The Complete Guide to PEX Pipe

Find out why this colorful tubing is a popular plumbing alternative to copper, especially for DIYers.

Find out why this colorful tubing is a popular plumbing alternative to copper, especially for DIYers.

Who knew that wearing silly slippers could keep your floors clean? With these fun and easy cleaning hacks, housework will take half the time it used to.

Staying comfortable through the summer often comes at a price (after all, air conditioning ain't cheap). If your energy bills have your blood pressure rising faster than the mercury in the thermometer, don't miss these tips on maximizing comfort with the AC turned off and minimizing expense with it turned on. Keep your cool without losing your live savings—yes, it's possible!

A backup generator doesn’t have to create a racket. Find out what happened when we tested models advertised as being quiet.

Prevent expensive water leaks by spotting them early with the best water-leak detectors.

Attract feathered friends and add appeal to your garden with a solar bird bath fountain.

Keep cushioned furniture looking great with the upholstery cleaning products and devices that passed our tests with flying colors.

If you’ve got the right planting setup, landscape fabric might be your best bet for holding pesky weeds at bay.

Rely on a quality angle grinder for cutting, grinding, carving, and a host of other tasks. We tested a variety of models to find the best options.

Make the switch to a greener yard with a high-performance battery-powered lawn mower.

Chop saws and miter saws are often confused for the same tool. But there are important differences every DIYer should know.

From whole-home backup kits to compact solar bundles, Jackery’s bestsellers now come with steep discounts and a valuable bonus.

If the flying menaces hanging out around your houseplants and seedlings are getting on your last nerve, here’s how you get them to bug off.

I’ve stood on more rickety ladders than I can count but Werner’s TS1250 isn’t one of them. It’s the sturdiest, safest telescoping ladder I’ve tested to date.

Each week, we bring you the hottest deals in Bob Vila-favorite categories like power tools, hand tools, home essentials, and more.

This Blackstone pizza oven is marked down more than 50% off. Hurry, it won't last long.

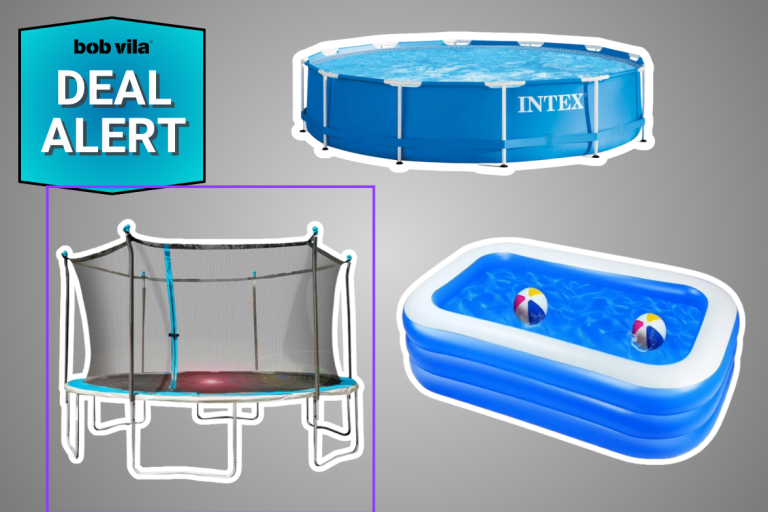

I scored a trampoline for $99, and found some huge markdowns on pools and more outdoor fun.

These garden accessories keep my plants well-watered, even when I'm away for the weekend.

I test and track tool prices year-round, and these DeWalt Prime Day deals on impact drivers, saws, and more are actually worth it.

Lowe’s Member Week runs through July 18. Here’s how to find the best markdowns—including a popular power tool under $100.