter’s individual policy will spell out how much the company will pay; each company has a slightly different formula that helps determine the payout to replace or repair covered items. Renters insurance companies typically offer two types of coverage for personal property: actual cash value and replacement cost coverage. Actual cash value coverage will pay to replace items damaged by a covered peril at their depreciated cost (less the deductible), whereas replacement cost coverage will replace the items at today’s prices (less the deductible). If a renter has a good inventory of possessions, including photographs and, where possible, receipts, it will help this process along and could maximize the payout.

Liability Coverage

Liability coverage helps protect the renter financially. If an accident occurs in the rented residence, the victim of the accident can sue the renter for damages. This is because the renter is liable, or responsible, for what happens in their home. These claims can amount to thousands of dollars: Without insurance, renters can be bankrupted by a liability claim, so it’s worth investing in an insurance policy that covers liability by investing in an insurance policy that will provide sufficient liability coverage in the event a renter is sued.

Medical Payments Coverage

Medical payments coverage is designed to cover medical expenses that arise in the event a guest is injured at the renter’s home, regardless of whether anyone is at fault. For instance, if a renter has a friend over to help them move a dresser and the friend drops the dresser on their foot, some or all of the medical expenses they incur may be covered by the medical payments to others portion of the renters insurance. This coverage is typically limited to either $1,000 or $5,000 and only applies to guests. Furthermore, this coverage doesn’t require payment of a deductible.

Loss of Use Coverage

After a covered event that damages or destroys a residence, renters will sometimes need to move out of the space for a period of time while the residence is repaired and rebuilt. They’ll likely still be paying rent, so the costs of living at a hotel can mount up quickly. Renters insurance will cover some of the cost of these expenses.

In addition to paying for a place to live during the repairs after a major claim, renters will incur other expenses faster than they might imagine. Even if the hotel has a kitchenette, they’ll likely pay more for food because the fridge is tiny and there’s minimal storage space. They may have to pay to park their car, or commute farther, or pay to have their children transported to school. The loss of use benefit of a renters insurance policy covers these extra costs up to the coverage limit.

Do I need renters insurance?

Some renters will find that insurance is required by their landlord, in which case they will need to determine how to get a renters insurance policy right away. However, in other cases it may seem like an unnecessary expense at first glance. The following reasons to consider getting renters insurance can help customers determine whether renters insurance is worth the cost.

Landlord Requirements

In some cases, the landlord may specify whether renters insurance is required, but in others it may be a requirement positioned by the landlord’s own insurance company. The landlord carries insurance on the property itself, which will cover physical damage to the building in case of a covered event, and the landlord may also have a home warranty for the rental property to help cover the cost of maintenance and repairs. The landlord’s insurance will also cover their liability in case someone is injured on the property. A requirement that tenants have their own policies—and can prove it—can reduce the landlord’s total claim and keep their insurance premiums lower.

According to Cude, “While some landlords might require renters insurance, many don’t, so it’s your choice whether you buy it. But we recommend that you buy renters insurance. Otherwise, you would have no coverage if your personal belongings are damaged, destroyed, or stolen, or if a grease fire in your kitchen destroys the other units in your building.”

Insufficient Savings

When determining whether renters insurance is worth it, renters will want to ask themselves, “In the event that all of my belongings are destroyed, could I afford to replace them?” For many, the answer is no. Even for those who have enough cash on hand for such an emergency, the prospect of spending that hard-earned money replacing belongings when an insurance policy could have covered the cost isn’t necessarily appealing. Renters will want to weigh the risks carefully against the (often relatively low) cost of a renters insurance policy.

Benefits of Getting Renters Insurance

Some renters may consider that their possessions and furniture are a motley collection of hand-me-downs left over from a string of college apartments and assume they’re not worth much. That may be true—but the cost to replace them all would likely still be significant. Renters will want to consider the expenses that can be incurred as a result of a fire that destroys not only personal items but the entire building; they add up fast. Insurance for rented spaces provides a host of benefits for a relatively low cost.

Affordability

Some renters hear others talking about the high cost of homeowners insurance and assume that renters insurance is too expensive, especially if they’re in a situation where their rent is high compared to their income and they’re trying to save up for a house. It’s important for renters to remember that homeowners insurance covers the building, the occupants, and the property surrounding it, while renters insurance covers the resident and their personal possessions. With an average cost of $173 per year, affordable renters insurance is actually pretty attainable. Renters insurance is a great investment to protect possessions, liability, and savings: If everything the resident owns were to be wiped out by a fire, the amount they’d lose in replacing everything would be far greater than the premium they’d pay to protect themselves. With that in mind, budget-minded tenants may want to consider getting a policy from one of the cheapest renters insurance companies that offers the most value.

Financial Protection

One of the main reasons to get renters insurance is to protect a renter’s wallet. Some renters may be financially capable of covering costs that arise in the event of an emergency, and therefore do not consider having renters insurance to be worth the cost. However, if the worst were to happen, having renters insurance means that they can keep their savings and will only be out the cost of their policy and the deductible.

Liability Protection

Liability protection covers renters in the event that they are held legally responsible for causing an accident or injury to another person or their property. It’s impossible to predict when a leak could cause water damage in a downstairs neighbor’s apartment or a guest might slip and fall on the front stairs. Renters with liability coverage can rest assured that insurance will help bear the cost of repairs, medical expenses, or legal fees should the unexpected occur.

Coverage Away From Home

A common misconception about renters insurance is that it only covers belongings while they are physically on the rented property. In actuality, if the policyholder loses their expensive watch or has their phone stolen while away from home, these scenarios could be covered by renters insurance, although it’s important for the policyholder to remember that the deductible would apply. In some cases, coverage can also apply to items that are stolen or vandalized while in a rented storage unit.

