We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

There are some home maintenance and repair issues that property owners are likely to put off because the tasks are time-consuming, expensive, or just don’t seem all that urgent at the time. Still other problems might be serious but remain hidden, and these are the kinds of catastrophes that can turn any dream home into a nightmare on Elm Street. Be prepared to spot and squelch these ticking time bombs in your own home before they go “boom.”

1. Foundation

A small crack in the brick veneer of your home’s exterior is no big deal, right? Maybe, maybe not. Though this kind of problem looks like it can be solved with a quick cosmetic fix, it might also indicate a problem with the foundation. When you’re in doubt as to whether foundation cracks are a big deal, it’s a good idea to hire a structural engineer to evaluate them. If a troublesome crack is caught early, a repair might only cost a few thousand dollars. If you wait too long to repair foundation damage, you may be looking at one of the most expensive home repair jobs possible: Foundation repair costs are considerable, and can easily run into the tens of thousands of dollars if you wait too long.

RELATED: Everything You Need to Know About a Foundation Inspection: Why It’s Crucial, Who to Hire, and More

2. Roof

A roof can look shipshape on one side of the house, but be crumbling on another side. This is one reason many homeowners make the mistake of waiting until they see water leaking through the ceiling to identify roofing issues.

Because water usually seeps into the attic first, it’s a good idea to inspect that space regularly for stains or dampness around the chimney and vents. To be on the safe side, you should also have your roof inspected every 5 years.

RELATED: Solved! This Is How Long You Can Expect Your Roof to Last

3. Septic System

Many rural homeowners rely on septic tanks for their sewage systems. Septic systems operate by breaking down solids and liquefying them. That liquid then goes out into septic pipes and is dispersed into the surrounding ground.

While indispensable, septic tanks are highly susceptible to being clogged by materials like cigarette butts and food waste that should not have been flushed into the tank in the first place. By regularly pumping the septic tank, you can save yourself the cost of digging up your yard to make septic repairs. Do this every 3 to 5 years, and check for signs of clogs and leaks routinely between inspections.

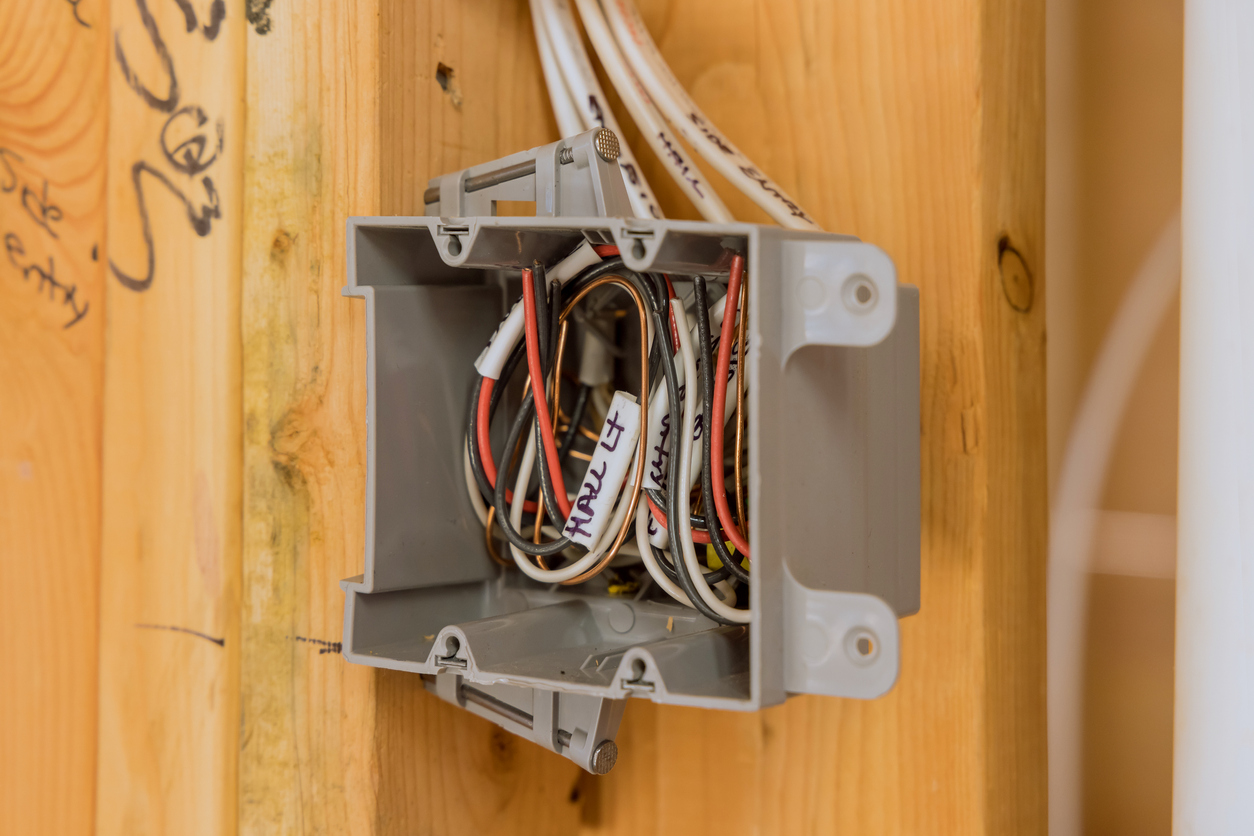

4. Old Electrical Wiring

Homes built before World War II didn’t have to conform to the same requirements for power that are now standard in home construction. Older wiring just can’t handle the demands of this generation’s high-tech gear.

