We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Home Advice You Can Trust

Tips, tricks & ideas for a better home and yard, delivered to your inbox daily.

Centriq

Once you unbox and set up home appliances, it’s easy to lose the owner’s manual and directions. That’s where Centriq comes in. Simply snap a picture of a product label or nameplate, and Centriq will load the warranties and manuals into the app. It also shares information about replacement parts, streams videos for fixing and cleaning the appliance, and alerts you about product recalls.

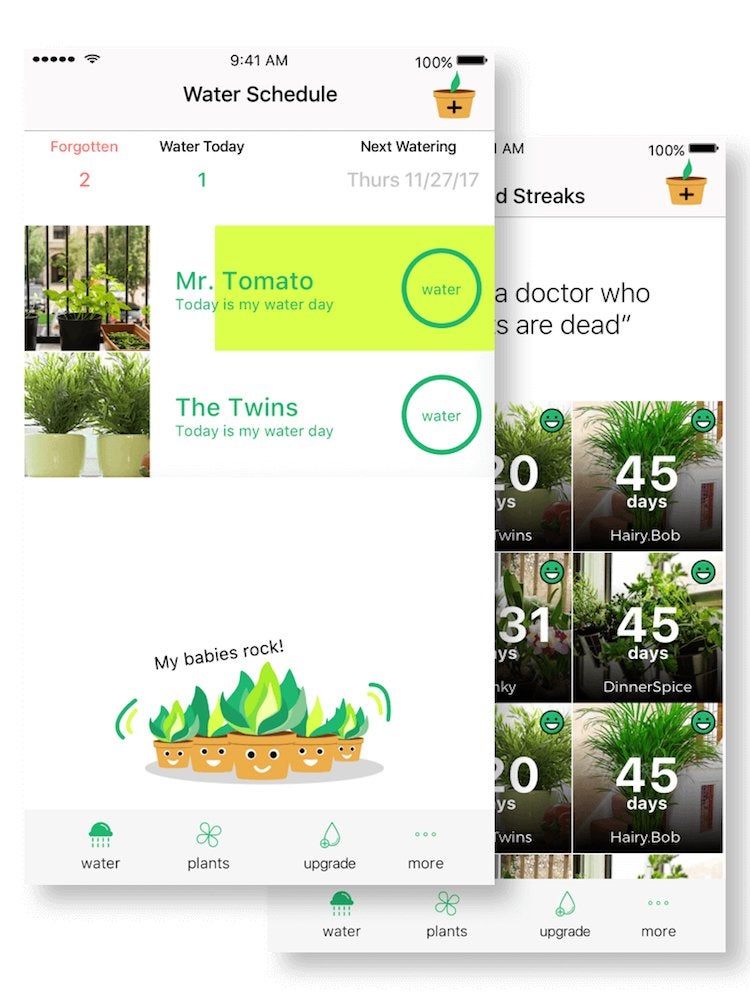

Happy Plant

Do you often forget to water your plants? Then download Happy Plant, a simple app that creates a watering schedule and sends notifications so you won’t forget. To make the chore more fun, Happy Plant tracks watering progress with colorful symbols. It also encourages you to take plant selfies and turn them into a time-lapse video to monitor your plant’s growth.

