We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Tenants who rent an apartment or house can avoid some of the costs that come with homeownership, but one need they shouldn’t overlook is insurance. While landlords may have coverage of their own (perhaps through the best landlord insurance companies), that coverage won’t do renters much good if their belongings are damaged, destroyed, or stolen during their rental period.

Renters insurance can come in handy if the tenant’s personal property is damaged by fire, smoke, leaking water, or other covered perils. Depending on the terms of coverage, it may also protect renters financially in the event that they are accused of causing damage to the property themselves. For tenants who want to recoup losses in the event their personal property is damaged or stolen, that sense of security could make the cost of renters insurance worth it.

Lemonade, Inc. claims to offer a new brand of renters insurance policy—one that’s focused entirely on the digital experience and driven by the company’s AI-based platform. The company promises quick online enrollment, easy policy management, and streamlined claims processes. Another major selling point is the company’s charitable donations, which are made with customers’ unclaimed premiums.

How does Lemonade stack up when it comes to renters insurance? We reviewed the company’s claims, strengths, and potential drawbacks to find out.

See more of the best renters insurance companies.

At a Glance

Lemonade

Specs

- Coverage area: 28 states and Washington, D.C.

- Quote process: Online

- Claims process: Online

- Additional policies: Auto, pet, life

- AM Best rating: Unknown

Pros

- Certified B Corp–certified company with high social and environmental standards

- Unclaimed money from customers’ premiums is donated to the charity of each customer’s choice with the Lemonade Giveback program

- Fast and convenient online quote process

- Some claims are paid out instantly

- Customers receive replacement cost coverage

Cons

- Limited coverage area spanning 28 states and Washington, D.C.

- Quote and claim systems are only available online

- Monthly costs can be relatively high for high limits and add-ons

Our Verdict: Lemonade offers a fast and convenient way to get renters insurance, with its user-friendly quote process and the ability to buy a policy online. The company’s insurance product is designed for digital natives and people who are more comfortable managing their insurance policy online or in an app rather than speaking to an agent. Its mobile-focused claims process could be appealing to a younger crowd, but it has the potential to alienate those who prefer a more traditional approach to filing a claim. Rates can vary depending on the policy terms selected, but customers may find that standard coverages costs can be relatively high unless they lower their policy limits. The Lemonade Giveback program is a notable unique feature, though, and it uses customers’ unclaimed premiums to fund donations to a wide variety of nonprofit organizations.

Lemonade Renters Insurance Review: Claims

Lemonade positions itself as a disruptive force in the insurance industry, drawing attention to its unique business model and commitment to social and environmental causes. The company heavily promotes its B-Corp certification and status as a public benefit corporation. Lemonade also prides itself on providing a quick and seamless customer experience using the latest technology—such as artificial intelligence—to streamline quote and claims processes. Environmentally conscious tenants and digital natives may find these qualities appealing, but it’s important to consider the total experience when choosing a renters insurance provider. Coverage, costs, and availability need to factor into that decision as well. By reviewing the advantages and potential drawbacks of Lemonade renters insurance, customers can make a more informed decision about their insurance needs.

About Lemonade

Lemonade is a digital-first insurance company, providing rental insurance as well as homeowners, auto, pet, and life insurance to parts of the U.S. and Europe. Lemonade renters insurance is currently available in 28 states and Washington, D.C., in the United States. Elsewhere in the world, it’s available in France, Germany, and the Netherlands. Lemonade’s business model is a bit different compared with many other insurance companies. Rather than generating profits from unclaimed premiums, the company charges a flat fee on all paid premiums throughout the year. According to Lemonade, this business model removes any added incentive to deny claims because the company does not profit from unclaimed premiums.

After the flat fee is assessed, Lemonade donates any remaining money to charitable organizations through the Lemonade Giveback program. When customers sign up for a new policy, they can choose which charity or nonprofit they would like to support. There are dozens of organizations to donate to, ranging from the ACLU to UNICEF. Lemonade’s donations have steadily grown over the years as its business has expanded. In 2021, the company donated more than $2.3 million through Lemonade Giveback. The one exception is the company’s term-life product, which does not participate in this program.

