We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Part of being a diligent homeowner is preparing for the unexpected. Routine upkeep will help maintain the property, but homeowners need to plan for the eventual failure of critical home systems and everyday appliances over time. While a homeowners insurance policy can help protect these items in the event they are damaged by a covered event, it won’t be able to offer financial assistance if HVAC systems, refrigerators, washing machines, or other appliances and home systems break down due to normal wear and tear. Purchasing a home warranty while appliances and home systems are in good repair can be a good investment, as it can help minimize the costs to repair or even replace items when they are near or have already reached their end of life.

Liberty Home Guard offers multiple home warranty options, including three standard policies and numerous add-on services, for homeowners to purchase in order to protect their home systems and appliances. Is Liberty Home Guard a good choice for home warranty protection, especially when there are so many options available across the country? Our Liberty Home Guard review delves into the nuances of the company’s home warranty policies—including coverage options, cost factors, and notable exclusions—to determine if the company can deliver on its promise of a customer-centric home warranty service.

See more of the best:

- Best Home Warranty Companies

- Best Home Warranties for Condos

- Best Home Warranties for Landlords

- Best Home Warranties for Sellers

- Best Home Warranties for Rental Properties

- Best Home Warranties for Roof Coverage

- Best Home Warranties for HVAC Coverage

- Best Home Warranties for Pool Coverage

- Best Home Warranties for Plumbing Coverage

At a Glance

Liberty Home Guard

Pros

- Nationwide availability

- Wide variety of service add-ons

- Add-on coverage for services like gutter cleaning and carpet cleaning

- Special coverage for pro-series appliances

- Transparent and customizable online quote process

- Month-to-month contracts available

- 2 months of free coverage with annual payment

- Low $60 minimum service fee

- Convenient online chat function

Cons

- Some plans may restrict coverage limits until 90 days after purchase

- Relatively low $2,000 coverage limit per item

- Somewhat limited septic system coverage available

- Unclear roof leak coverage terms

- High pool and spa coverage rates

SPECS

- Service area: 50 states and Washington, D.C.

- Plans: Appliance Guard, Systems Guard, Total Home Guard

- Average monthly pricing: $55

- Waiting period: 30 days

- Claim process: Online or phone

- Service fee: $60 to $125

- Workmanship guarantee: 60 days

Our Verdict: Liberty Home Guard offers customizable home warranties to every corner of the country, with numerous add-on service options available for customers to build out their home warranty plan. Although the company’s rates are not overly competitive, promotional offers and discount opportunities can help lower the cost of coverage for customers. The company’s low coverage caps could be a concern for some homeowners, but these limits apply to each covered item rather than in aggregate.

Liberty Home Guard Review: Claims

Liberty Home Guard presents itself as a home warranty provider focused on the customer experience first and foremost. The company’s website highlights positive customer reviews, high ratings from various review sites, and awards Liberty Home Guard has received from different media outlets and independent organizations. Liberty Home Guard’s overarching message is one of convenience and helpfulness, claiming to help customers simplify maintenance and upkeep tasks that come with homeownership.

About Liberty Home Guard

Liberty Home Guard is a home warranty company that provides service plans designed to help cover the costs to fix issues with home systems and appliances that result from age and normal wear and tear. Customers can choose from three overarching policy tiers, purchasing home warranties that exclusively cover appliances or home systems as well as policies that provide protection for both. There are also numerous extra service options for customers to add to their policy at an additional cost.

Although the company previously had some coverage gaps that could impact availability, it now offers home warranties to every state in the country as well as Washington, D.C. As such, Liberty Home Guard is one of a select group of home warranty companies that can claim to be a nationwide service provider in this industry.

As is typical with a home warranty service, Liberty Home Guard requires customers to pay a service fee on any covered repair or replacement. This fee may vary depending on what options a customer chooses when setting up their home warranty policy, but that payment must be made before a technician can be contacted to set up an inspection. In most cases, that technician will be selected from the company’s network of preferred contractors. Liberty Home Guard’s website notes that there may be scenarios where a customer can pick their own service contractor, but it’s not clear what circumstances would allow for that option.

