We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Hurricanes are one of the most destructive forces a home can face. In 2021, the Atlantic hurricane season alone was expected to exceed $70 billion in damage costs. For homeowners who live in areas that are at risk for hurricanes, it’s a smart idea to look into how to get hurricane insurance. Hurricane insurance can help ensure that a home and its possessions are covered in the event a hurricane hits. Read on to learn how to find hurricane insurance, the best time to look for coverage, and how to get the right type of coverage.

Before You Begin…

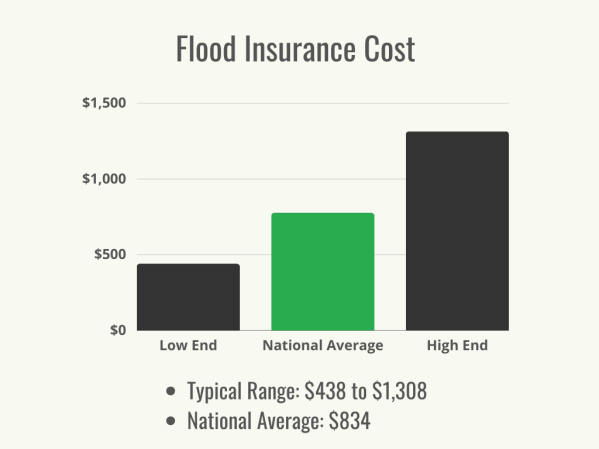

The terms “hurricane insurance” or “storm insurance” are often used, but it’s important to know going into the process that hurricane insurance is not actually a type of stand-alone insurance. Many of the best homeowners insurance companies offer coverage against the types of damage a hurricane can cause. For instance, many standard homeowners insurance policies cover damage from windstorms or hail, both of which can be caused by hurricanes. As such, some standard homeowners policies operate as wind and hail insurance. However, standard homeowners insurance policies don’t cover flooding caused by hurricanes. To protect against this, homeowners will need flood insurance, which is a stand-alone product that covers buildings and contents from flood damage. Homeowners might be able to find both homeowners and flood insurance policies through one provider, or they might have to purchase different policies through separate companies. For instance, one company might offer homeowners a policy that includes windstorm insurance coverage, and another company might have the right flood insurance option.

It’s also important to read standard homeowners insurance policies closely since not all of them cover damage caused by a hurricane. Some policies might include windstorm damage, and some might even specifically exclude hurricane damage.

STEP 1: Plan ahead before hurricane season comes around.

Hurricane season officially runs from June 1 through November 30 each year. However, there can also be off-season hurricanes, which can more likely happen in May or December. In general, homeowners should consider looking for hurricane insurance well before the season starts to ensure they have coverage in case their area is hit by a hurricane.

Because some insurance providers also have a waiting period before coverage takes effect, this makes it even more important to find hurricane insurance well before the hurricane season begins. Homeowners insurance waiting periods can typically run anywhere from 30 to 90 days, so homeowners will want to begin looking for the right coverage as soon as possible to make sure they have hurricane protection.

STEP 2: Take inventory of your personal belongings and the cost to replace your home and possessions.

Homeowners will need to know how much their home and possessions are worth. This will allow them to determine how much homeowners insurance they need so they can purchase an adequate amount of coverage. To start, homeowners will want to find out how much their home is worth in the current market. To get the most accurate assessment, homeowners either pay for an appraisal, which is the most accurate, or get a comparative market analysis from a real estate agent, which is typically free. They can also check online calculators, like the FHFA House Price Index Calculator. It’s also helpful to know how much it would cost to rebuild the home; this may involve consulting a contractor.

Homeowners can also look at how much their belongings are worth. To complete this step, many people fill out a home inventory list. This list includes all the items in the home, how much they are worth, any available receipts showing proof of purchase, and potentially even photos or videos of each room. Having a home inventory list can also help make filing claims easier.

STEP 3: Identify all the different ways that a hurricane could damage your property.