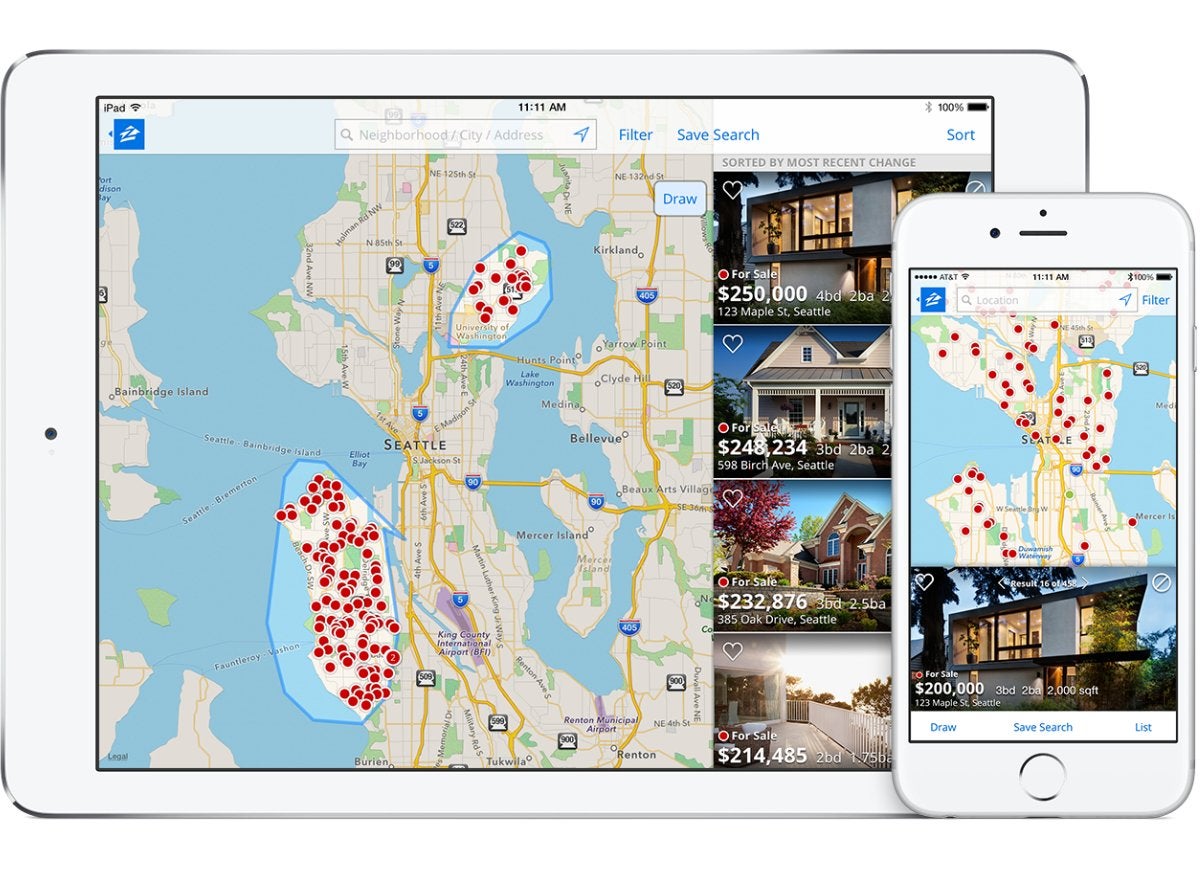

Zillow

Whether you’re looking for a new home or you’re just a nosy neighbor, the Zillow app lets you navigate through neighborhoods to see real estate available for sale or rent. Users can browse listings, save searches, and receive notifications when the house you’ve been eyeing finally hits the market.

