We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Home Advice You Can Trust

Tips, tricks & ideas for a better home and yard, delivered to your inbox daily.

Happy 75th Birthday, Bob!

Bob Vila has had his own remodeling and design business, spent almost three decades hosting television shows about renovation and preservation, and has written more than a dozen books about purchasing and maintaining homes. What’s more, he has supported philanthropic causes to end homelessness, build homes for those who need them, and restore historic properties.

Bob Vila turns 75 this week, and we figure there’s no better way to celebrate him than to share his wisdom with this collection of tips about home maintenance and repair. Here’s to many more healthy, happy years, Bob!

Dryer Vents

Don’t use foil-look or plastic dryer vent ducts. Though appealingly inexpensive, these types of ducts can melt or catch fire. Instead, opt for flexible or rigid metal ducts, secured with metal foil tape rather than screws.

Home Siding

Although it’s heavier and more expensive than other types of siding, fiber-cement siding has many benefits: It resists both fire and termites, and it comes prepainted—and the painted finish lasts a long time.

Drill Bits

Make sure your tool kit is stocked with drill bits for masonry, tile, and wood. It’s a bad idea to use wood drill bits on tile, and vice versa. A quick-change chuck, which makes easy work of switching bits, is another great tool to have at the ready.

Wheelbarrows

A good rule of thumb to follow when shopping for a wheelbarrow: Find one whose handles are about as wide as your shoulders. If the handles are farther apart than that, you’ll have a hard time steering.

Crabgrass

If you have small patches of crabgrass in your yard, prevent them from spreading by pulling them out by hand. Also, be careful how you mow: Using a mulching mower on these patches will spread crabgrass seed, which will make eradicating the weed that much more difficult.

Home Inventory

It’s always a good idea to keep a home inventory—a record of the contents of your home—in case disaster strikes. The easiest way to do this is to take a video of every room in your house, including the contents of closets, pantries, and drawers. Talk about your home’s contents as you record. Don’t forget to record the exterior too. Store the final video in the cloud or in a safe deposit box.

Sleeper Sofas

Before purchasing a sleeper sofa, carefully measure the room where the sofa will go. Make sure there’s enough space to maneuver around the bed once it is pulled out! If space is tight, consider opting for two chair-size fold-out beds rather than one big sleeper sofa.

Buying Tile

To figure out how much tile you need for a project, calculate the room’s square footage by multiplying its length by its width, then add 5 percent for waste. It’s a good idea to buy even more than that, just in case you have to make repairs or replace a few tiles.

Kitchen Layout

Most folks already know about the kitchen’s work triangle. There is, however, a second guiding principle of kitchen layouts: work stations. You should have a cleanup station by the sink, a prep station near the stove, and a storage station by the refrigerator.

Space Heaters

Always keep space heaters at least 3 feet away from combustible materials, and make sure they’re situated on a level surface. Pay close attention to the heater’s cord, making sure it isn’t frayed, and never use a space heater with an extension cord.

Birdhouses

When building or purchasing a birdhouse, remember that the size of the house’s hole determines which species can use the house. Most bird species will fit through a 1.25-inch hole—and most predators will not.

Beadboard

DIYers and crafters should think of beadboard as sort of a dressed-up version of plywood. Consider beadboard if you’re installing a new back panel in a bookcase, crafting a new headboard, or even putting in a kitchen backsplash.

Fire Drill

Gather your family for a fire drill at least twice a year. Make sure there are at least two exits for each room in the house and that you have the right ladders or other equipment needed to escape through window exits.

Power Drills

A ⅜-inch drill (a drill that holds a ⅜-inch diameter bit) will suffice for most homeowners. When purchasing a drill, make sure it’s reversible so it can back out of holes and remove screws.

Metal Roofs

Although metal roofs are pricey, they are great options for homeowners in fire-prone areas because they can’t be accidentally ignited by embers. Because they contain at least one-quarter recycled materials (and are recyclable once removed), these roofs are also eco-friendly.

Bathroom Vent Fans

To determine the right size fan for your bathroom, first calculate the square footage of the space. Your bath vent fan should move at least 1 cubic foot per minute (CFM) of air per square foot of bathroom area. So if your bathroom is 100 square feet, you’ll want a 100 CFM fan.