Although Lemonade does not have local agents or a nationwide footprint, it is a fully licensed insurance company and underwrites its own policies. That being said, the company does not currently hold a rating from the industry’s leading credit rating agency, AM Best, so it’s difficult to assess Lemonade’s financial strength with any degree of certainty.

Customers’ Online Experience

Lemonade prioritizes the online experience over traditional face-to-face interactions in this space, supporting an end-to-end customer experience that is entirely digital. Customers can get a renters insurance quote online through Lemonade’s website by clicking the “Check Our Prices” button at the top of any page. The quote process is relatively quick and allows customers to customize their quote according to their coverage needs and cost considerations. They can increase or decrease policy limits and add extra endorsements as they see fit. Once they have adjusted the quote to their liking, customers are then able to purchase a policy directly through the website.

Policy and claims management is handled a bit differently, however. Rather than having customers use an online portal to manage policy details or file claims, Lemonade handles these tasks through its dedicated mobile app. Tenants considering Lemonade for their renters insurance needs should note that this is the only way to file a claim. While going through the claims process, customers will never be required to speak to an agent—instead, they will create a short video describing the covered event and provide details about the damaged or stolen possessions.

Renters insurance policyholders are encouraged to email the company’s representatives or contact agents via the mobile app—rather than call a customer support line—if they have any questions or need assistance. Customers can also use the site’s virtual chat assistant to find out more about policy options, managing policies, making payments, and other subjects. However, the chatbot’s ability to answer questions is somewhat limited.

What’s Included?

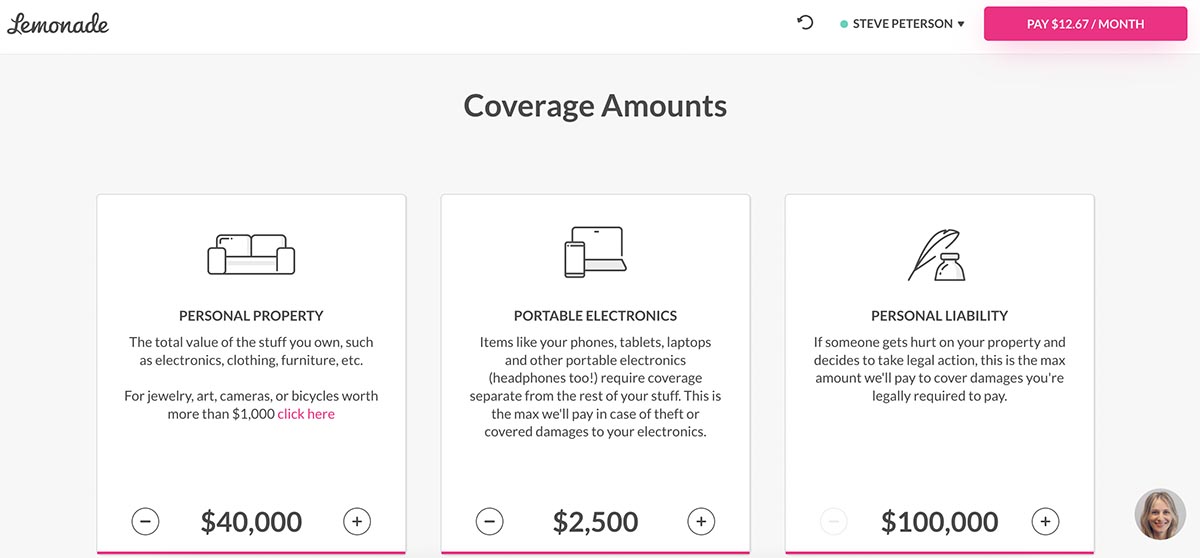

Every Lemonade renters insurance policy comes with a few standard coverage areas. Personal property coverage, for instance, insures renters’ possessions in the event they are damaged by a fire, windstorm, lightning, smoke, or certain types of water leaks. Like other renters insurance policies, Lemonade insurance, for the most part, covers accidental property damage rather than deliberate acts such as arson. That being said, policyholders are also covered for theft and vandalism after the deductible has been paid. The minimum coverage for personal property is $10,000, but customers can increase their policy limits if they like. Lemonade policies have separate coverage for portable electronics—smartphones, laptops, tablets, etc.—with coverage limits starting at $1,500.

