We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Q: My landlord doesn’t require that I carry renters insurance, but I’ve been told it’s a good idea anyway—except I’m worried that I’ll pay for it and then have my claims rejected because of loopholes. I want to understand my policy better. What does renters insurance cover, and more importantly, what does it not cover?

A: Your concern is a valid one and something that everyone who pays for any kind of insurance thinks about. Renters insurance policy documents, just like other types of insurance documents, can be filled with terms that you’d think only an insurance professional could understand. In truth, the categories of what is excluded from the policy should be clearly listed in the policy, right alongside the renters insurance definition (perhaps after some of those confusing terms). Renters insurance policies are considered policies of exclusion, so if an event or type of damage is not specifically listed as something that isn’t covered, then by default it should be covered. To really understand the renters insurance policy, the policyholder should read the list of exclusions in their policy so that they know which situations won’t be covered. Every policy is slightly different, but there are some common exclusions in almost every policy, such as bed bugs or flood damage.

What is renters insurance? How does renters insurance work? Like other insurance policies, the kind of specialized insurance renting a house, condo, or apartment requires is purchased for an annual premium. The policy documents will identify the coverage type and limits, the term of the policy, and the conditions under which the policy will pay out. If a covered event occurs, the policyholder must first meet their deductible, which is an amount of money they’ll have to pay out of pocket for repairs before the insurance coverage kicks in. The deductible is specified in the policy document so there’s no surprise. After the deductible is met, the insurance will cover the cost of repair or replacement of the damaged or lost items up to the limits of the policy.

Renters insurance offers coverage to renters for a wide variety of covered events, but there are some exceptions to what it will cover.

It’s important to remember that renters insurance companies are businesses, not charities; they exist to make a profit while genuinely helping their customers. Because of that, they count on earning more money in premiums each year than they pay out in damages. This consideration is how the companies set their rates and coverage limits. It also plays into how they decide which events are covered and which ones are not. Events that are limited to certain parts of the country, such as floods or earthquakes, are typically excluded in order to protect the company. Also, policyholders making a claim may need to prove that the covered items were not intentionally lost or damaged—if that’s the case, the insurance won’t cover their repair or replacement.

How can renters minimize the likelihood that a claim will be denied? First, they will want to read the policy documents carefully to make sure they understand the exclusions. Second, they should make a complete, organized home inventory. This can be accomplished by using an app that catalogs home contents and stores digital copies of receipts, or it can be done by simply walking slowly around the home while running a video, zooming in on serial numbers where appropriate and pairing that with a file folder full of receipts. The more evidence of ownership and condition a renter can provide when filing a claim, the more likely it is that the claim will be approved and the reimbursement amount maximized.

In general, renters insurance won’t cover “extreme” events like flooding, earthquakes, sinkholes, or terrorism.

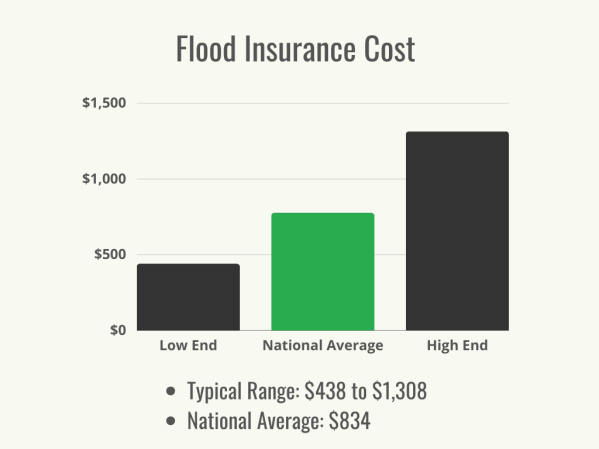

Flooding causes extraordinarily expensive damage, because the water is full of bacteria and debris once it makes it inside a home, and it will damage literally everything it touches. Earthquakes aren’t much better; catastrophic structural damage can mean that there’s no possibility of repair and only the option of tearing down the building completely and starting over. And like floods, earthquakes cause damage to large numbers of buildings at the same time. Sinkholes often involve both earth movement and water, leading to enormous damage and collapse. These three perils, however, are not equally likely across the country. For the most part, they are limited to particular areas such as designated FEMA flood areas, areas along fault lines, and areas with unstable bedrock. Therefore, most homeowners and renters insurance companies exclude these perils rather than ramping up all of their customers’ rates to cover perils that threaten relatively few. Some coverage for earthquakes and sinkholes may be available as “add-on” coverage for an extra cost in areas where those dangers are prevalent, and flood insurance is available for separate purchase from the National Flood Insurance Program for renters who live in flood-prone areas. Does renters insurance cover water damage? It can, but it generally only covers damage resulting from accidents or pipe breakage in the home or water that comes in due to damage to the roof. Flooding is a separate type of damage and therefore requires additional coverage.