Turning Screws

If you can’t get a screw to budge, putting a bit of candle wax on the screw may make it easier to drive. Also, longer screwdrivers will give you more leverage to turn a stubborn screw.

Polyurethane Glues

They’re finicky and sometimes hard to work with, but polyurethane glues are great adhesives for outdoor projects because they are both strong and waterproof. These glues need moisture to set, so be sure to dampen the surface to be adhered before applying the glue.

Shovel Shopping

When shopping for a shovel, make sure the blade’s step (the spot where you can place your foot to apply force to the shovel) is wide enough to accommodate your foot. Turned or rolled step edges will be more comfortable to use.

Moth Prevention

Forget mothballs—they smell bad and can be toxic if inhaled. Instead, keep moths away by laundering or dry cleaning your woolen clothes and then either storing them in airtight containers or packing them away with strongly scented cedar blocks.

Banquette Seating

Banquettes are charming, but they aren’t suitable for every household. Elderly family members or others with mobility issues may have trouble getting into and out of banquettes, and large families may tire of standing up and sliding around every time someone needs to grab some ketchup or use the facilities.

Fire Extinguishers

Every home should have multiple fire extinguishers and keep them in the kitchen, basement, and near grills or other combustible appliances. Although different classes of fire extinguishers are meant for different applications, a rechargeable multipurpose ABC unit should do the trick for most households.

Roofs and Ladders

When using a ladder to access a roof, be sure the ladder extends at least 3 feet above the roof. How far away from the house should the ladder be? Divide the span of the ladder by 4.

Woodworking Chisels

Wood chisels are handy for cleaning edges of woodwork and leveling surfaces. If you buy just one, opt for the ¾-inch size, and store it in a cloth inside the toolbox so it doesn’t get damaged.

Front Yard Curb Appeal

Make sure your landscaping doesn’t obscure your front door. Instead, use plants and shrubs to draw the eye to the entry. Beds in front of the house should have plants of varying heights, hues, and textures.

Situating a Sunroom

Before building a sunroom or solarium, plan its location carefully: If it has a northern exposure it will be too cold; western will be too hot. Ideally, sunrooms should be oriented within 30 degrees of south.

Locksets

Before purchasing a lockset for a door, be sure to measure the door’s thickness, note whether the door opens inward or outward, and figure out whether the door is left-handed or right-handed. (If you look at a door from the outside, a left-handed door has hinges on the left side.)

Headlamps

Ingenious helpers for DIYers who need both hands free while working in the dark, headlamps are invaluable. They’re particularly useful when you’re making repairs behind appliances, or in the basement or attic. Headlamps with dimmer switches maximize battery life.

Dandelions

If you’re set on removing dandelions from your property (and here’s why you might reconsider), the best way to do so is to remove them individually with a weeding tool before their seed heads develop and spread even more seed.

Childproofing

To identify hazards to young children, get down on your hands and knees to see your home from their perspective. Make sure that outlets are covered, look for sharp corners that can hurt little heads, and be extra cautious of anything having to do with water. (While you’re at it, turn your water heater down to 125 degrees Fahrenheit.)

Pressure Washing

When pressure washing, be aware that streams of water at pressures of more than 1200 psi can damage paint and siding. To avoid leaving marks, use a wide-angle nozzle, stand several feet away from the house, and point the spray about 30 degrees from the surface you’re washing.

Caulking Tubs

Pros don’t recommend silicone caulking around bathtubs—it’s just too difficult to remove. Instead, opt for a latex, PVA, or acrylic type. These water-based caulks can be removed using a utility knife or razor blade.

Cleaning Plant Pots

Before putting a new plant into a container you’ve already used, wash that pot well to avoid transferring undesirable microbes and bacteria to the new plant. Begin by scrubbing off the dirt, then soak the pot in a weak water-and-bleach solution. Next, wash the pot with water and mild dish detergent, and then rinse again.

Basement Waterproofing

Minimizing the amount of water that gets into your basement—and getting any water out quickly—is the key to a sound foundation. Some homes require perimeter drains and sump pumps to resolve water issues. All homeowners would be wise to make sure rain gutters stay clear and downspout extensions are angled away from the home.