Customers’ Online Experience

Liberty Home Guard offers a relatively satisfying online experience for customers, with a well-structured website that’s easy to navigate. The company’s online quote tool is a standout feature, with policy comparison charts and add-on service tables that make it easy for prospective customers to compare their options and decide on the best assortment of coverage terms to suit their needs.

Elsewhere, the site’s FAQ section clearly and succinctly answers some of the most common questions homeowners may have about Liberty Home Guard’s services, such as how home warranties work, what they cover, and what steps are necessary to request repairs and replacements. Liberty Home Guard is also very transparent about its coverage area, displaying a coverage map right on its home page for potential customers to explore. Other aspects of its coverage aren’t quite as transparent, however. Key information such as coverage limits, service fee options, and exclusions can be buried within the site, making it difficult for visitors to easily find this information.

Once they have signed up for a Liberty Home Guard home warranty, customers can set up an online account that allows them to request services, check on the status of repairs, and make changes to their home warranty policy. If they have questions or concerns about their Liberty home warranty, customers can email customer service representatives through the website or turn to the site’s online chat for assistance. Although the online chat tool is fairly limited, it can also direct customers to live agents for further support.

Home Warranty Plans, Coverage, and Caps

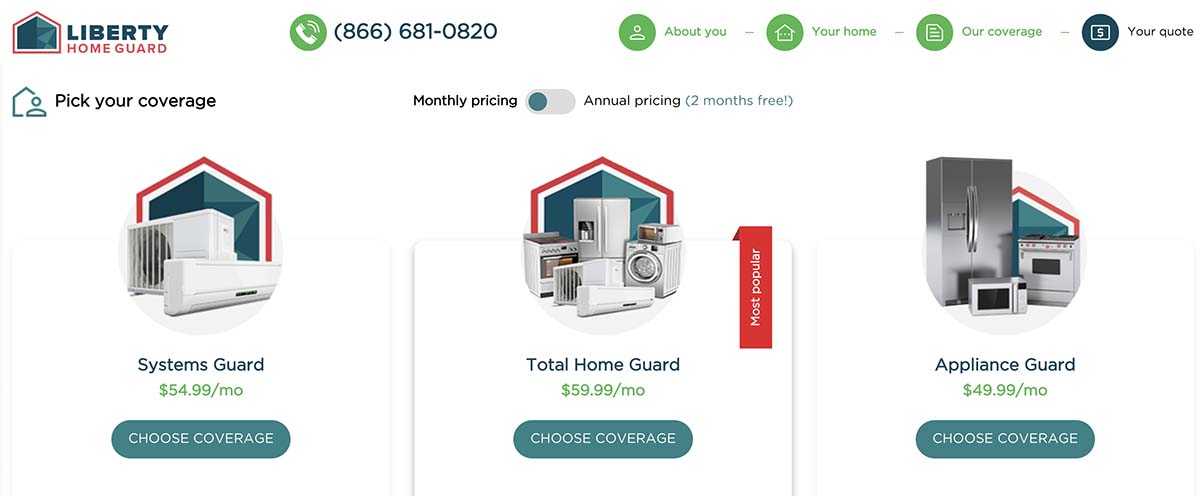

Liberty Home Guard customers can choose from three policy tiers, one focused exclusively on home systems, another strictly covering appliances, and a third option that combines both types of coverage. Depending on what level of coverage and protection a homeowner needs, they may find that one plan suits them better than the other two:

- Appliance Guard: The most affordable standard plan available, Appliance Guard covers several appliances throughout the home, including washers and dryers, refrigerators, dishwashers, ovens, and garbage disposals.

- Systems Guard: This plan is slightly more expensive than Appliance Guard and covers major home systems that homeowners may be looking to protect with a home warranty, including HVAC systems (air conditioning, heating, and ductwork), plumbing systems, electrical systems, and water heaters.

- Total Home Guard: Offering the most comprehensive coverage available through Liberty Home Guard, the Total Home Guard plan is also the most expensive policy that the company offers. Although Total Home Guard comes at a higher price, customers who select this option will receive all of the coverage included in both Appliance Guard and Systems Guard policies, so this plan actually offers the most value for the customer’s dollar.