As with many standard renters insurance policies, Lemonade plans include personal liability coverage. This protects renters in the event a visitor is injured in their rented apartment or house and chooses to take legal action. It also protects a renter if their actions cause damage to someone else’s property. In addition to helping cover any damages that a policyholder is legally responsible to pay to the injured party, it also covers legal fees. The minimum coverage amount customers can choose is $100,000. Additionally, Lemonade policies come with medical payments coverage—starting at $1,000—to cover medical expenses if a visitor is injured on the premises regardless of negligence.

All renters insurance policyholders will also receive loss of use coverage as part of their standard policy. In some cases, property damage from a covered peril may be so severe that the tenant must vacate the premises while repair work is completed. Loss of use coverage will help pay for other accommodations, such as staying in a hotel or another rental property. Coverage amounts for loss of use start at $3,000, but customers can choose to increase their policy limits.

What’s Not Included?

Lemonade provides an entirely digital experience for customers, but that commitment to online processes can come at a cost. In particular, policyholders are unable to get a quote or file a claim over the phone or through a local agent. In fact, there are no local agents for customers to speak with if they have issues with their policy—all processes are handled online. Renters looking for hands-on support with their insurance provider won’t find that kind of experience here.

Depending on where renters live, they may not be able to take advantage of Lemonade’s services at all. The company only offers renters insurance in 28 states plus Washington, D.C., so it’s entirely possible that renters will not be eligible for coverage based on their location. Lemonade renters insurance does not provide liability coverage for pets, either, so tenants may need to purchase additional coverage elsewhere if they want to be covered in the event their dog or cat causes injury to a third party. Policyholders also need to document their possessions when filing a claim—receipts, photos, and order confirmation emails are recommended—because Lemonade will not pay out a claim for undocumented belongings that have been stolen or damaged by a covered event.

The perils and events not covered by renters insurance are fairly standard for this type of insurance. Although earthquake coverage can be purchased as an extra endorsement in select states—California and Arkansas, to be specific—flood insurance cannot be purchased through Lemonade. Customers will need to seek out a separate insurance provider if they want to protect their valuables from flood-related damage.

Extra Coverage Options

Lemonade allows customers to customize their renters insurance by purchasing optional endorsements that expand their coverage. Customers have the option to add extra coverage to insure high-value possessions such as jewelry, fine art, musical instruments, cameras, and bikes. In addition, policyholders can purchase water backup coverage to provide coverage in the event their belongings are damaged or ruined by water coming up from a drain or the sewer. If tenants have furnished their apartment themselves, they may be interested in appliance breakdown coverage, which provides coverage if their refrigerator, oven, or other appliances malfunction. This type of coverage also extends to electronics such as televisions and window air conditioner units that tenants purchase themselves.

Spouses are automatically included on any renters insurance policy offered by Lemonade, but unmarried customers can add their significant others as well for a small monthly fee. Although pet liability coverage is not included in a standard renters insurance policy, tenants can purchase a landlord property damage endorsement that covers property damage caused by pets. Customers may want to note that this coverage is not the same as pet liability, as it does not cover incidents where pets bite, scratch, or otherwise injure another person.