Homeowners may want to do some research to determine exactly what sort of damage a hurricane could do to their home. There are the more commonly known types of damage, like wind damage to the roof, felled trees, or flooding. However, there are also lesser-known types of damage that a hurricane can cause, such as sewer backups, which can happen when heavy flooding and storms hit an area.

Homeowners can talk with their insurance agent to identify which products can give them adequate coverage for hurricane damage. The agent may suggest combining different insurance products or adding endorsements to make sure the home is sufficiently covered. For instance, a standard homeowners policy will likely provide wind insurance to cover roof leaks or fallen trees, but it will not cover flooding. A homeowner would need to purchase flood insurance to cover storm surges. If the homeowners insurance policy doesn’t cover windstorms, a homeowner may need to add a windstorm endorsement that would cover damage from the high winds that accompany a hurricane.

STEP 4: Determine how much coverage you need from a hurricane insurance policy.

Once homeowners know what their home and belongings are worth and what types of coverage they need, it’s time to look at coverage limits. Insurance policies offer coverage up to a certain limit. Coverage limits for personal property are typically 50 to 70 percent of the dwelling coverage limit. Therefore, a home that has $300,000 in dwelling coverage would likely have personal property coverage between $150,000 and $210,000. Homeowners will want to match their coverage limits to the value of the home or the cost of rebuilding, as well as how much their personal property is worth.

Homeowners will also want to check to see whether their homeowners insurance policy covers additional living expenses. This coverage is designed to help pay for additional expenses the homeowner incurs if they need to relocate while their home is being rebuilt or repaired, and it offers reimbursement for expenses that exceed the homeowner’s usual living costs. This type of coverage can reimburse for costs such as hotel or short-term rental fees, restaurant food, or travel expenses.

STEP 5: Check what your existing homeowners or renters insurance policy already covers.

In order to get hurricane insurance coverage, homeowners may not need to overhaul their whole policy or find a new insurance company. Before making any changes, they will want to see what their existing policy covers. Homeowners can read their policy closely to understand what is covered and what is excluded. Many homeowners policies list windstorm damage as a covered peril, and some even list hurricanes. Some policies provide coverage for anything that is not specifically listed as excluded. Homeowners might discover that their current policy offers almost all the protection they need against hurricanes, and they might only need to purchase flood insurance if they don’t already have this coverage. If the wording in the policy is unclear, homeowners can work with their insurance agent to understand what might already be included on the policy in relation to hurricanes.

STEP 6: Ask your insurance provider if you can add coverage for hurricane-related damage.

While reviewing their policy, homeowners might notice gaps in their hurricane-related coverage. As mentioned above, standard homeowners insurance policies do not cover flooding, which is a common occurrence during hurricanes. Some insurance companies might only cover windstorm damage under an endorsement. It’s important for homeowners to work closely with their insurance agent to find out which product or combination of products will offer the most protection in the event of a hurricane. The agent can help the homeowner understand whether they can simply modify their existing policy with endorsements or riders, or whether they need a completely different policy. While acting as a sort of “hurricane adviser” in this capacity, an insurance agent can provide reassurance that a homeowner is choosing the policy that will offer the best protection.

STEP 7: Shop around and gather multiple hurricane insurance quotes.

Even if the homeowner’s current policy offers coverage against hurricane damage, homeowners can be proactive and look at other insurance companies as well. This can help the homeowner understand whether they are getting the most comprehensive coverage for the lowest premiums.

Homeowners can shop around by gathering a list of major homeowners insurance providers and listing what they offer for hurricane coverage. Some websites also compare insurance quotes side by side, which can be helpful for homeowners looking for the best hurricane insurance quotes or multiple homeowners insurance quotes. Homeowners will want to check that each company is reputable by looking at metrics such as Better Business Bureau ratings, J.D. Power scores, Trustpilot scores, the NAIC (National Association of Insurance Commissioners) Complaint Index, and AM Best ratings. It might also help to read reviews of homeowners insurance companies from customers. However, shoppers will want to bear in mind that some negative reviews are to be expected; their experience won’t necessarily mirror those of the customers who are writing an online review. Therefore, a company with negative customer reviews doesn’t necessarily need to be crossed off the list if it has good scores in the industry and offers the coverage the homeowner needs.