Coverage caps can be on the lower side for a home warranty, as Liberty Home Guard sets a maximum limit of $2,000 for repair costs. That being said, the $2,000 limit is per covered item, not in aggregate, so customers can submit service requests for multiple appliances or home systems without worrying that the combined repair costs will exceed their coverage cap.

There are certain exceptions to the coverage limit that homeowners will want to be aware of before signing a contract, though. In particular, plumbing and electrical system repairs are capped at $500 per covered item. Certain add-on services, such as pool and spa, well pump, sump pump, and stand-alone refrigerator repairs, are also capped at $500 per covered item. In addition, according to the company’s terms and conditions, covered repair and replacement costs may be limited to $250 within the first 90 days of the policy’s coverage term.

Plan Add-Ons

Liberty Home Guard offers customers a wide variety of service options to add on to their home warranty policy at an additional cost. In total, there are 42 extra service add-ons for customers to purchase, with options spanning several distinct categories:

- Outdoor/backyard: Pool and spa, additional spa, lawn sprinkler system, saltwater pool, generator, casita guest unit

- Electronics: Electronics protection and TV mounting

- Pumps/pumping: Sump pump, well pump, septic system pumping, ejector pump, grinder pump

- Optional appliances: Central vacuum, stand-alone freezer, water softener, swamp cooler, second refrigerator, trash compactor, ice maker (in refrigerator), freestanding ice maker, wine cooler, water dispenser water line, instant hot water dispenser, reverse osmosis water filter system

- Professional-series appliances: Refrigerator, stand-alone freezer, range/oven/cooktop, dishwasher, microwave, washing machine, clothes dryer

- Home maintenance: Limited roof leak, rekey, gutter cleaning, pest control, carpet cleaning, window washing, power washing

- Fixtures: Light fixtures and plumbing fixtures

Among those many extra options for customers to consider, the professional-series add-ons are particularly noteworthy since they offer increased coverage limits for high-end appliances, which is not typically available through a home warranty. Homeowners who have professional-grade or restaurant-quality appliances may want to seek out this expanded coverage option, as such appliances can be expensive to repair or replace due to the higher-quality materials used and more specialized skills required to handle repairs.

Other standout add-on options include extra services to cover saltwater pools, guest units, and central vacuums, as this type of coverage is not always available with a home warranty—either as an add-on service or as part of a standard policy.

Home Warranty Plan Pricing, Fees, and Discounts

Unlike some other home warranty companies, Liberty Home Guard sets the same prices for every state and ZIP code. No matter where homeowners live in the U.S., they will find that monthly prices for each policy tier remain consistent:

- Appliance Guard costs $49.99 a month

- Systems Guard costs $54.99 a month

- Total Home Guard costs $59.99 a month.