Whirlpool Tubs

If you’re thinking about purchasing a whirlpool tub, first note where the motor is located and be sure you’ll be able to access it—maybe through a closet or the basement ceiling, or in an adjacent room. Also bear in mind that these tubs are very heavy, so you may have to reinforce your floors before installing one.

Pruning Young Trees

The best time to prune young trees is before leaves emerge, typically in late winter. Cut branches that are dead first, then cut the smaller of any two branches that cross or rub together. Don’t cut more than 15 or 20 percent of a tree at once.

Watering the Lawn

In most climates, watering the lawn twice a week should suffice; most lawns can’t absorb more frequent watering. In drought-prone areas, planting more ground cover and drought-tolerant shrubs will help reduce water consumption.

Faux Paint Finishes

Most faux finishes follow roughly the same process: Paint a base color and once it’s dry, use tools and a glaze coat to achieve the desired effect (combs for woodgraining, for example). Be sure to hone your skills on practice boards first!

Laundry Room Fix-Up

Make the laundry room look nicer by covering concrete floors with rugs and using curtains to hide messes (or even the washer and dryer). Bins and baskets can help organize clothes and laundry supplies.

Potting Benches

A potting bench isn’t just a good spot to repot plants and stow garden tools and fertilizers. Once sanitized, it can also double as a buffet or bar for outdoor gatherings.

Flag Display

It’s easy to install a wall-mounted flagpole onto the side of your house: Screw in a metal bracket and you’re done. Don’t forget to bring the flag in overnight if it is not illuminated, and always bring it in during inclement weather.

Water-Saving Faucets

A faucet aerator costs just $5 to $10 and will pay for itself in water savings in just a few months. While shopping, look for one with a flow rate (measured in gallons per minute, or GPM) of less than 2.2.

Garden Hoses

When you’re in the market for a garden hose, opt for those with brass, not plastic, couplings—brass lasts longer. All-rubber and reinforced rubber hoses are more durable than vinyl models, and the higher the number of plies, or layers, the better.

Drip Irrigation

If your garden hose has sprung a leak that’s beyond repair, consider using it for DIY drip irrigation. You can put the system on a timer, and you’ll use 30 to 50 percent less water than you would standing outside with a hose in your hand.

Glass Block

Glass block is a great way to let light into your space while maintaining privacy. It resists fire, is easy to clean, and is a better insulator than single-pane glass. What’s more, glass block can be less expensive—and more secure against break-ins—than traditional windows.

Baseboard Covers

Protecting your family from the hot surfaces of a baseboard heater is a good reason to spring for baseboard covers, but they’re also great for upgrading a room’s appearance by hiding dingy, dinged-up baseboard heating units. Before shopping for baseboard covers, measure carefully and make sure that the kind of covers you’re eyeing are compatible with the type of heating system you have.

Cork Flooring

The upsides of installing cork flooring are considerable: It’s comfortable underfoot, it insulates well, and of course, it’s about as sustainable a material as there is. The downsides are that it’s sensitive to moisture and heat, it fades, and it can be gouged and scratched more easily than other flooring materials.

Outlet Inspection

Make sure each outlet in your home is covered by a plastic plate in good condition and that no outlets are warm or smoking. Consider upgrading outlets that do not accommodate 3-prong plugs and any outlets that are close to water that are not ground fault circuit interrupters (GFCIs).

Bee and Wasp Proofing

If bee and wasp nests are located far from where your family congregates, they’re probably best left alone. Treat in-ground yellowjacket nests by pouring a soap-and-water solution into the hole at night, when they’re least active.

Fall Lawn Care

To give your lawn a leg up for the following spring, nourish the roots with a compost tea or fall fertilizer. Don’t mow your grass too short, either—long grass can shade out weeds and absorb more of the sun’s nutrients.

Washing Machine Hoses

Failing washing machine hoses are responsible for millions of dollars of flood damage each year, which is why it’s smart to inspect your hose monthly and replace it every 3 to 5 years. Reinforced stainless-steel braided hoses are more durable than the rubber versions.

Keeping Fido Safe

Household products that are dangerous—even fatal—to dogs include antifreeze, laundry dryer sheets, rat poison, and mothballs. Be sure to keep coins out of dogs’ reach too!

