We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Q: I’m renting an apartment, and my dog tore up the carpet in a common area. Will my renters insurance cover the cost to replace the carpet? Does a standard renters insurance policy include pet liability coverage?

A: A standard renters insurance policy that many landlords require renters to carry does often offer some protection against damage caused by pets. If a pet causes an injury to someone or damages their property, renters insurance with pet coverage can cover those damages or legal fees under the liability part of the policy. An example might be if a dog bites someone or the dog ruins someone’s expensive family heirloom rug, which is why the insurance product is sometimes called pet damage insurance. However, there are also often optional insurance products that can give added pet liability coverage for renters. Read below to learn more about pet liability insurance.

Renters liability insurance can cover injuries or damages to others caused by a renter’s pet.

Renters liability insurance is structured so that if a renter’s pet causes injury or damage to someone else or their property, coverage may exist. With a renters insurance policy, pet liability provides coverage if a policyholder’s pet causes injury or property damage to anyone who is not part of the insured’s household. This coverage could apply if a renter’s pet damages a neighbor’s house, yard, or possessions.

Another example in which coverage might apply to a third party is if an insured’s dog bit a neighbor’s child as the child was reaching to pet the dog or if the dog got out and dug up most of the neighbor’s yard.

An umbrella policy can provide additional liability coverage for pets beyond the limits in a renters insurance policy.

Renters policies have limits on the total liability coverage. These limits are the amount of money the insurance company will pay if an insured is found to be liable. According to the Insurance Information Institute (III), liability limits on renters policies generally start at about $100,000, but the III states that it’s often recommended that renters should purchase at least $300,000 worth of protection.

Umbrella or excess liability policies can increase these protection amounts by quite a large sum. Renters can often get an extra $1 million in liability protection for about $200 to $350 per year, according to the III. If a dog causes major damage to someone, the medical bills can mount up, so an umbrella policy might be a good idea for some renters who are looking for renters insurance for pets.

Some insurance companies may offer riders or endorsements to renters insurance policies to cover dog bites or property damage.

When considering renters insurance with pet liability, there are other insurance products for renters to look into if there are concerns about a pet causing property damage or personal injury. Riders and endorsements are added amendments to policies that often expand the coverage of base policies.

While most base renters insurance policies tend to cover pet liability, it’s important to read the policy to see what is actually covered on an individual basis. Some policies may require a rider or endorsement to be added for more complete protection against dog bites or property damage caused to other people by the policyholder’s pet. Renters might want to talk to an insurance agent to see what their options are for damage caused by pets or look up insurance products using search terms like “renters insurance pet damage.”

Renters insurance will generally not cover damage or injury caused by a pet to the renter or to their property.

An important point to understand about pet liability insurance is that it only protects if someone other than the policyholder or a member of their household is harmed by the pet. If the insured or anyone else in the household sustains damage from a dog bite or a pet destroys their rental unit, then there is no coverage in these cases.

If an insured’s pet causes injury to the insured or a member of the insured’s household, coverage would likely fall under a health insurance policy, as pet renters insurance would not provide coverage in that scenario. For instance, if the family dog bites the policyholder’s spouse or child, then that would often fall under standard health insurance rather than liability coverage.

Certain dog breeds and exotic pets are often excluded from renters liability insurance coverage.

It’s also important to check with the insurance agent or read the policy closely to see which pets are covered under dog liability insurance for renters. Some dog breeds have a history of aggressive behavior and may be harder to control. Since this is the case for certain breeds such as rottweilers and pit bulls, many insurance companies simply consider them to be too risky to insure and therefore won’t provide coverage for any incidents involving certain dog breeds.

The same applies for some exotic pets, especially ones that may be more likely to cause damage or harm. For instance, if someone decides to keep a python as a pet, an insurance company would be unlikely to cover the animal and any resulting damages, since pythons are not domesticated and can easily turn aggressive.

Renters insurance companies may have sublimits for certain pets, such as a dog with a bite history.