Cost and Discounts

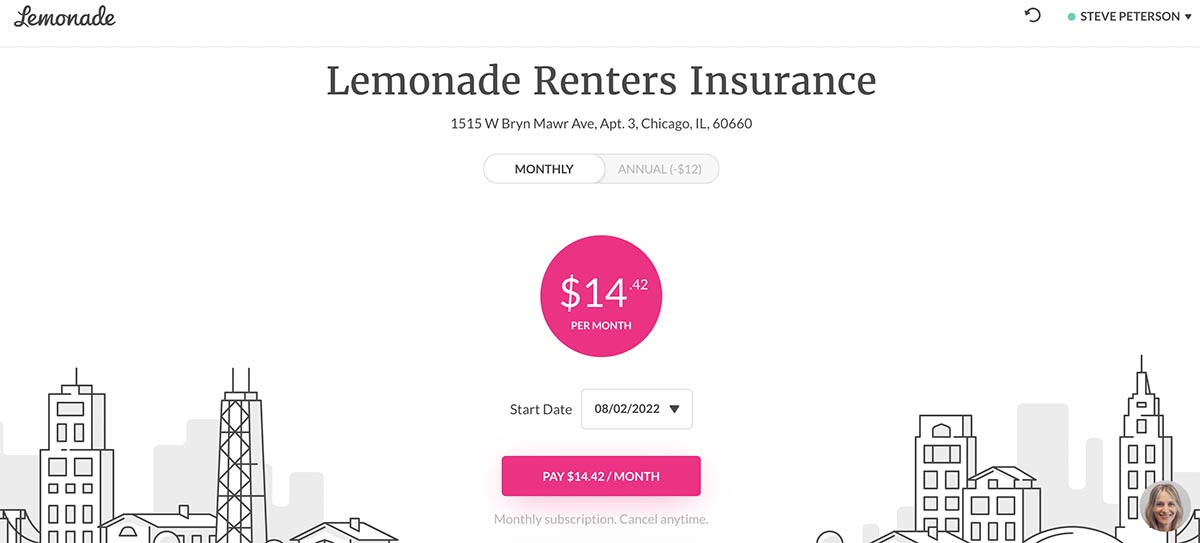

Insurance rates for Lemonade renters insurance start out at $5 a month for the most basic coverage. However, the price can start to climb once customers increase their policy limits and add endorsements to build out their policy to get the renters insurance coverage they need. In fact, tenants may find that Lemonade’s rates are somewhat higher than other renters insurance options unless they select the most limited coverage available.

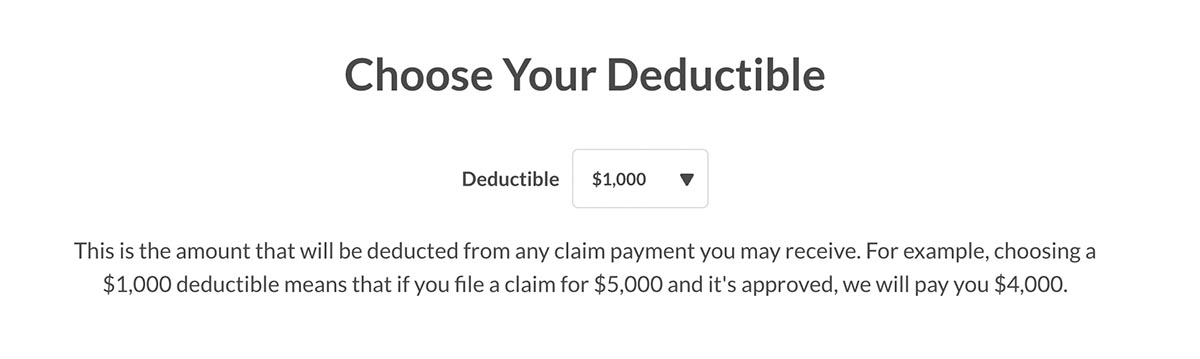

That being said, customers may have opportunities to lower the total cost of their Lemonade insurance through bundles and discounts. For instance, the company offers a few different bundles to help lower insurance rates, including auto, term life, and pet insurance bundles. Customers can also receive a discount on their renters insurance by scheduling their premium payments on an annual basis rather than a monthly basis. In addition, Lemonade offers a few different deductible options to choose from—$500; $1,000; and $2,500—and customers can reduce their monthly or annual premium by increasing their deductible.

Getting a Quote

Renters who prefer to shop for insurance online will be pleased to know that Lemonade’s quote process is done completely through the company website. There’s no option to get a quote over the phone or by speaking to an agent, so prospective customers will need to go through the website. Getting a quote is a relatively quick process that takes just a few minutes and only requires a few pieces of information from the customer. Once starting the quote process, customers will be asked to provide their building’s location, the number of tenants living in their residence, high-value possessions they want to insure, and any security or safety features that could help reduce the risk of fire or theft.

Upon receiving their preliminary quote, customers can further adjust their rates by increasing or lowering policy limits for personal property, personal liability, and portable electronics coverage. They will also be able to tweak their coverage limits for loss of use and medical payments coverage to best suit their insurance needs. In addition, if prospective customers wish to add extra coverage for high-value possessions or purchase extra policy options such as water backup coverage, they can do so from the quote page. One of three deductible options may also be selected before moving forward to enrollment. Although customers have the option to bundle renters insurance with other types of coverage to lower their rates, they cannot include bundles in their online quote.