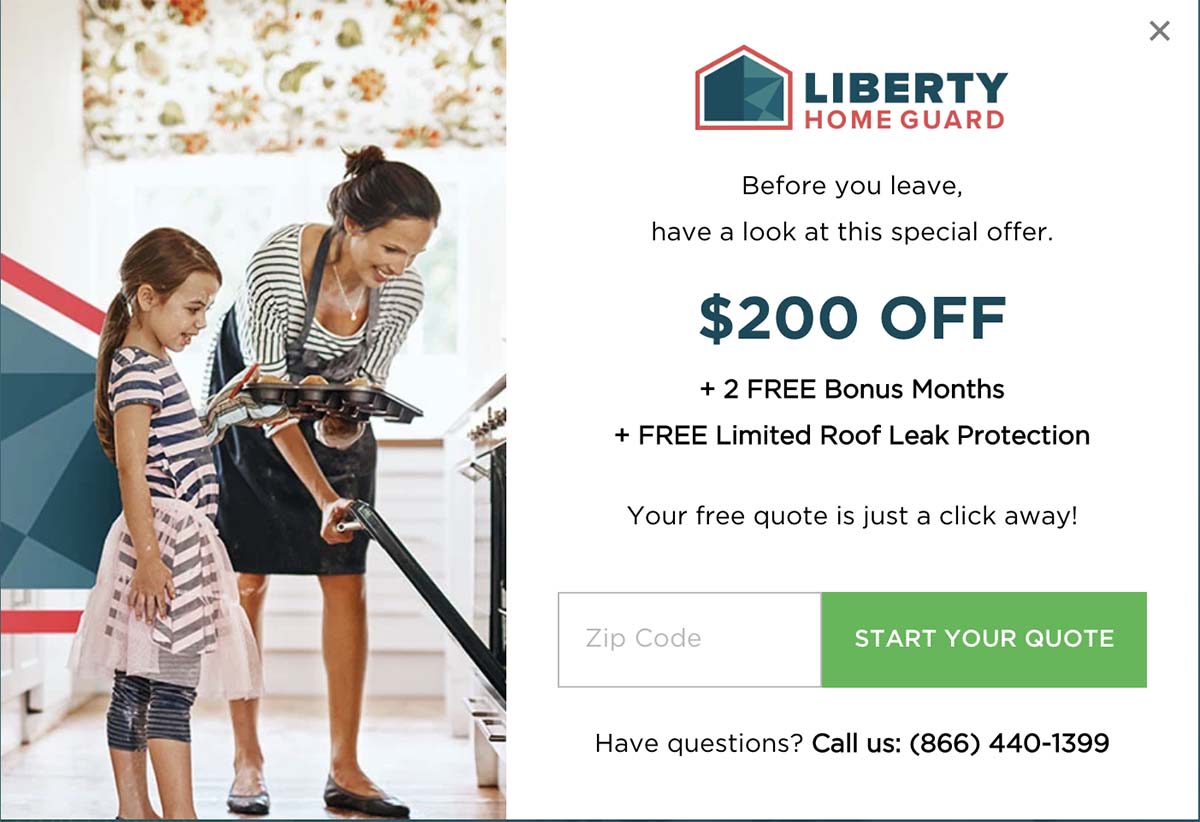

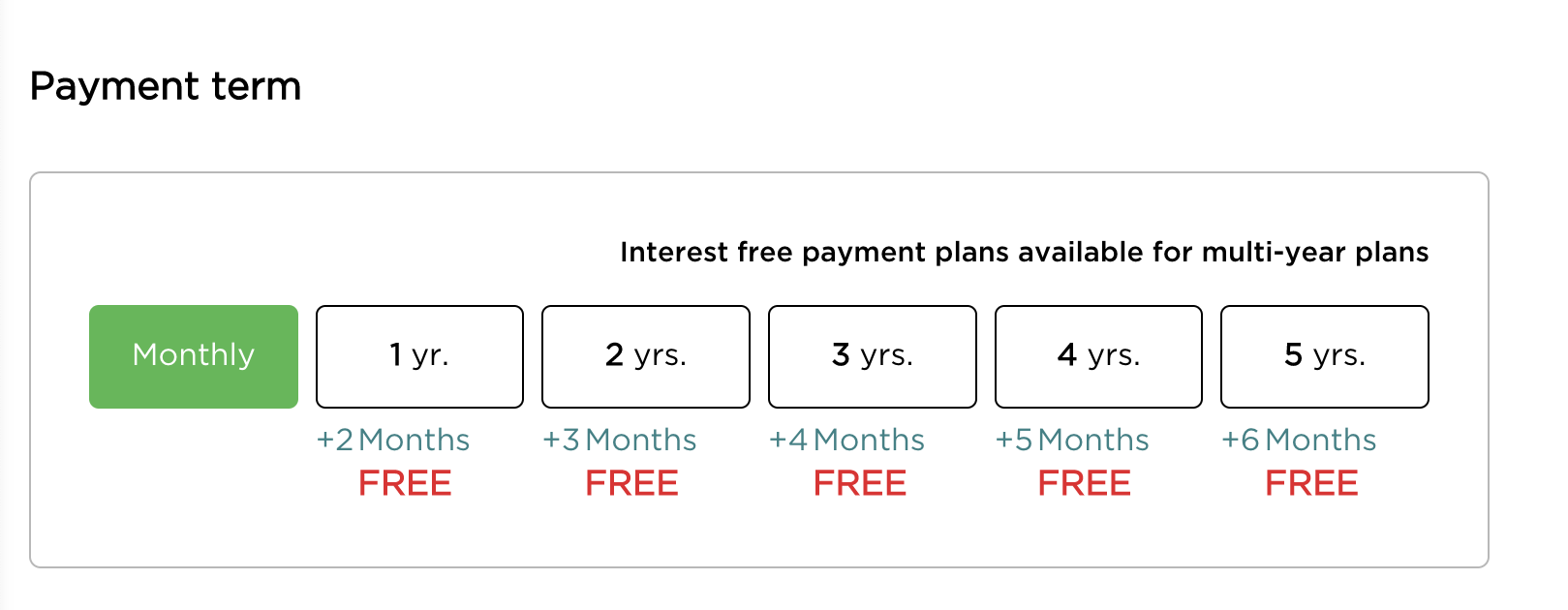

Depending on their timing, customers can lower their home warranty costs with Liberty Home Guard by taking advantage of promotional offers and discounts that may be available at various times throughout the year. In some cases, these offers for new-customer enrollments may reduce the annual cost of a home warranty by hundreds of dollars. Customers who choose to pay for a full year’s worth of coverage up front will receive an additional 2 months of protection at no additional cost. This option essentially gives customers 14 months of coverage for the price of 12. If they like, customers can purchase multiyear policies as well, with additional coverage perks increasing with longer policy terms. Customers who pay for a 5-year policy up front will receive 6 additional months of coverage for free.

Adjusting the policy’s service claim fee can impact the total cost of coverage as well. Service fees are the out-of-pocket expense that customers need to pay when submitting a repair request and can run between $60 and $125 with Liberty Home Guard. Electing to have a higher service fee will result in a lower monthly rate and vice versa, so this is another factor that homeowners may want to consider when determining home warranty costs.

