We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Highlights

- The typical annual cost of earthquake insurance in California is $3.54 per thousand dollars of coverage.

- The exact cost depends on the earthquake risk level in the policyholder’s area, the type and amount of coverage they choose, their deductible percentage, and the construction of their home.

- Policyholders can opt for several types of coverage, including dwelling, personal property, loss of use, and other structures.

- Although earthquake insurance isn’t required by law, it is strongly recommended for California residents due to the heightened risk of seismic activity in the state.

California is home to numerous active fault lines, which means it experiences more than its fair share of seismic activity. Since earthquakes can cause substantial damage, it’s advisable for California residents to make sure they have insurance to help cover the costs to rebuild their home or replace their belongings if an earthquake were to occur. However, renters insurance and homeowners insurance does not provide coverage for earthquakes, so it’s important for Californians to look into insurance for earthquakes.

But how much is earthquake insurance in California? Golden State residents can expect to pay an average of $3.54 per thousand dollars of earthquake insurance coverage. For a home with $500,000 of coverage, that means earthquake insurance in California costs the homeowner around $1,770 per year.

What is the California Earthquake Authority (CEA)?

The California Earthquake Authority, or CEA, was created in 1996 by the California Legislature to help Golden State residents find earthquake insurance coverage. This was in response to a massive 6.7-magnitude quake that struck the San Fernando Valley in 1994, causing around $20 billion in damage. After the earthquake struck, insurance companies largely stopped writing California earthquake policies in the state because of the potential for extremely high expenses.

The not-for-profit CEA works with participating insurance companies to provide earthquake insurance coverage to Californians, as well as provide seismic retrofit grants of up to $3,000. Homeowners whose homes have had a seismic retrofit can get a discount on their CEA insurance premiums of up to 25 percent. The CEA also helps educate Californians on how they can minimize the risk of damage to their property should an earthquake hit their region, and on how they can stay safe during an earthquake by using a survival kit stocked with several essentials.

After getting an earthquake insurance quote from the CEA’s website, the customer will work with their insurance company to purchase coverage, which will be administered by the CEA. As of 2024, the CEA provides insurance for over 1 million policyholders and has 22 participating residential insurers.

Factors in Calculating Earthquake Insurance in California

Several factors can determine how much a homeowner or renter will pay for California earthquake coverage, including risk level, coverage type and amount, policy type, the home’s age and construction, the deductible, and the home’s geographic location. The best California earthquake insurance providers will take all these and more into account when determining the average cost of earthquake insurance.

Earthquake Risk Level

One of the main factors affecting earthquake insurance costs in California is the home’s risk level. In general, a home close to an active fault line will cost more to insure than one located farther away. As such, earthquake insurance coverage in Alameda has an average cost of $3,235 per year for $500,000 of coverage, while a home in Fair Oaks will cost around $1,230 per year for the same amount of coverage. Even homes in the same region can have differing costs. For example, earthquake insurance in Los Angeles tends to be cheaper in lower-risk neighborhoods like Echo Park and Silver Lake and more expensive in higher-risk neighborhoods like Culver City and West Los Angeles.

| City | Annual Rate Per $1,000 of Coverage |

| Fair Oaks | $2.46 |

| Yuba City | $2.47 |

| Lake Tahoe | $2.54 |

| San Diego | $2.90 |

| Irvine | $3.22 |

| Corona | $3.65 |

| Long Beach | $4.11 |

| Santa Clara | $4.31 |

| Calexico | $5.82 |

| Alameda | $6.47 |

Coverage Type and Amount

The type of coverage a policyholder chooses will also affect the total cost of earthquake home insurance in California. An earthquake insurance policy for a homeowner will have dwelling coverage to help pay to repair or rebuild the structure of the home following an earthquake. Homeowners and renters earthquake insurance policies will offer personal property coverage to help cover earthquake damage to their belongings.

In addition, homeowners and renters earthquake insurance policies usually offer some loss of use coverage, which can cover additional living expenses if the policyholder is required to temporarily relocate following an earthquake. Other types of coverage might include building code upgrades (covers the cost to rebuild the home to current building codes) and breakables (covers the cost to repair or replace breakables such as china, crystal, and glassware).

The amount of coverage chosen will also affect the cost. The dwelling coverage limit on an earthquake insurance policy will typically match the limit set on the homeowners insurance policy. Therefore, if the home is insured for $750,000, the earthquake insurance policy will also have a dwelling coverage limit of $750,000.

Personal property coverage will also have a limit, which the policyholder may be able to increase or decrease to change the policy cost. The more personal property coverage a policyholder has, the more expensive their earthquake insurance policy will be.

CEA vs. Private Insurer

California residents can choose to get a policy through the CEA or through a private insurer. While many will choose the former, customers whose homeowners or renters insurance provider doesn’t work with the CEA might need to look into getting a policy through their current company. Customers can use the CEA’s premium calculator to get an estimate and compare it to a quote from their current insurer to see which offers the most comprehensive coverage for the best price.