Filing a Claim

Lemonade’s claim process is pretty unique among insurance companies, completely removing live agents from the equation. To file a claim on their renters insurance, policyholders will first need to download the Lemonade app. While one can get a quote and even sign up for a policy online, the only way to file a claim is through the company’s dedicated mobile app. If the policyholder’s phone is damaged or stolen during a covered event, then Lemonade recommends borrowing a friend or family member’s phone to download the app and file a claim.

When policyholders are ready to file a claim, they’ll be directed to tap the “Claim” button in the upper right-hand corner of the app. From there, the company’s AI platform will ask for some details regarding the covered peril and the damaged or stolen possessions. Rather than speak to an agent, policyholders will then be asked to record a short video of themselves describing the inciting event. For claims involving theft, customers will need to scan a copy of the police report—Lemonade cannot request a copy itself, so this is an important step to remember when filing a claim. The last piece of information the app will request is the value of the stolen or damaged items. This final step includes showing proof of value, which may include receipts or order confirmation emails. Once the policyholder taps the “Submit” button, the AI program will go to work processing the claim using 18 anti-fraud algorithms.

Lemonade states that policyholders will “find out right away if it’s approved instantly,” though we could not verify this claim. It’s worth noting that there may be circumstances when the AI program is unable to process a claim on its own, in which case the claim will be handed off to the company’s claims team for a more thorough review. The good news is that if the claim is approved, Lemonade says that policyholders can expect their funds—minus the deductible—to land in their account within 1 or 2 days.

Additional Lemonade Policies

Lemonade customers can take advantage of a few different bundles that package renters insurance with other policies to lower premiums, provide more coverage, and simplify their insurance needs. The newest offering is Lemonade car insurance, which comes with free roadside assistance if the policyholder’s car breaks down and requires a tow or jump-start. Standard Lemonade auto insurance policies also include emergency crash assistance and discounts for electric vehicles and low-mileage drivers. As part of its commitment to the environment, Lemonade vows to offset the carbon emissions footprint of each auto insurance customer by planting trees in their name based on their annual mileage.

Lemonade pet insurance is also available, covering the cost of diagnostics, procedures, and medication for policyholders’ pets. Customers may be able to receive discounts on routine checkups and care for their furry friends, with preventative packages that include wellness exams, heartworm tests, vaccinations, dental cleanings, and other exams. Lemonade pet insurance is only available for cats and dogs, so renters with exotic pets will need to consider other options.

Lemonade also offers term-life insurance, with rates starting at $9 a month. The company does not require customers to submit to a physical or in-person health screening to be eligible for coverage, and this flexibility could be appealing to customers who want a quick and easy enrollment process. Customers will need to submit some information about their health, however, and those with certain chronic or life-threatening illnesses in their medical past may not qualify. Renters who decide to one day buy a home will be interested to know that Lemonade home insurance is also available.

Customer Service Experience

Renters looking for hands-on support from their insurance provider may find that Lemonade comes up a little short in this department. All customer support requests are handled via email or through the company’s mobile app. Although there is a customer service number to call, this line is dedicated to Lemonade homeowners insurance customers, and representatives may not be able to answer questions or provide assistance to renters insurance policyholders.

Customers who have signed up for a policy or even just started a quote can ask the site’s virtual chatbot for assistance, but this is an AI-based program and is not staffed by live agents. When asked a question—for instance, ”How much is renters insurance?”—it will respond with preselected prompts such as “Contact our team” or “Get a new Lemonade policy.” As such, it may be able to direct customers toward additional steps to address any questions, but the chatbot cannot answer them directly.

Because customer support for renters insurance is exclusively managed through the mobile app and email, customers may not always be able to get immediate answers to questions about their policies or claims. It’s worth noting, though, that customers who are unhappy with their coverage or want to switch providers can cancel their Lemonade insurance at any time through the mobile app without paying a cancellation fee. Customers will be refunded whatever premiums they have paid in advance—the time left on an annual coverage plan, for example—once they have canceled their coverage.