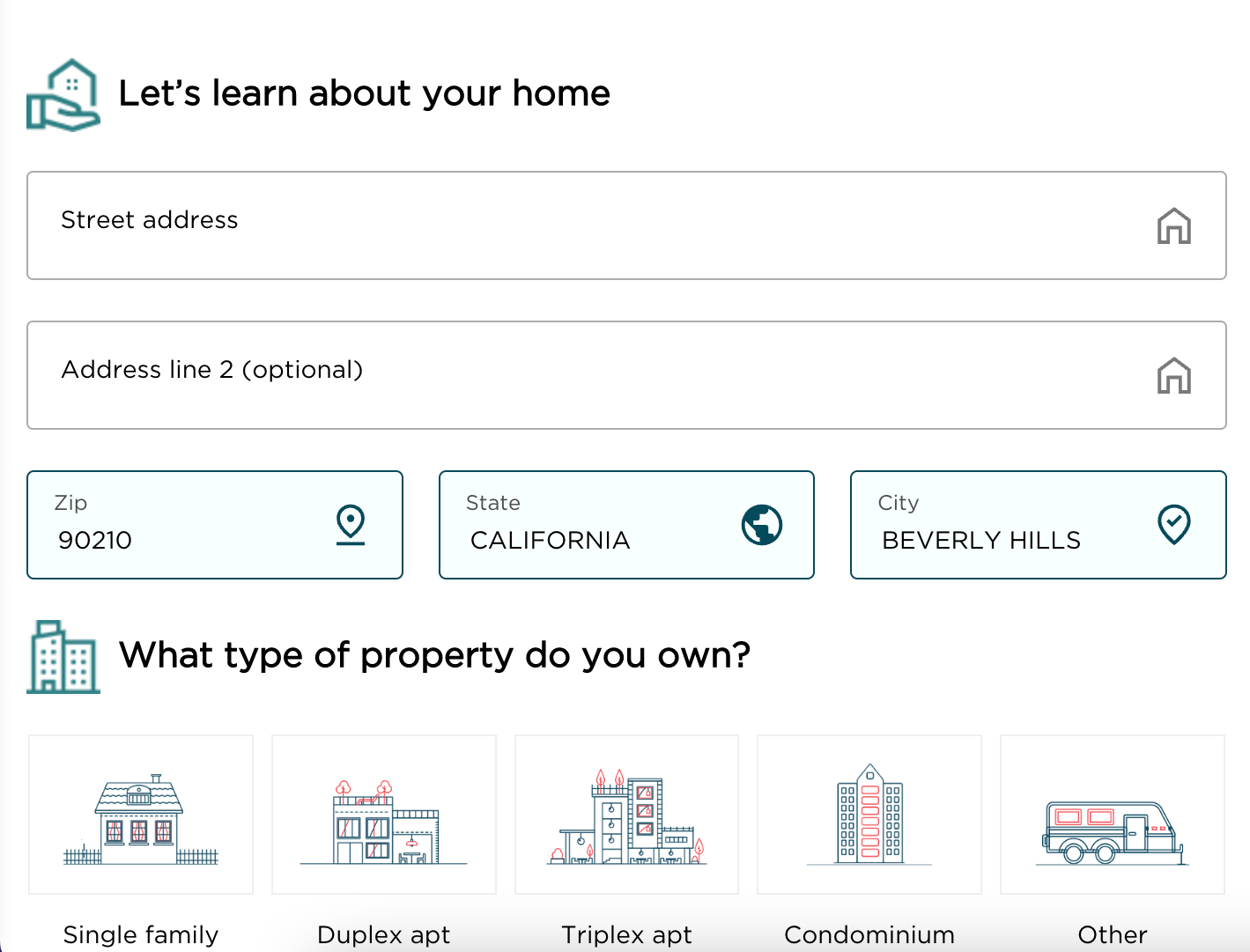

Getting a Quote

Homeowners interested in finding out how much a home warranty will cost can get a quote either online or over the phone. Liberty Home Guard’s online quote tool is very straightforward and easy to use.

After providing a few details about themselves and their home, including their contact information, address, property type, and approximate property size, customers will be given the option to choose from the company’s three basic tiers. The quote tool clearly breaks down the coverage included with each policy type with a comparison table that outlines the standard coverage for appliances and home systems across all three basic plans.

After customers select their policy type, they can then customize their plan by selecting from 42 additional service add-ons. The online quote tool even highlights which add-ons are especially popular among other customers in the homeowner’s state, providing some insight into the types of add-on options that may be best suited for their particular location. Monthly rates for these extra services are clearly labeled so customers can get a good idea of their additional cost.

Once customers have finished selecting all of their coverage options, they will be taken to a payment page where they can see the total cost of their home warranty. Before finalizing their purchase, prospective customers can select from multiple payment plans, ranging from monthly installments to a bulk payment covering 5 years’ worth of coverage. Going through this entire quote process can be done very quickly—taking no more than a couple of minutes, in some cases.

Meanwhile, customers who would prefer to talk through their options with a representative can call the company’s customer service line to get a quote over the phone. One of the advantages of speaking with a representative using the Liberty Home Guard phone number is that customers can request a different service fee, as the online quote tool does not provide that flexibility. Either approach should be a relatively easy and convenient option for homeowners looking to get a quote on a home warranty.

Filing a Claim

Customers have two options when they want to file a claim and submit a repair request. They can either log into their dedicated account and submit a claim online or they can call a Liberty Home Guard representative and file a claim over the phone. The company’s website notes that both options are available 24/7, even on holidays and weekends.

Taking the online approach may be appealing to digital natives and tech-savvy customers, but some homeowners may be pleased to know that they can go through the process over the phone if that’s easier for them. Even in those cases, it may be helpful for customers to log into their online account since they will be able to track the status of their claim through the company website. Customers will want to keep in mind that before a technician can be assigned to a claim, they will need to pay a service fee, which typically runs between $60 and $125.

Response times could vary, but Liberty Home Guard states that the company will do its best to have a technician scheduled within 48 hours. In fact, the company states that a technician can be on site and ready to inspect the problem within 24 to 48 hours of receiving a claim for the majority of service requests.

Another key aspect of the claims process that homeowners may want to consider is the workmanship guarantee, which runs for 60 days. If a customer notices an issue with the quality of the technician’s work and discovers that the underlying problem has not been fully addressed, they can request a follow-up appointment within those 60 days. After that window has closed, customers may need to pay an additional service fee for another technician to do the job.

Customer Service Experience

Liberty Home Guard gives customers a few different ways to reach out for assistance when they need it. The most direct method is to call Liberty Home Guard’s customer support line, which the company’s site claims is available 24 hours a day, every day of the year. Speaking with a representative over the phone could be the quickest way to get answers to questions or resolve issues, but customers who prefer to handle matters online have options to consider as well.