Home Holiday Prep

Before hosting for the holidays, situate furniture in groups to encourage conversation. Clear out stuff you don’t use, and be sure that there’s a clear path through the house so traffic flows well.

Garden Planning

Don’t even pick up a trowel until you’ve sketched out your yard. Make note of sunny and shady areas, soil condition, and which areas are visible from your windows and the road. A little planning will make it easier to determine what to plant where and how many plants you will need.

Cleaning Saves Money

Vacuuming refrigerator coils and baseboard heaters, cleaning the dryer vent, and changing furnace filters regularly will keep appliances in tip-top shape and save money on repairs in the long run.

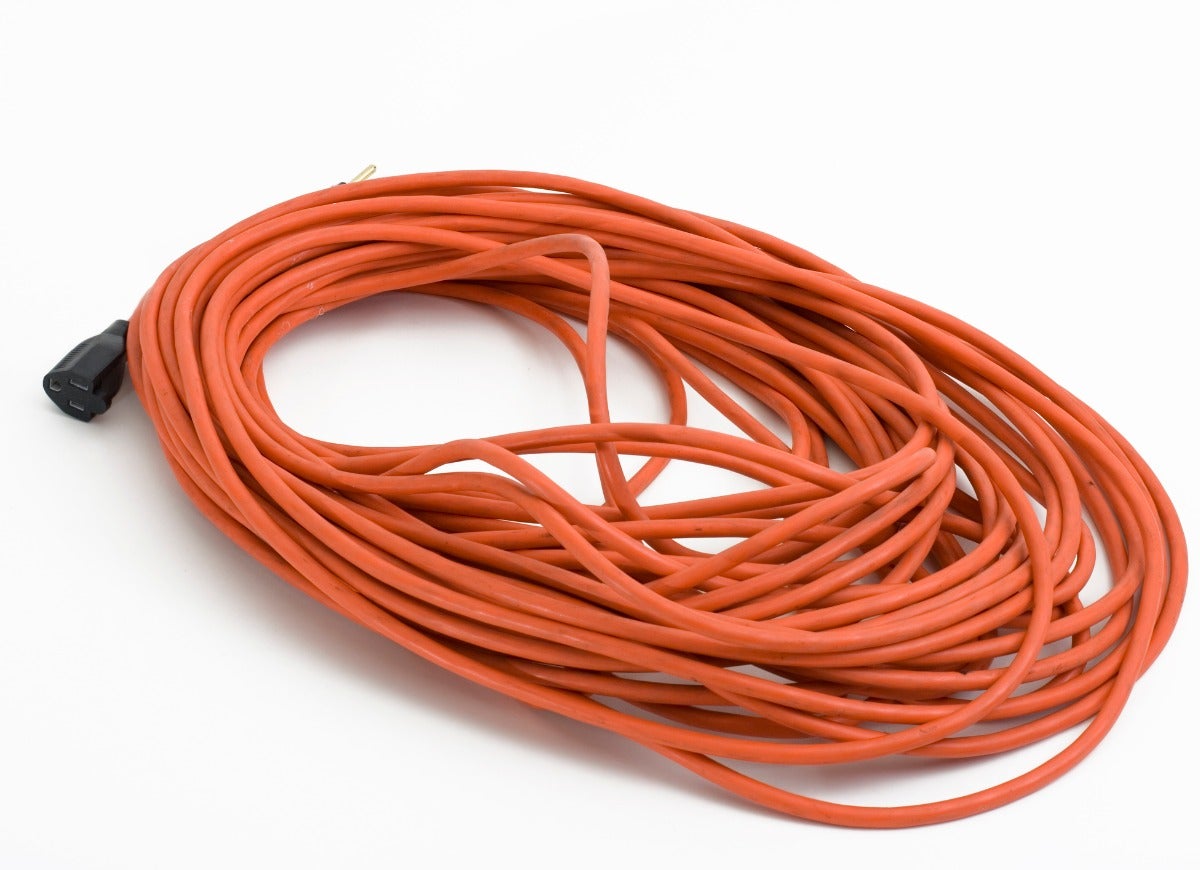

Corralling Cords

If you have a long cord you want to keep coiled, stow it in a 5-gallon bucket. Drill a hole near the bottom and let the female end hang outside the hole. Coil the cord inside, and keep the male end at the top.