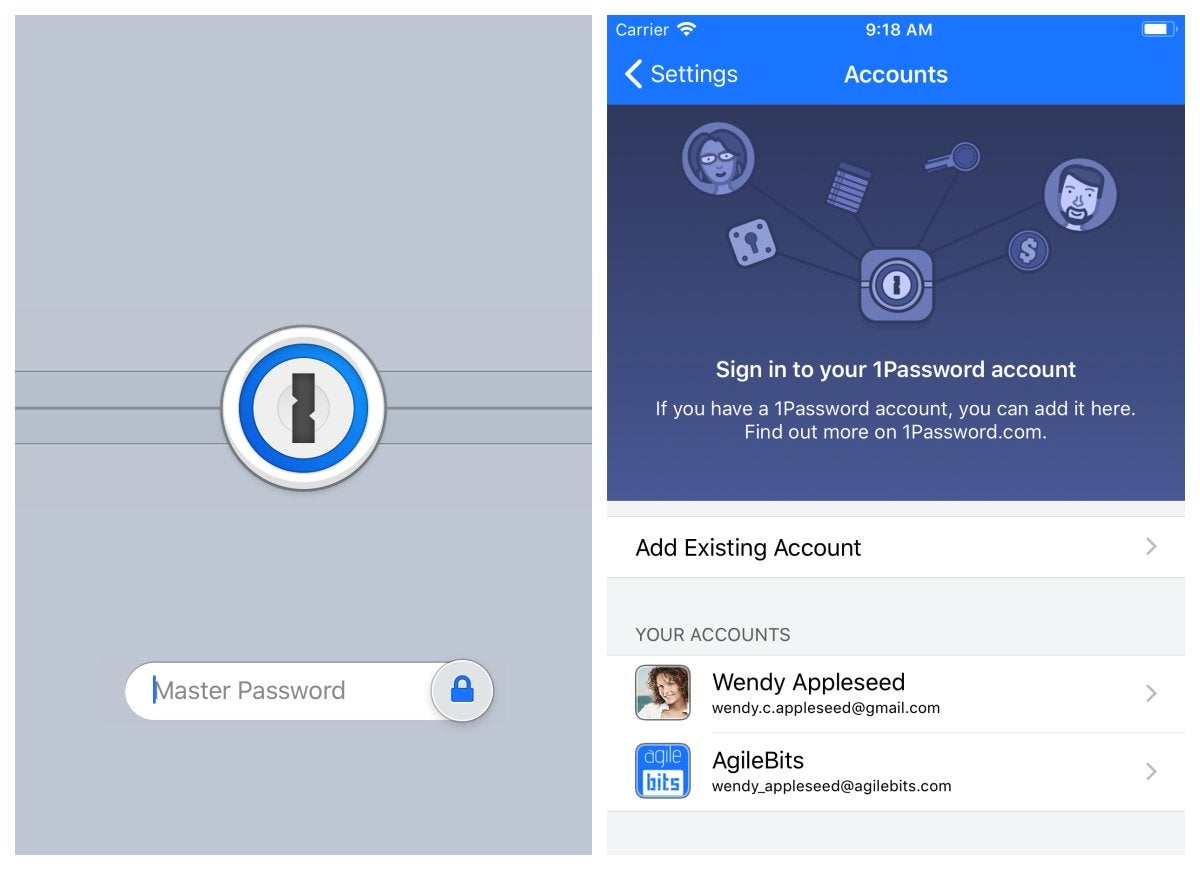

1Password

Online accounts need a strong unique password to protect your identity, but remembering the numbers and symbols for every website is nearly impossible. 1Password securely collects and stores this information, then locks it behind one master password. Use this master password to access your online banking account, social media platforms, and other apps—no need to search for the scrape of paper you wrote the original password on! The app also judges the strength of your passwords, and it will change them automatically if your account has been compromised. Online safety has never been easier!

Color Capture by Benjamin Moore

If you’ve ever found yourself scrutinizing paint swatches, you’ll know that picking out the right color can be difficult. The next time want to remember the exact hue of something, whether it’s a couch cushion or the bathroom walls of a restaurant, pull up Color Capture by Benjamin Moore. The app will match the color to one of Benjamin Moore’s

paint shades. Other handy features, like the ability to create color combinations, make Color Capture the perfect app for anyone gearing up for a painting project.