Liberty Home Guard’s website features an online chat assistant that can answer questions about the company’s services, although its functionality is somewhat limited. Aside from answering the most rudimentary questions, the chat bot is unable to offer more sophisticated or hands-on assistance, and it tends to direct visitors to speak with a live agent for other requests.

If customers like, they can also contact Liberty Home Guard via email, although it is unclear how quickly they may receive a response if they reach out using this method. Because the company has a 24-hour customer service line, it may be more expedient to call a representative over the phone when a problem arises or if a customer has a question they need answered.

Liberty Home Guard Reviews by Customers

Liberty Home Guard has received generally positive feedback from customers across different review sites. Liberty Home Guard home warranty reviews featured by the Better Business Bureau praised the company’s customer service team for their helpfulness and responsiveness. A few negative reviews complained about the back and forth required to have covered repairs approved for the full expense, but the company appears to be fairly responsive to these concerns. In each case, a representative replied to the review, promising to assign a Senior Director to look at these complaints more closely. Although Liberty Home Guard is not currently accredited by the Better Business Bureau, it does hold an A+ rating from the organization.

Trustpilot reviews were similarly positive overall, with the company holding an average rating of 4.6 out of 5. Many customers remarked on how quickly claims were processed and repairs were scheduled by Liberty Home Guard representatives. Positive Liberty Home Guard product reviews also praised the quality of work on covered repairs and the expediency of the entire claims process. Not all customers had such positive experiences, though, with some expressing frustration that their home warranty did not cover water leaks and other issues that would typically be excluded from this kind of service plan.

Customer reviews on Sitejabber were a bit more measured, although experiences lean in the positive direction, as Liberty Home Guard has around a 3.3 out of 5 rating at the moment. Some reviewers expressed concerns that they were unable to receive a brand-new replacement on covered items, settling for repair work instead. However, positive reviews lauded the company’s exemplary customer service—in one instance, Liberty Home Guard even provided a credit toward repair work not covered by the homeowner’s policy.

Liberty Home Guard has largely steered clear of controversy with its customers, although a lawsuit was filed against the company in 2020 alleging excessive marketing communications. This Liberty Home Guard lawsuit has yet to be fully resolved, but the outcome of this case won’t reflect on the company’s quality of service one way or the other.

It’s often important to remember when weighing customer reviews that they are inherently subjective and may not be representative of each person’s experience. Home warranties may be particularly prone to customer complaints due to policy exclusions that are noted in a policy’s terms of agreement but are otherwise easy to miss. Frustrated customers may confuse Liberty Home Guard home warranties for Liberty house insurance, but the company’s service plans specifically cover wear and tear, rather than property damage caused by covered events like a homeowners insurance policy would.

How Liberty Home Guard Stacks Up to the Competition

Liberty Home Guard compares favorably with many of the best home warranty companies that homeowners may consider when purchasing a policy. Although home warranty providers tend to have large footprints, Liberty Home Guard stands out as a true nationwide home warranty company, offering policies within all 50 states as well as Washington, D.C. In comparison, Choice Home Warranty does not provide service to residents in California or Washington State, although its coverage area is still quite large.

Where Liberty Home Guard truly distinguishes itself is through its many extra add-on services that are available for purchase. The company has 42 service add-ons for customers to choose from, providing a wide variety of ways to expand the scope of their coverage. Many other companies, such as American Home Shield, have much more limited add-on options, which could make Liberty Home Guard an appealing choice for homeowners who want to customize their policy to their precise needs.

Coverage amount is one area where Liberty Home Guard can come up somewhat short, though. The maximum coverage limit on any single item is $2,000, which is fairly low compared with some other home warranty providers. AFC Home Club, for instance, has a $3,000 coverage cap, while American Home Shield can offer coverage limits as high as $5,000 per item in some cases. Even so, with its large coverage area and exemplary customization options, Liberty Home Guard could be a great option for many homeowners looking for a home warranty.

Is Liberty Home Guard worth it?