Extension Cords

When purchasing an extension cord, splurge a little on a thicker-gauge cord: 10-gauge is best for outdoor use and for use with multiple tools. Be sure the cord is grounded and is both UL and OSHA approved.

Dishwasher Care

To keep your dishwasher in top shape, run an empty load using Tang drink mix instead of dishwasher detergent. The machine will run cleaner, and the citric acid in the mix will reduce mineral and food deposits.

Programmable Thermostats

A programmable thermostat will pay for itself in a matter of months if you set it back 10 degrees for at least 8 hours a day. Doing so will save you about 10 percent on your electricity bill!

Steel Studs

If your next renovation requires framing, consider using steel studs. They don’t bow, don’t attract insects, and are resistant to mold and fire.

Painting Tips

Start with the ceiling, then paint the room from the top down. Do the walls one section at a time, making a V shape with the roller, then fill in horizontally and finish off with a couple of vertical strokes for good measure.

Protecting Wood

Before taking on renovations or repairs that can damage floors, trim, and newel posts, wrap scraps of old carpet around wood surfaces and secure with duct tape. Old sheets, towels, and shower curtains will work too, as will cardboard boxes.

Repairing Drywall

When patching drywall, if the hole or scratch is minor, simply apply a bit of joint compound to the blemish, allow it to dry, and then sand it. If the hole is larger, you’ll need to use plastic mesh tape or a drywall “bandage” along with compound.

Universal Design

Universal design makes it easier to age in place in your home. Some things you can do now include replacing doorknobs with lever door handles, widening doorways, and renovating your home so you can access at least one bathroom and bedroom without having to climb stairs.

Bathroom Vanity Lighting

Overhead vanity lighting is likely to cast shadows. Eye-level sconces on either side of the mirror or vanity that are at least 3 feet apart will cast an even light on your face.

Bird Feeder Care

Dump old seed from your bird feeder periodically so rancid seed doesn’t attract raccoons or possums. Cleaning the feeder prevents the spread of disease among birds. (Pro tip: Cayenne powder mixed in with the seed is a good squirrel deterrent.)

Home Journals

Home journals are a great way to keep track of the projects, maintenance, and services you need to do each season. Keep receipts, before-and-after photos of projects, contracts, homeowners insurance policies, and important phone numbers in there too.

Painting Windows

The best paintbrush for the job is an angled sash and trim brush. There’s no need to use painter’s tape to protect the glass, either—simply scrape any dried paint drips off the glass with a razor blade.

Rain Gutter Care

If it’s raining and you notice a leak in your home’s rain gutter, mark the leaky spot with a china marker. When the weather’s better (and you’re cleaning the gutters anyway), repair the leak.

Firewood

Firewood burns best when it’s well seasoned. Season the wood yourself by cutting it (or purchasing it cut) and storing it away from your house in a covered, well-ventilated space.

Thawing Pipes

Using a blowtorch to thaw pipes is a bad idea that can cause more harm than good. Instead, open the faucet by using a hair dryer, working your way from the faucet to the frozen spot.

Second Refrigerators

Many of us replace our old, inefficient refrigerators with new models, only to keep the original fridge for overflow items. How is that saving energy? Purchasing a new, smaller Energy Star-rated refrigerator as your second fridge will save you money on electricity.

Deck Safety

Most deck failures have to do with the way the deck is connected to the house. The deck’s main beam should be attached to the house with bolts, not nails. Keep water out of the deck-to-house connection with ample flashing or spacers, which promote air circulation.

Cabinet Hardware

When purchasing hardware for kitchen cabinetry, be mindful of how easy it will be to clean—deep crevices will harbor gunk and grime. Tally the number of knobs and pulls you need, and order a few extras in case your hardware style is discontinued.

Lightning Protection

When a storm is headed your way, it’s a good idea to unplug appliances and electronics. Hiring an electrician to install a lightning protection system is also worth considering.

Meet the 2025 Tools of the Year

After months of scouring the market and putting products through their paces, we’ve named the best of the best in new tools. There’s something for everyone, from veteran pros to average Joes.