STEP 8: Consider the added costs that may come with hurricane coverage.

Hurricane coverage can also come with added fees. Understanding these fees can help homeowners determine how to fit them into their budget. For instance, they might come across specific deductibles, like hurricane deductibles and windstorm deductibles, for named storms. These deductibles are separate from the regular deductible on the policy and may be higher. A deductible is the amount the policyholder must pay before insurance coverage kicks in.

Homeowners who are in high-risk areas for hurricanes might also face higher premiums. These higher premiums help protect insurance companies financially, since more money gets paid out in claims to areas that have more frequent hurricanes. In these cases, it can pay for homeowners to shop around to make sure they’re getting the best price on a policy that offers the coverage they need.

STEP 9: Check for discounts that may reduce the cost of hurricane coverage.

Just because hurricane insurance can come with more costs doesn’t necessarily mean it needs to put too much stress on a homeowner’s budget. Some insurance companies offer discounts that can help ease the cost of hurricane coverage. Many of these discounts pertain to making the house less prone to damage during high winds. For instance, homeowners who can prove they’ve added storm shutters or impact-resistant window panes might qualify for a discount with some insurance companies for this added wind protection. They might also qualify for discounts if their home was specifically designed to withstand hurricanes better. Homeowners can ask their insurance company if it offers any discounts related to hurricane coverage. Discounts could be especially helpful in high-risk areas that face higher premiums.

STEP 10: Review your state’s FAIR Plan or beach and windstorm plan if you are unable to get windstorm coverage.

Sometimes homeowners who live in high-crime areas or high-risk inclement weather areas have a harder time finding insurance. Insurance providers can also deny coverage if a home has dangerous and outdated home systems, such as old plumbing, heating, or electrical systems. In this case, many states offer a program called the Fair Access to Insurance Requirements (FAIR) Plan. A homeowner can start the process by searching for a FAIR Plan in their state. In seven states that border the Atlantic Ocean or Gulf of Mexico, there is also an option called the beach and windstorm plan, which is specifically designed to provide residents and businesses with coverage against hurricanes or tropical storms. Beach and windstorm plans are a counterpart to FAIR Plans, and the coverage they offer can vary by state.

STEP 11. Check with the National Flood Insurance Program if insurance providers will not cover flood damage.

Homeowners may be wondering whether they need flood insurance. Generally, homeowners in hurricane-prone regions should have flood insurance, but they may struggle to find a provider. That’s where the National Flood Insurance Program can help. This program is offered on a federal level and handles building coverage and contents coverage. However, this type of insurance defines flooding as “an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties.” It can cover sewer backups that are caused by flooding, but not non-flooding sewer backups. Like all policies, it’s important to review the wording of the policy itself before signing up.

STEP 12. Look into separate hurricane coverage for cars and other vehicles if necessary.

An important point to remember about homeowners insurance is that it does not cover damage to vehicles. Even if the vehicle is parked on the premises and in the garage when a hurricane hits, the vehicle will not be covered by homeowners insurance and will instead fall under the purview of auto insurance. As such, it’s important to check an auto policy to make sure a car is fully protected against hurricane damage. If a car has full coverage (comprehensive and collision), it would have coverage in the event a hurricane flipped it over or if falling debris were to damage it. If the car were being driven at the time of a hurricane and collided with another vehicle, the collision portion of the policy would provide coverage for any resulting damage.

STEP 13. Choose the right policies for your needs—even if that means using more than one provider.

Homeowners who live in areas that are prone to hurricanes will want to make sure they have adequate protection against hurricane damage. That might mean getting policies from multiple providers for different types of coverage (such as homeowners insurance and flood insurance) and piecing together the right amount of coverage. Since providers can vary in their coverage limits and premiums, combining coverage from multiple providers might make the most sense for some homeowners.

By following the steps above, homeowners can make sure the insurance they purchase fully covers them in the event of a hurricane. It might require looking at different companies or even government agencies, but the coverage is likely available for anyone who needs it. These steps can help homeowners find the most comprehensive coverage with the best premiums for their budget.