Liberty Home Guard gives homeowners plenty of reason to consider it for their home warranty needs. The company provides home warranty coverage in all 50 states and Washington, D.C., so homeowners can buy a policy anywhere in the U.S. The ample customization options can be very appealing as well, thanks to the 42 extra service add-ons that can be purchased to expand the scope of coverage with a Liberty Home Guard policy. While Liberty Home Guard’s baseline prices are not particularly low compared with most affordable home warranty policies out there, the ample cost-savings opportunities—thanks to the promotional offers for new customers and generous benefits for customers who pay in full—can help lower the cost of home warranty policies for homeowners.

Liberty Home Guard’s claims process can be a middle-of-the-road experience, with response times and workmanship guarantees that are fairly typical for a home warranty provider. Customers may not be wowed by these aspects of the company’s services, but they aren’t likely to be disappointed by them, either. That being said, the option to select a service fee as low as $60 is noteworthy and could lower the out-of-pocket costs associated with submitting a claim and scheduling a repair. All in all, Liberty Home Guard is a solid choice for just about any homeowner looking to buy a home warranty and could be the perfect fit depending on what exactly they need from a home warranty provider.

FAQs

Figuring out what exactly is covered by a home warranty isn’t always easy because the terms and conditions are often buried in contracts and user agreements. Liberty Home Guard customers may find that’s the case for them as well, so it can be helpful to review some of the most common questions homeowners have about the company’s home warranty policies. This way, they can decide if Liberty Home products are a good fit based on the precise conditions of coverage included with each home warranty.

Q. What’s Liberty Home Guard’s cancellation policy?

Liberty Home Guard’s cancellation policy varies depending on when a cancellation request is submitted. Customers who cancel their Liberty Home Guard home warranty within the first 30 days of coverage will receive a refund for their full payment minus a $50 cancellation fee as well as any repair costs the company may have incurred. After that initial period, any refunds will be prorated based on the length of time remaining on the home warranty agreement. In those cases, the refund amount will also account for any repair costs paid by the company as well as the $50 cancellation fee.

Q. Does Liberty Home Guard have any hidden fees and costs?

The only additional fee that Liberty Home Guard customers will need to pay is a service fee ($60 to $125) that’s required when submitting a claim. Such fees are standard for home warranties, although Liberty Home Guard’s website could be more transparent about what service fee options are available, as they are not listed when customers get a quote online.

Q. How long does it take to get Liberty Home Guard?

Customers can purchase a home warranty policy within a few minutes if they use the company’s online quote tool. Buying a home warranty over the phone shouldn’t take much longer than that, either. Like many home warranty companies, however, Liberty Home Guard has a standing waiting period or holding period before coverage can begin. This waiting period typically runs for 30 days from the point of purchase and serves to protect the company from unscrupulous homeowners who might try to file a claim on a pre-existing issue and then promptly cancel their policy for a refund after repairs have been completed.

Q. Are there any fulfillment conditions that I need to meet before signing up for Liberty Home Guard?

There are no set fulfillment conditions that customers need to meet to qualify for a home warranty with Liberty Home Guard. Because the company’s footprint now extends across the entire country, there are no coverage gaps that prospective customers have to worry about, either. Homeowners should be aware that Liberty Home Guard policies do not cover any known or unknown pre-existing conditions. However, the company’s home warranties will cover home systems and appliances regardless of their age.

Q. Does Liberty Home Guard cover plumbing issues?

Both the Systems Guard and Total Home Guard plans include plumbing coverage as part of their standard terms and conditions. In particular, these policies cover leaking or broken water, drain, and waste lines, as well as toilet tanks, showers, bathtubs, gate valves, whirlpool motor assemblies, and wax ring seals, among other items. Liberty Home Guard’s coverage in this area is not necessarily unique, though. Home warranties typically cover plumbing to some extent, but this may depend on the specific policy terms available.

Q. Does Liberty Home Guard cover electrical repairs?

Customers who purchase either a Systems Guard or Total Home Guard plan will be covered for electrical system repairs, including mechanisms and components directly related to this home system. There are some exclusions to be aware of, though, such as intercom systems, attic exhaust fans, auxiliary panels, and GFI upgrades for existing outlets.

We independently reviewed this service by weighing the company’s claims against first-hand experience with its professionals. However, due to factors such as franchising, human error, and more, please note that experiences with this company may vary.