Renters may also find that renters insurance for dogs may only cover a type of incident up to a certain amount of money, which is known as a sublimit. This can be a common situation if a dog has ever bitten anyone in the past.

A dog with a documented history of biting is another situation where the pet may become too risky for the insurance company to insure fully. If a dog has repeatedly bitten other people, then that pet may become very expensive for the insurance company to cover. To protect themselves financially from repeat offenders, renters pet insurance companies often institute sublimits on dogs with a bite history.

Pet liability insurance does not cover the animal’s health care costs; that is covered by pet insurance.

Distinguishing the difference between pet liability insurance and pet insurance can sometimes be confusing. Pet insurance is a completely separate insurance product from renters insurance that covers dogs, cats, and other types of pets; it does not protect a renter or their possessions in any way.

Pet insurance actually covers the health of the pet. It works much like traditional health insurance in that it has premiums, copays, and deductibles pet owners pay to access coverage for certain covered medical procedures and treatments for their pet. For instance, pet insurance might cover a policyholder’s dog if the dog requires treatment after contracting ringworm. In that scenario, pet insurance could help pay veterinary bills, medication costs, and other related expenses. Pet owners can purchase pet insurance from companies that specialize in selling this product. Pet liability insurance, on the other hand, in no way covers the health care expenses of the pet.

Renters insurance is generally recommended for all renters to help protect their personal property as well as to provide liability coverage for pets.

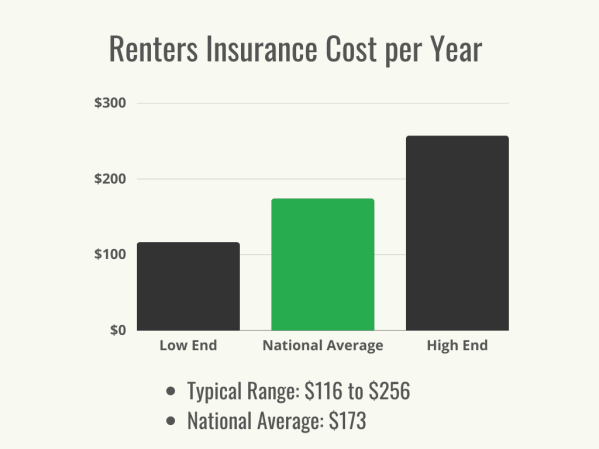

However, it’s still important to look into getting renters insurance in most cases. Outside of pet liability insurance, renters insurance can also protect personal property. It covers policyholders in the event of perils such as wind storms, fire, theft, or snow damage.

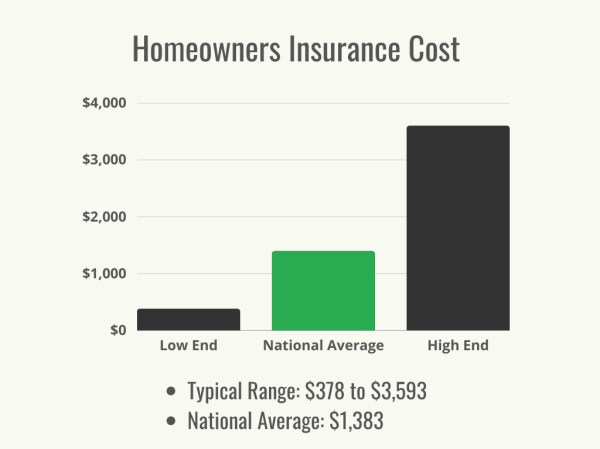

A landlord’s insurance policy only protects what the landlord owns, such as the property itself. A renters insurance policy, however, can protect a renter’s possessions. For instance, if a fire devastated a rental property, a renter may be able to receive reimbursement (up to the limits of the policy) for any possessions lost in the fire once the deductible has been met.

Renters insurance can also cover additional living expenses in the event of a disaster. For example, if a renter had to live in a hotel after an apartment building caught fire until repairs were made, renters insurance would cover any living expenses above and beyond normal costs like rent. With the personal property and pet liability coverage provided through renters insurance, renters can protect their belongings and their finances in case of a covered peril or event.