California homeowners will want to note that several major insurance providers (including Allstate, Farmers, State Farm, and USAA) now offer limited or no homeowners insurance coverage in the state, which could impact their options for earthquake insurance. That’s why it’s important for homeowners to use the resources provided by the CEA and shop around to find the right coverage.

Home Age

Homes built before 1980 were constructed before the introduction of modern seismic codes, which makes them more susceptible to earthquake damage and therefore cost more to insure. However, homeowners can retrofit their older home to better withstand seismic activity, and the CEA offers a discount of up to 25 percent for homeowners who choose this route. A seismic retrofit involves bolting the home to the foundation, bracing the chimney and large appliances such as the water heater, and installing automatic gas shut-off valves.

Building Materials, Foundation Type, and Soil Type

The materials used to build the home can also affect earthquake insurance costs in California. A house with a wooden frame generally has more flexibility than one built using stucco, concrete, or masonry, which makes it able to better withstand an earthquake. Since the insurer is less likely to be faced with a complete rebuild, premiums may be lower.

Additionally, the type of foundation a home has will affect the total earthquake insurance cost. A home with a slab foundation is more likely to sustain damage from an earthquake than one built on a raised foundation. A home that’s bolted to the foundation can also better withstand seismic activity, which could lead to lower insurance costs.

Homes built on a soft surface such as sandy soil are more prone to earthquake damage than those built on a hard surface such as clay or rock. That’s because rocky surfaces can absorb seismic waves more efficiently than soft surfaces, reducing the damage to any structures built on top of them. Therefore, a home built on a soft surface will likely cost more to insure than one built on a hard surface.

Stand-Alone Insurance vs. Endorsement

There are generally two ways to get earthquake insurance coverage. The first is to take out a stand-alone policy that only covers earthquakes, which are available through several companies in California. These options have several benefits including specialization in this type of coverage, which can give policyholders greater peace of mind. Alternatively, policyholders may be able to add an earthquake insurance endorsement to their current homeowners or renters insurance policy.

Deductible

Earthquake insurance deductibles are usually expressed as a percentage of the total dwelling coverage limit. CEA earthquake insurance deductibles range between 5 and 25 percent of the coverage limit, which means a homeowner will likely need to pay quite a lot out of pocket if they make a claim. The following table outlines the insurer’s and policyholder’s responsibility for a $500,000 claim for a variety of deductible amounts.

| Deductible Amount | Insurer’s Responsibility | Policyholder’s Responsibility |

| 5 percent | $475,000 | $25,000 |

| 10 percent | $450,000 | $50,000 |

| 15 percent | $425,000 | $75,000 |

| 20 percent | $400,000 | $100,000 |

| 25 percent | $375,000 | $125,000 |

Policyholders can opt for a lower deductible percentage, but this will generally result in higher premiums. Therefore, it’s important for a policyholder to determine whether they would prefer to save on insurance premiums and pay a higher deductible or pay more in premiums in exchange for a lower deductible.

Types of Earthquake Insurance Coverage in California

Just like there are several types of homeowners insurance coverage, there are four main types of earthquake insurance coverage California residents can take out: dwelling, other structures, personal property, and loss of use. Homeowners will want to make sure they understand each type of coverage, what is and is not covered, and who is eligible.

| Dwelling | Other Structures | Personal Property | Loss of Use |

| Covers the main home and attached structures such as garages and decks | Covers detached structures such as sheds and fences | Covers personal items in the home such as clothes and electronics | Covers additional living expenses if temporary relocation is required |

| Does not cover vehicles, pools, flooding | Does not cover landscaping damage | Does not cover valuable or collectible personal property | Does not cover regular living expenses |

| For homeowners only | For homeowners only | For homeowners and renters | For homeowners and renters |

Dwelling

Dwelling coverage covers the main structure of the home, as well as any attached structures such as an attached garage. The dwelling coverage limit of a homeowner’s earthquake insurance will match the limit on their homeowners insurance policy. Therefore, if a home is insured for $500,000 through homeowners insurance, it will also be insured for $500,000 earthquake insurance.

Other Structures

Dwelling coverage will not cover unattached structures such as a detached garage, garden shed, or fence. If a homeowner has these structures on their property, they’ll want to take out “other structures” coverage to ensure that their policy will pay for the repair or rebuilding of these structures.

Personal Property

Personal property coverage is designed to protect a homeowner’s or a renter’s personal belongings that are damaged or destroyed by an earthquake. This includes items such as clothing, furniture, and televisions, up to an agreed-upon limit that typically ranges from $5,000 to $200,000. To cover items like china and crystal, the policyholder will likely need to add optional breakables coverage to their main policy.

Loss of Use

If a home is unsafe following an earthquake, the residents will need to temporarily move elsewhere. Loss of use coverage helps pay for additional living expenses that a homeowner or renter incurs during this temporary relocation, such as hotel bills, meals out, and additional travel expenses.

Do I need earthquake insurance in California?

According to the CEA, there are more than 500 active faults in the state of California, and most residents of the state live within 30 miles of an active fault line. Therefore, earthquake insurance is worth it for most Californians. Residents who aren’t sure whether they need to add earthquake coverage will want to review the main reasons they might need this type of coverage.