Sockets and switches can wear out, breakers grow less reliable as they age, and heavy use of extension cords could lead to a fire. Squelch worry about these larger problems with a thorough electrical system inspection every 20 years. If your home doesn’t meet the current code, consider replacing the entire electrical system—and avoiding a major fire hazard.

RELATED: 15 Things You Should Never Plug Into a Power Strip

5. Crawl Space

When it comes to maintenance and repair, the out-of-the-way and untraveled crawl space is one of the most overlooked areas of the home. But because the crawl space is like the window into the belly of your home, it could also hold the key to revealing any number of problems before they get bigger and expand to other areas: weakening floors, termite damage, and even issues with your heating and cooling ducts.

Grab a flashlight and routinely take a peek at this often-ignored storage spot. If you aren’t sure whether what you see is normal, call in a home inspector for a professional opinion.

RELATED: Solved! What to Do When There’s Water in Your Crawl Space

6. Furnace and HVAC Unit

When your heating goes kaput and you have to replace the furnace, you’re looking at an expense of upwards of $6,000. Careful maintenance of your furnace (and a yearly inspection by an HVAC professional) will ensure you won’t have to tap your emergency savings.

Another easy way to improve air quality, efficiency, and extend the life of your heating unit is to replace the furnace filter at least every 90 days. (You may want to do this even more often if you have allergies or pets.)

RELATED: 9 Ways to Lower Cooling Costs in Rising Heat

7. Deck

Building a deck is sure to boost the value to your home, but if you don’t keep up with maintenance your outdoor oasis could fall apart. While deck maintenance typically runs $100 or so a year, the average cost of replacing it from the ground up is closer to $10,000.

Save the cost of replacing the deck by keeping it clean, securing any loose nails, and refreshing deck sealer as needed. A full inspection at least once a year will help you determine whether any repairs are necessary, and catch any early signs of rot.

RELATED: The Dos and Don’ts of Sealing the Deck

8. Heating Oil Tank

Homes equipped with oil furnaces have large 300- to 600-gallon tanks that hold the heating oil. As those tanks get older, they can corrode and eventually leak into the surrounding earth, leading to a clean-up that can extend into the hundreds of thousands of dollars.

Most states require heating oil spills to be cleaned up according to specific standards to prevent groundwater and soil contamination. Unless you’ve added specific coverage for a leaky oil tank, your homeowners insurance probably doesn’t cover it. Avoid this calamity by having your tank inspected annually and by making sure you have insurance to cover any leaks. If you do spot a leak, cleaning it up quickly is the key to minimizing the cost of cleanup.

RELATED: How Much Does Oil Tank Removal Cost?

9. Dryer Vent

The hundreds of loads of laundry that go through your dryer each year create a lot of lint. While your dryer’s removable filter will catch the bulk of it, some will inevitably end up collecting in the dryer vent hose and eventually clog it.

A dryer vent clogged with lint forces your dryer to work harder to dry clothes, shortening its life. More important, all that lint coupled with the high heat the dryer produces creates a serious fire hazard. Extend the life of your dryer and reduce the risk of fire by pulling out your dryer, disconnecting the hose and cleaning your dryer vent once a year.

RELATED: Here’s Exactly Who to Call for Dryer Vent Cleaning

10. Old Plumbing

If you live in a home built in the 1980s or earlier and it still has its original plumbing, chances are you have galvanized steel or copper pipes running through your home. Over time, hard water, oxidation, drain cleaner, and other substances will slowly eat through the pipes.

Left unchecked, this could lead to a burst water supply line or leaky drain pipe, resulting in thousands of dollars in flood damage. If you live in a home with metal plumbing, ask a professional plumber to inspect those pipes each year.

RELATED: 15 Little Signs Your House Has a Big Problem

11. Water Heater

As a water heater ages and collects sediment, the pressure inside the tank increases. While water heaters are equipped with a temperature relief valve that releases this pressure, these valves can malfunction. When that happens, the pressure inside the tank can build up so much that it causes the water heater to explode out the bottom, launching it through the upper floors of the home and even through the roof. The force of the explosion can even crack your home’s foundation. Prevent your water heater from becoming a missile by getting it serviced once a year to flush out sediment and ensure the pressure valve is working.