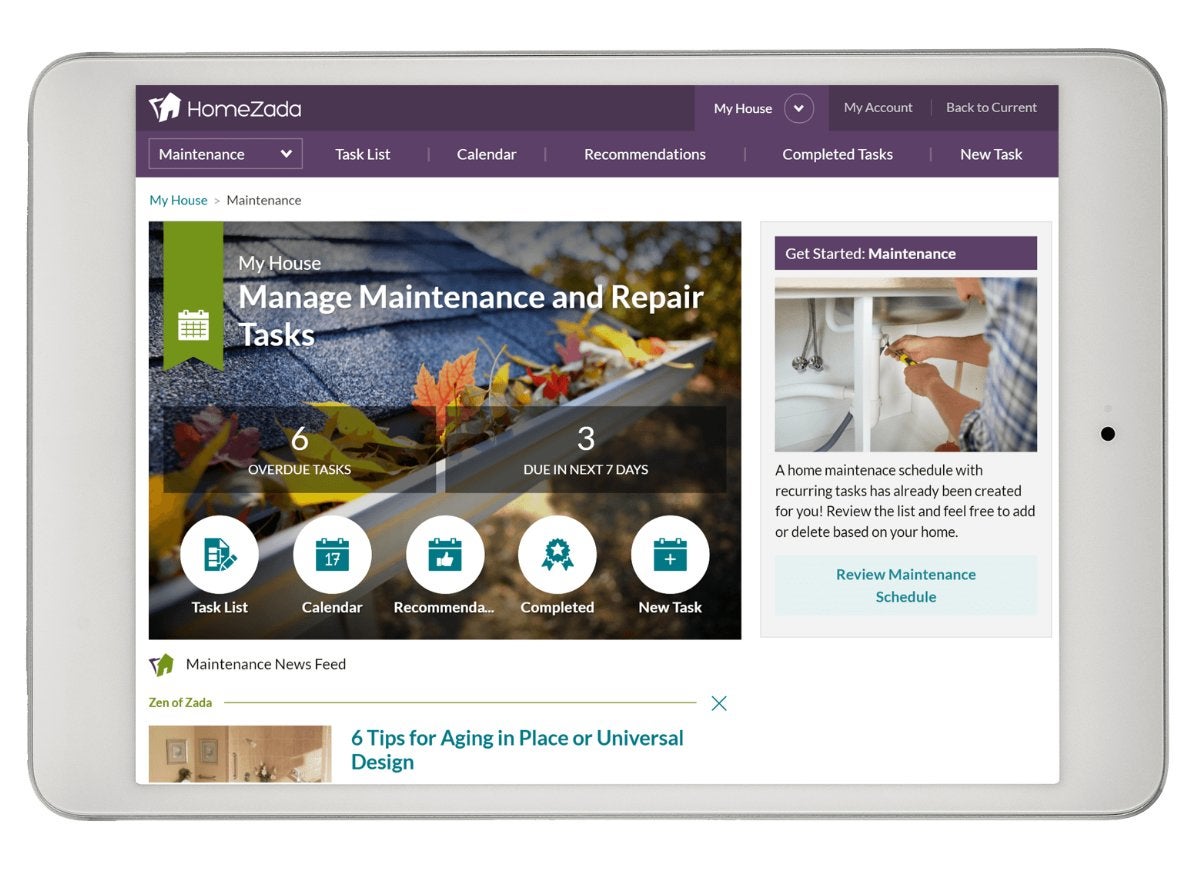

HomeZada

HomeZada has many different home-related functions. The app keeps track of all finances related to home ownership, from your mortgage to your property taxes. It automates home maintenance by managing deadlines and duties (like changing the AC filter), and sending routine reminders until you complete the tasks. If you’re starting a renovation project, HomeZada also has a budgeting feature that tracks your spending

and compares costs.

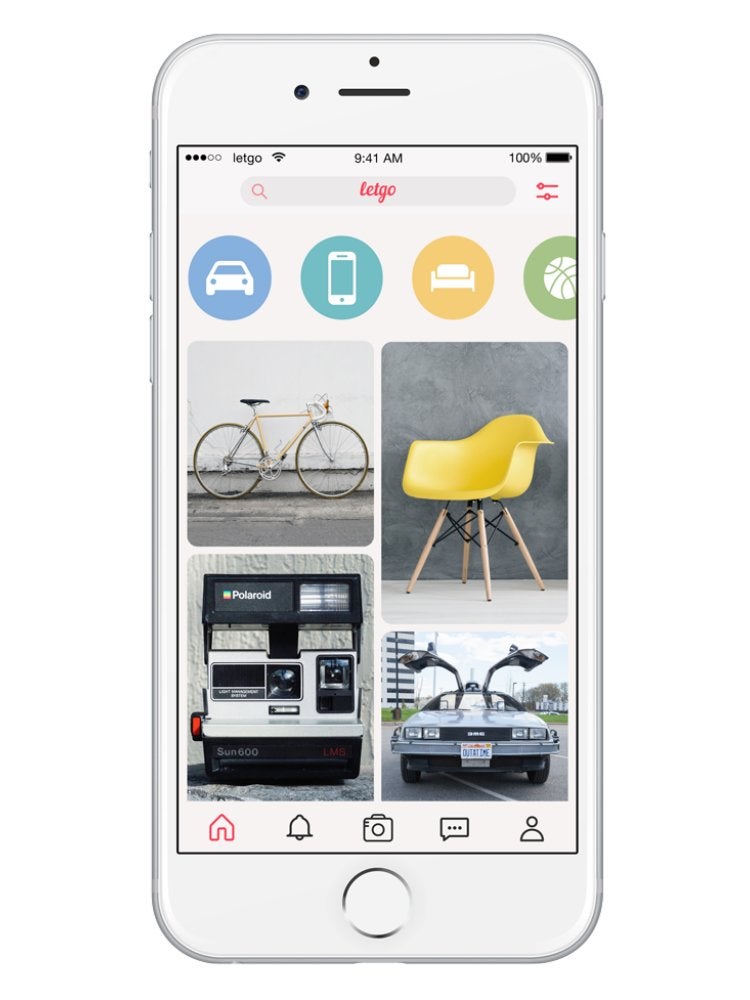

Letgo

Letgo allows homeowners to have a virtual garage sale. Simply take a photo of the item(s) you’re trying to sell and post it to the app in a matter of seconds. People who live nearby can then message you through the app, allowing you to safely coordinate exchange of the items. Your garage will be clear of clutter in no time!