Terrorism is also excluded from most policies for similar reasons. It’s a broad term that can apply to large or small events and is impossible to predict, but it may cause damage to a large area all at once.

Damage from “preventable” pest infestations, such as bed bugs, is also not typically covered by renters insurance.

This exclusion will dismay many renters. Damage caused by pests such as bed bugs, termites, mice, and other vermin is usually excluded from renters insurance policies. The thinking behind this exclusion is that an infestation large enough to cause widespread damage has been in place for some time, which suggests a failure in maintenance. This is not an across-the-board exclusion; some claims may be approved based on the circumstances, but in general, it’s best to take preventive measures to protect personal items if a renter feels it’s likely that pests are present—and to notify the landlord immediately.

Renters insurance doesn’t normally cover the property of anyone living with the policyholder unless listed on the policy.

Roommates share everything—the couch, the kitchen, the bathroom—but they can’t share renters insurance. In the case of a claim, sorting out which reimbursement would apply to which roommate’s possessions is a swamp insurance companies don’t want to jump into. Some companies will permit a shared policy, but in that case, both renters must be listed on the policy and an itemized list of possessions must accompany the policy. Even then, it’s usually best for roommates to purchase their own rental insurance coverage to avoid disputes after a disaster has occurred.

Renters insurance covers the contents of a car, but not the car itself if it’s stolen or damaged.

Many people don’t realize that renters insurance will cover personal property that is stolen or damaged even if it’s not in the rented space at the time of the loss. So if a backpack containing a laptop is stolen out of a car parked at work, renters insurance will cover the replacement of the stolen items after the deductible has been met. However, the car isn’t covered in and of itself; any damage to the car, or loss of the entire vehicle, would be covered by auto insurance.

Renters insurance won’t typically cover damage to the property itself; that’s covered by the landlord’s insurance.

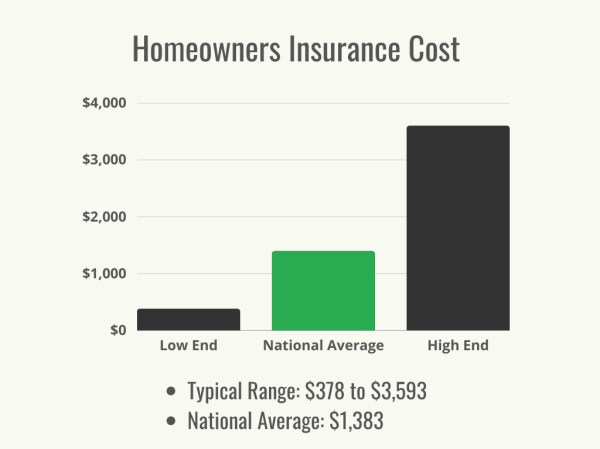

One of the aspects of renters insurance that makes it more affordable than homeowners insurance is that it only covers the renter and the renter’s property. Where homeowners insurance includes coverage for the structure of the building, the grounds, the appliances and home systems, and the contents of the home, renters aren’t responsible for all of those things. That’s why renters liability insurance and personal property insurance does not cover damage to the home structure itself. Landlords can purchase separate policies that cover the other components of a building, including the structure, appliances, and grounds, but landlord insurance will not cover their renters’ personal property.

Mold damage isn’t usually covered by renters insurance unless it was caused by a covered incident.

Mold falls under two of the categories that are reasons for exclusion from renters insurance: it’s often caused by a maintenance issue, and it’s often caused by flooding. Mold isn’t usually caused by a sudden event, because it grows over time and is quite expensive to remediate and repair. For that reason, mold damage is typically not covered by renters insurance.