Frequency of Earthquake Activity

The CEA reports that two-thirds of earthquakes in the United States occur in California. But that doesn’t mean every area in the state has the same amount of seismic activity. Generally, homeowners and renters who live in areas that experience frequent seismic activity are more likely to experience damage to their home and belongings than those who don’t.

Proximity to Active Fault Lines

The CEA has a map showing the risk of earthquakes by county across California so residents can determine the likelihood of an earthquake affecting them directly. In general, residents who live in areas that are close to an active fault line will want to strongly consider earthquake insurance coverage.

Insufficient Savings

Without earthquake insurance coverage, the average homeowner or renter will likely not have the funds to pay to rebuild their home or replace their belongings. Home prices in California are higher than the national average, which means a homeowner will need to have more in savings to rebuild their home than they would if they lived in a lower-cost state. Homeowners and renters generally underestimate the value of their personal belongings, and without personal property coverage they may not be able to pay to replace items damaged in an earthquake.

How to Save Money on Earthquake Insurance in California

Earthquake insurance premiums are relatively high in California, with the average annual cost of earthquake insurance around $3.54 per thousand dollars of coverage. That means a California resident will pay an average of $1,770 for $500,000 of dwelling coverage—and that’s in addition to homeowners insurance premiums. Since earthquake insurance is so important for Californians to carry, it’s smart to look into the different ways to save money while preserving coverage, such as the following.

- Consider a seismic retrofit. While there will be an up-front earthquake retrofit cost, homeowners may be eligible for a discount on their earthquake insurance coverage if they retrofit their home. The CEA offers a discount of up to 25 percent.

- Opt for a higher deductible. The deductible percentage a policyholder chooses can have a major effect on their earthquake insurance premiums. Policyholders can opt for a higher deductible if they want to save money on their premiums—but this will result in a lower payout for an approved claim.

- Bundle your policies. If a policyholder has multiple policies under one insurer, they might qualify for a bundling discount.

- Ask about additional discounts. Private insurers may have unique discounts that policyholders can take advantage of to lower their premiums.

Questions to Ask About Earthquake Insurance in California

Before choosing an earthquake insurance policy, it’s a good idea for customers to vet their potential insurance providers by asking some or all of the following questions:

- Do I need earthquake insurance?

- What does a standard earthquake insurance policy cover?

- How much coverage do I need, and what will it cost?

- What deductible options do you offer?

- Am I eligible for any discounts that can lower my premiums?

- How often will you reassess my earthquake insurance rates?

FAQs

Understanding California earthquake insurance pros and cons can be difficult, especially for residents who wonder if they need this coverage. After all, if a resident has done an online search for “Is earthquake insurance required in California?” they’ll know that it’s not a mandatory type of insurance—but that doesn’t mean it’s advisable for homeowners and renters to skip this coverage. Golden State residents will want to have a full understanding of this type of coverage to ensure they can find the best policy for them.

Q. What is the California Earthquake Authority (CEA)?

The California Earthquake Authority is a not-for-profit organization that underwrites earthquake insurance policies for California residents through participating insurance providers. Although customers will get an earthquake insurance quote from the CEA, they will work with one of the best renters insurance companies in California or their homeowners insurance provider to take out the policy.

Q. Is there earthquake insurance for renters?

Yes; renters can get earthquake insurance that covers their personal property and any additional living expenses they incur due to a mandatory evacuation. The best earthquake insurance companies may offer coverage for renters as well as for homeowners.

Q. Does car insurance cover earthquake damage?

Comprehensive car insurance covers damage the insured vehicle sustains from seismic activity. Other types of car insurance coverage, such as liability or collision coverage, will not cover earthquake damage.

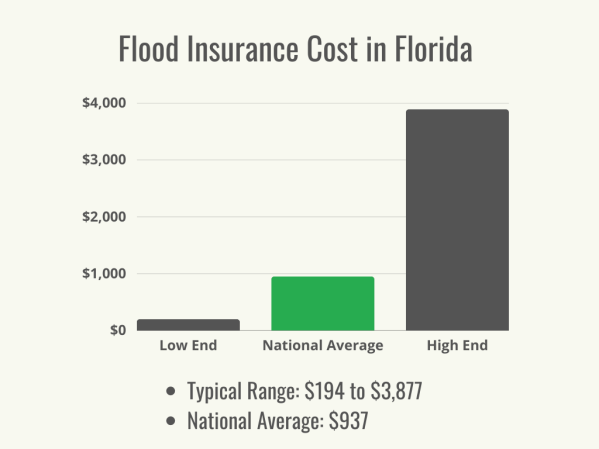

Q. Does earthquake insurance cover tsunamis?

Although a tsunami is a byproduct of an earthquake, any tsunami damage will not be covered by an earthquake insurance policy. If a policyholder lives close to the coast, they will want to look into coverage from the best flood insurance companies if they want to make sure they are protected against tsunami damage. Flood insurance costs can add to a homeowner or renter’s premiums, but if the worst happens it’ll be well worth the investment.

Sources: ValuePenguin, California Earthquake Authority, California Department of Insurance, Policygenius