Hi, I'm Bob Vila

You probably know me from TV. For the better part of a half century, as the host of shows like This Old House and Home Again with Bob Vila, I’ve been teaching and inspiring people to upgrade their homes and improve their lives. I learned firsthand about home building from my father, and I’ve written more than a dozen books about remodeling, buying your dream home, and visiting historic homes across America. It’s fair to say that buildings, especially homes, are my life’s work.

Lawn Care

The Best Lawn Mowers for Every Yard, Tested

Make your yard the envy of your neighbors with one of these top lawn mowers.

How to Overseed a Lawn

Gardening

12 Reasons to Plant Native Instead of Non-Native Plants

Choosing native plants for the garden protects the planet, helps wildlife, and lessens outdoor chores without sacrificing the beauty of blooms or greenery.

How we test and review products

The Bob Vila Product Reviews team tirelessly researches and tests products to ensure they live up to the hype.

- Our team scours the market for best-in-class products.

- We do our homework and thoroughly vet popular products.

- We’ll test as many as we can get our hands on.

- Our unfiltered, honest opinion is what you see on the page.

-

Appliances & Cookware

Appliances & CookwareThe Best Handheld Vacuums for Pet Hair to Clear Fur From Floors

-

Appliances & Cookware

Appliances & CookwareCooling Comfort: Is This Vornado Fan the Answer to Summer Swelter?

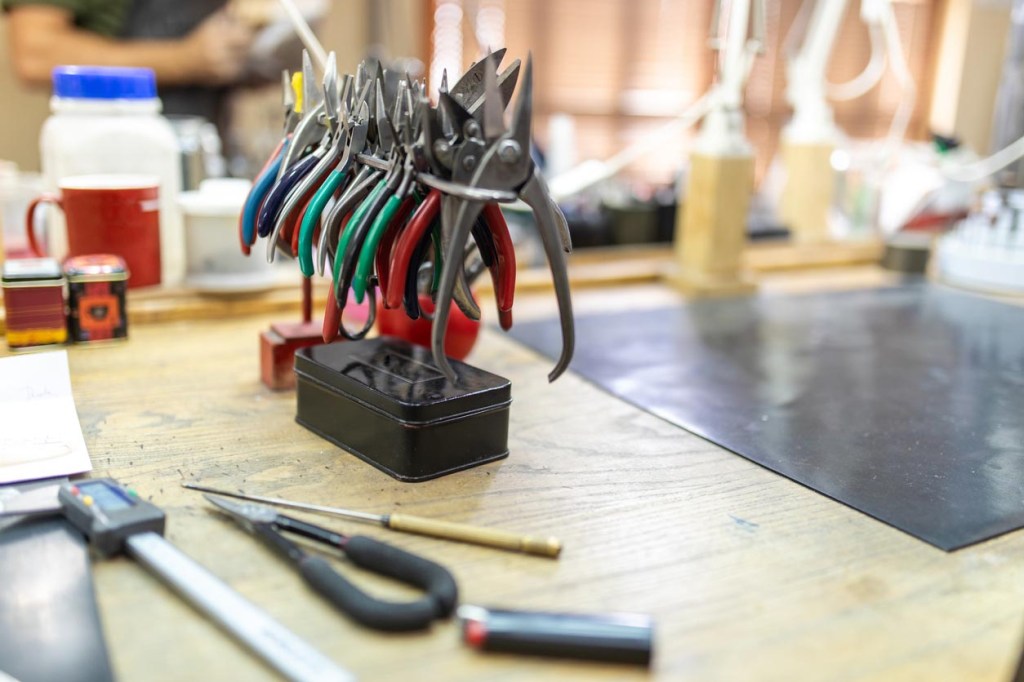

Tools

14 High-Quality First-Time Tool Kit Essentials for Under $100

We’ve put together a collection of durable, high-performance equipment you can purchase without breaking the bank.

Meet the Experts

We’re not just here to answer your questions and offer advice. BobVila.com seeks to educate and empower.

Our team of writers and editors are passionate about all things home. We are general contractors, master gardeners, real estate pros, historic preservationists, product testing specialists, and veteran journalists with expertise in everything from design to DIY. Our common bond is the mission of BobVila.com—to simplify, demystify, and chronicle the joys and challenges of homeownership through a commitment to accuracy, clarity, accessibility and good old-fashioned fun.

BobVila.com is the complete toolbox and ultimate resource for inspirational ideas and nitty-gritty know-how. It’s been that way since the site began in 2011. Our goal is to carry forward Bob Vila’s decades-long tradition of helping people maintain and upgrade their homes to live better each day.