Lemonade Renters Insurance Reviews by Customers

Lemonade garners mostly positive reviews from customers online. Reviewers on Trustpilot have noted how quick and easy the app is to use, even when filing claims. Lemonade insurance reviews have also called out the high-quality customer service policyholders have received from the company’s representatives. Some reviewers lauded Lemonade for the quick turnaround time processing claims, with approval and payouts happening within days of submission.

Comments submitted to the Better Business Bureau were slightly less positive overall, but several customers did note that they received low rates for renters insurance coverage. The most common BBB complaints focused on the customer service limitations resulting from the company’s digital-only focus, with a few customers expressing frustration with their inability to speak directly to a representative when reaching out for assistance. In other BBB comments, customers complained about the amount of money they received on approved claims that were paid out.

It’s worth noting that customer reviews—whether they are positive or negative—are highly subjective, and an individual’s experience will be dependent on a number of factors that may not be evident when reading a review. For instance, payouts may be determined by the customer’s selected policy limits, coverage options, and risk profile. As such, while these comments can be insightful, prospective customers may want to consider everything that an insurance company has to offer before making a decision.

How Lemonade Stacks Up to the Competition

Lemonade stands out in the marketplace because of its all-online approach to renters insurance. Other major insurance companies, such as State Farm and Nationwide, allow customers to get quotes and file claims over the phone—or with a local agent, in some cases—whereas Lemonade customers manage every aspect of their policies online and through the mobile app. Although that may be somewhat limiting at times, Lemonade’s digital focus translates into speedy processes from start to finish, with quote and claims processing offering quick turnaround times.

At a fundamental level, Lemonade takes a different approach with its business model, which helps support its charitable activities. While other companies may make charitable donations as well, Lemonade is unique in the way it uses unclaimed funds to support nonprofits and gives customers the option to choose which charities they want to support.

Lemonade customers may find that their rates are higher than they might be if working with a different provider, but insurance costs will depend on a number of factors, and each person’s experience could be different. The standard coverage provided by Lemonade is pretty typical for this type of insurance, but tenants may find that they can get more expansive standard coverage elsewhere. USAA, for instance, includes flood and earthquake coverage, although eligibility is limited to service members and their families.

The company’s coverage area is significantly smaller than that of large insurance carriers like State Farm, which has a nationwide footprint. That being said, Lemonade’s coverage area continues to grow and is actually larger than that of some other companies—American Family Insurance, for instance. Prospective customers who want to work with an insurance company that stands on solid financial ground may want to note that Lemonade does not currently hold a rating from AM Best. Meanwhile, companies such as State Farm and USAA have A++ ratings—the highest possible grade.

Should You Buy a Renters Insurance Policy From Lemonade?

Lemonade renters insurance is a good option for tenants who value speed and simplicity and are comfortable relying on a mobile app to manage their policy. The online quote process is very quick and easy to use, and prospective customers can get a quote in just a few minutes. It’s also highly customizable, allowing renters to adjust coverage limits and add on extra endorsements as they see fit. Filing a claim should be relatively straightforward as well, but some customers may prefer a claims process that doesn’t require a mobile app. On the other hand, some renters may like the idea of being able to file a claim without needing to speak to an agent or representative.

Tenants who need a personal, hands-on touch when working with their insurance provider may want to look elsewhere. Although agents can be reached via the Lemonade app, the lack of any customer support over the phone could deter some customers. It’s also possible that tenants will not be able to use Lemonade renters insurance due to the company’s relatively limited coverage area. Lemonade, Inc. continues to expand, though, and that coverage area could grow in the coming years.

Renters looking for an insurance provider committed to social and environmental causes may find Lemonade to be the perfect fit for their renters insurance needs. The company’s B-Corp status and annual donations to various charities are laudable, and some customers may love the fact that their unclaimed premiums will be used to support nonprofit organizations rather than line Lemonade’s pockets. With its charitable spirit, digital support, and user-friendly processes, Lemonade could be the right choice for many people searching for renters insurance.

We independently reviewed this service by weighing the company’s claims against first-hand experience with its professionals. However, due to factors such as franchising, human error, and more, please note that user experiences may vary.