However, there may be some circumstances where items damaged by mold are covered. If the mold damage is the result of a covered incident, such as a burst pipe or storm, the renters insurance policy may cover replacement of damaged or destroyed items. The best way for renters to avoid paying out of pocket to replace mold-damaged items is to report any leaks or possible water damage to their landlord to fix the issue as soon as possible, thereby preventing mold from forming in the first place.

Belongings that are accidentally damaged by you or a pet are usually not covered by renters insurance.

Pets don’t damage their owner’s items with intent, but the damage they cause is not covered by renters insurance. If a dog chews the legs of a table or a cat scratches up the arms of a couch, the pet owners will be making the repair out of their own pocket. The same goes for carpets that are soiled.

Similarly, accidental damage caused by humans is generally not considered a covered peril. If someone drops a heavy item and cracks the bathroom sink, that won’t be covered by renters insurance, and the renter will likely have to pay for it or forfeit their security deposit.

Valuables and personal business items typically require additional coverage.

Renters insurance policies have coverage limits, as do all insurance policies. The total payout limit will be listed in the policy documents, and depending on the insurance company, may be limited per claim, per item, per event, or per year. This amount is usually high enough to provide basic personal property coverage and liability insurance. However, most renters’ belongings are worth more than they might expect, so completing an inventory prior to purchasing the policy is a good idea. An inventory can help an insurance agent assist renters in determining how much coverage they need.

There are certain situations that will almost always require additional coverage. The first is if the renter owns items of high value, such as collectibles, musical instruments, antique items or furniture, jewelry, and other items whose replacement value would exceed the regular coverage limit. Rental insurance policies have add-on coverage, called endorsements, that can be tacked on to the policy to raise the coverage limits for specific items or categories of items. The second situation is if the renter owns a small business that is operated out of the rental unit. The equipment that is used specifically for the business is not covered by the regular renters policy, but like the high-value item endorsement, most companies have a business endorsement that can be added to a policy so the renter is fully covered.

Belongings that are not documented by the renters may be more difficult to get covered by insurance.

Grandma’s ring and Dad’s pocket watch both have enormous sentimental value and can never really be replaced, but unless they’ve been appraised, it will be hard to pinpoint their monetary value in the event that they’re stolen or destroyed. Even electronic items, such as computer equipment or the big television in the living room, will be difficult to get reimbursed if the receipts or purchase confirmations are all missing. Meticulous renters keep a file with receipts, appraisals, and ideally photos of their big-ticket items, but even a solid file cabinet can be taken out by a long-duration fire. The best plan is for the renter to collect documentation as they purchase more expensive items (including furniture) and either scan or take pictures of the receipts and upload them to a cloud file. For valuable items that no longer have documentation, such as heirlooms, older jewelry, or collections, renters can consult experts for an appraisal document and do the same with that information. Even photographs of the model and serial numbers of electronics can help when filing a claim. Documentation streamlines the claims process, and claims accompanied by careful documentation raise fewer questions and challenges and are more likely to be paid out promptly.

Renters insurance is typically inexpensive and covers personal belongings in most situations, making it highly recommended to all renters.

It seems like renters insurance has a lot of exceptions, but that’s really only because they’re itemized; the list of things that are covered is much longer. What is renters insurance coverage used for? Fires; windstorms; rain, snow, and hail damage; lightning strikes; burst pipes; explosions; vandalism—those perils are usually covered and are the most likely causes of significant financial loss. Does renters insurance cover theft? It does, and it will also cover damage caused by the burglars while they’re inside the apartment. Even if the renter doesn’t think the contents of their apartment are worth much, they should still take a moment and tally up how much the items would cost to replace. Renters can shop around online and get a realistic idea of the replacement cost of their belongings. Many renters may find that the cost to replace their personal items after a disaster isn’t an amount they have saved up or would be willing to put on a credit card to replace. In the stressful days after experiencing the loss of personal property, deciding what the renter will be able to replace and what they won’t shouldn’t have to be part of the upheaval. Renters insurance usually costs a small fraction of the amount most renters would have to pay to replace everything, especially if the renter shops around and requests quotes from the best renters insurance companies before choosing a policy. Whether the landlord requires it or not, renters insurance is a must-have for renters to protect their peace of mind and their wallet.