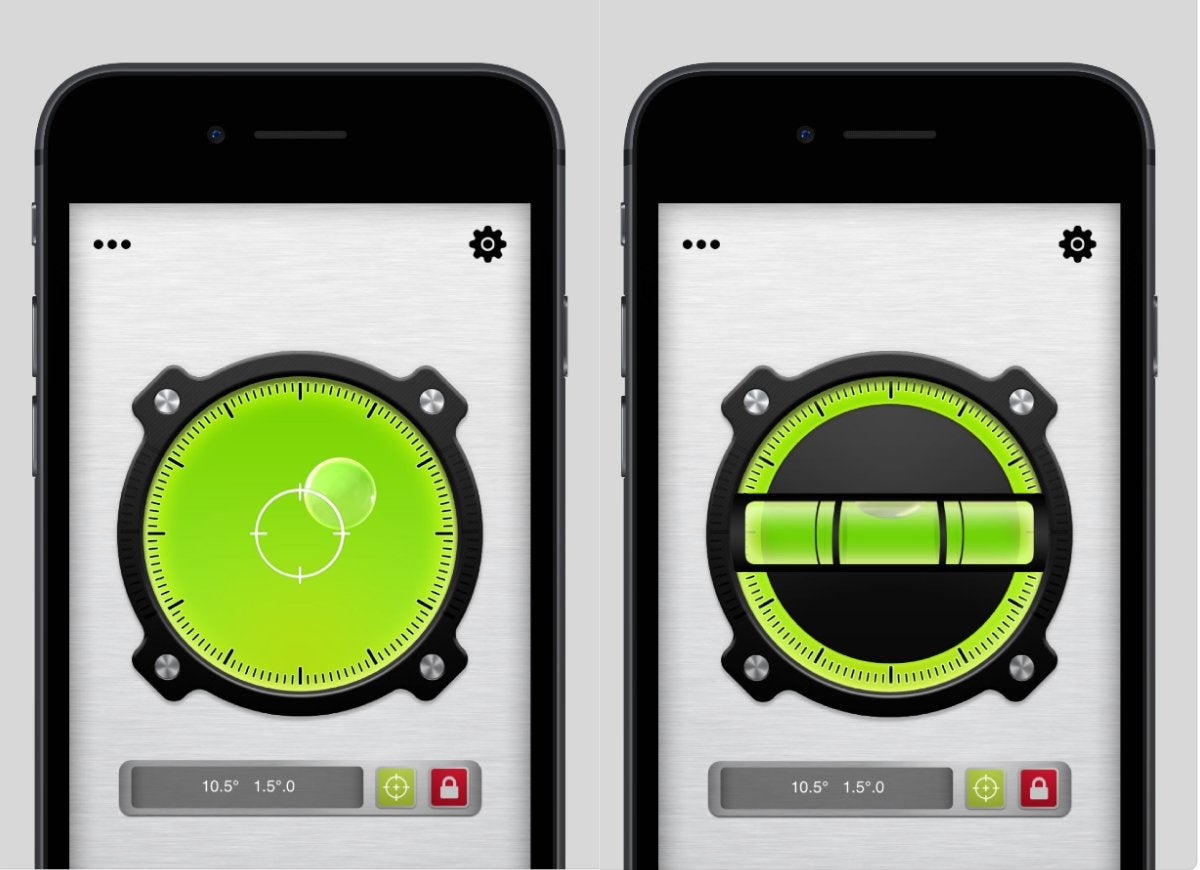

Bubble Level

The Bubble Level app is like a toolbox in your back pocket. In addition a bubble level, it also functions as a surface level, AR ruler, and metal detector for finding wires inside walls before you drill. With an easy-to-use interface, the app is a must-have for anyone looking to hang pictures or take on a construction project.

The Homeowner Survival Kit

This year’s Bob Vila Approved is a hand-picked curation of tested, vetted, must-have essentials for surviving homeownership today.