Peace of Mind

Plenty of people will admit that they worry about emergencies like fires or burglaries, and these are not unfounded fears. Renters insurance monthly costs can be as low as $10 to $15 per month, and for that price renters can have the reassurance that they won’t lose their savings should the worst happen.

How to Save Money on Renters Insurance Cost

Even though renters insurance is competitively priced, it’s a good idea to look to see where it might be possible to save a few dollars. In the case of renters insurance, there are actually quite a few ways to reduce the premium other than searching for “cheap renters insurance” online and picking a policy based on price alone.

- Look into bundling. If tenants also have auto insurance, they may want to ask their agent about bundling their auto and renters insurance for a multi-policy discount.

- Ask about safety discounts. Tenants may want to look for, install, or check with their landlord about installing safety features such as smoke detectors and alarm systems in their unit and the building, as these can qualify them for discounts.

- Ask about additional discounts. Renters insurance companies often have discounts available for seniors, members of the military, teachers, first responders, and other program members. It doesn’t hurt to ask.

- Consider automatic payments. Many insurance companies offer a cost reduction if policyholders set up automatic payments, so check whether that is an option. As a bonus, renters won’t need to remember to pay their premiums if they are automatically deducted from their account.

- Raise your deductible. A higher deductible means a lower premium, and if the policyholder never needs to file a claim, they’ll save significant money by choosing the higher deductible. If they need to file a claim, however, this can backfire, but choosing a balance between the amount of the deductible and the amount spent in premium is a good option.

- Improve your credit score. Having a relatively good credit score may reduce a customer’s insurance rates. Renters can build their credit by paying bills on time, asking for limit increases on their credit cards, and making sure there are no errors bringing down their overall score.

- Shop around. Renters shouldn’t necessarily buy the first policy they find. Looking at multiple options can help tenants find the best renters insurance company (such as Lemonade or State Farm) for their needs at the most affordable price.

Questions to Ask About Renters Insurance

Not all renters insurance companies are the same; the process for obtaining insurance and access can vary. In addition to collecting all the information they need on costs and basic coverage questions, there are a few specific things renters will want to ask their agent before signing a policy.

- Will my policy cover my roommate as well? Some renters insurance companies require roommates to purchase separate policies, but others permit renters to share a policy as long as they agree on all the terms.

- Will my pets affect the cost or coverage of my policy? Sometimes the answer is yes, and it’s important to pin down exactly how much.

- Do you provide cash value or replacement cost coverage? This is important: Cash value coverage pays out how much the property is worth, so the original cost minus depreciation. Replacement cost coverage pays out what it will cost to purchase a replacement item at today’s prices.

- How do I file a claim? Some companies allow policyholders to file a claim only through a mobile app; others staff a call center or encourage policyholders to contact their agent directly.

- Can I take my policy with me if I move? For renters who move annually, this is a key question. The answer is usually yes, but renters may want more details on how to move their policy and what costs might be associated.

FAQs

Many people don’t even realize that renters insurance exists until they’re told that they need to get a policy, but the product provides real protection for new renters and those who have existed without the handy umbrella of insurance for years. With insurance, rental units and their contents are as protected as they can be from accidents, natural disasters, and theft or vandalism. The following are some of the most frequently asked questions, along with their answers.

Q. How much does renters insurance cost on average?

What does renters insurance cost? The current nationwide average is $173 per year, plus the cost of meeting the deductible prior to the payout of a claim. The premium can be paid annually, semiannually, or monthly, in most cases. Based on the national average, the average renters insurance cost per month would be around $14 or $15.

Q. Is renters insurance cost lower if I have a home security system?

Yes! Insurance companies love security systems because they significantly lower the likelihood of theft and can function as an early-warning system in case of fire, reducing the overall cost of a loss. Renters will want to check with their renters insurance company before choosing a security system to see what parameters the system must meet to qualify for a discount. For example, some companies only offer discounts if the system is professionally monitored.

Q. Does renters insurance cover theft of my personal property?

Renters insurance covers theft—and the property doesn’t even have to be in the rented property when it’s stolen to qualify. If items are stolen from the home or while the resident is at work, school, or out on the town, they will likely be covered, less the deductible. In addition, items kept in a rented storage unit may be covered, but it’s a good idea for renters to check with their insurance carrier to see if that applies. Some insurance companies also have a requirement that the renter file a police report before items can be covered and provide them with a copy, and many policies have coverage limits for stolen items to help avoid fraudulent claims.

Q. How long does a renters insurance claim process take?

This depends on the type of claim and the steps that have already been taken. For a property damage or loss claim, things can move along quickly, especially if the renter has a detailed inventory and has receipts and photos of their belongings. The claim will likely be filed and processed quickly, especially if accompanied by information from the police or first responders.

Liability claims take longer since the injured party has to file the claim, which starts an investigation by the insurance company. Often the discussion of the case has to be run through lawyers for both insurance companies and the renter, and then based on the merits of the case, it might go to a judge or a trial to be settled, which can take an indefinite amount of time.

Q. Can I pay the renters insurance premium quarterly?

In most cases, yes, and it may even be possible to get a discount for doing so. Insurance companies like annual payments and quarterly payments because they reduce the risk of taking on a client. To encourage more people to do so, insurance companies often offer incentives to pay ahead.

Q. Does renters insurance cover items in my backyard?

Yes, as long as the items belong to the policyholder and are damaged or lost due to a covered event. Whether the items are in the car, a locker, a desk drawer, or the backyard, they’ll be covered by a renters insurance policy as long as the damage or loss occurred as a result of a covered event, and only after the deductible has been paid.

Sources: Insurance Information Institute